|

CNNfn market movers

|

|

July 28, 1999: 2:41 p.m. ET

Technology IPOs soar, while weak earnings spook investors

|

NEW YORK (CNNfn) - Investors gushed over several initial public offerings Wednesday, while shares of companies that reported weak earnings got hammered.

In one of the day's most dramatic intraday gains, shares of drugstore.com (DSCM), an online drugstore, tripled in their debut. After being priced at $18, stock in the Bellevue, Wash.-based startup rose 36 to 54. (For more on drugstore.com, click here.)

Other IPOs also fared well.

Shares of Packeteer Inc (PKTR), a Cupertino, Calif.-based software maker gained 98 percent to 30-1/16. And stock in Focal Communications (FCOM), a Chicago-based local telephone provider, climbed 36 percent, to 18-5/16.

But earnings weakness hit many companies, pummeling their shares.

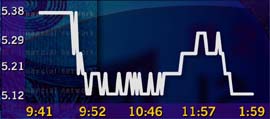

HomeBase (HBI), a home improvement retailer, fell lost ¾, or 12 percent, to 5-1/8. The Irvine, Calif.-based company warned late Tuesday that it expects to earn 22 to 24 cents per share in the second quarter, below the 27 cents forecast by analysts surveyed by First Call.

HomeBase shares plunge

And shares of MindSpring Enterprises (MSPG) fell 4-1/4, or 11 percent, to 36-1/16 in heavy Nasdaq trading, after the company reported an increased loss late Tuesday. The Atlanta-based Internet service provider lost $7.08 million in the second quarter, or 11 cents per share, compared with $3.30 million, or 6 cents per share, in the year-earlier period.

Segue Software (SEGU) was also a Nasdaq loser, falling 2-11/16 to 8. The maker of testing software for e-commerce applications disappointed investors with a second quarter loss of 56 cents per share.

On the Big Board, cosmetics maker Revlon (REV) fell after the company late Tuesday said its second-quarter earnings dropped 52 percent to $5.6 million. Shares of New York-based Revlon dipped 1-7/8 to 20-3/8.

Star Telecommunications Inc. (STRX) was punished after issuing a profit warning Wednesday. Downgrades followed immediately for the Santa Barbara, Calif.-based long-distance telephone service provider. The stock slipped 1-19/32 to 5-9/16.

But earnings were not the only thing affecting stocks.

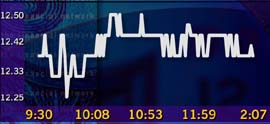

After a takeover bid from British rival Dicom Group Electronic, imaging equipment maker Kofax Image Products Inc. (KOFX) jumped 3, or 32 percent, to 12-3/8.

Kofax shares soar

Irvine, Calif.-based Trimedyne (TMED), meanwhile, continued to benefit from U.S. Food and Drug Administration approval for its Knight Needle laser device used in the treatment of hernias. The news prompted California-based investment bank Donner Corp. to upgrade the company to a "buy." The company's stock climbed ¾ to 3-7/16.

And Easco Inc. (ESCO) rose almost 24 percent after a unit of U.K.-based building products-to-printing company Caradon agreed to buy it for $155 million, or $15.20 per share. Easco, the largest independent extruder of soft alloy aluminum products in the United States, rose 2-13/16 to 14-13/16.

Mylan Laboratories Inc. (MYL) felt the full force of a broker's downgrade after SG Cowen took the Pittsburgh-based drug maker off its "strong buy" list. The stock fell 4-3/8 to 22-1/2.

|

|

|

|

|

|

|