|

Small business exporting

|

|

July 30, 1999: 6:30 a.m. ET

Learning curve of trade is steep, but government resources abound

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - Ken Perdue was convinced exporting wasn't for him.

"I attended this business development meeting in 1995 and all they talked about was building bridges and getting governments to guarantee payments," he said. "I didn't want any part of it. All I was trying to do is sell a $100 item to a distributor."

Perdue, founder of Dallas-based Epic Medical Equipment Services Inc. , was introduced to a trade expert at the International Small Business Development Center who helped him keep an open mind.

That was three years ago. Today, Epic Medical sells blood oxygen sensors in 44 countries. The company's revenue has doubled to $10 million a year and more than half its income is derived from overseas markets.

"The first obstacle we had to overcome was the fear of the unknown, " Perdue said, attributing the company's rapid growth to its newfound niche in global sales.

Until Epic Medical entered the market, Perdue said there was only one other manufacturer of electronic medical sensors in the market. The lack of competition enabled that company to charge "greatly inflated prices," he said, adding his company is continuing to explore new expansion opportunities.

Next stop: Japan.

Playing the game

International trade is no longer the "members only" club it once was.

Aided by productivity gains and the advent of new technology, namely the Internet, experts say a growing number of small business owners are taking on their multi-national counterparts for market share abroad -- and winning.

"Most people think small businesses are not involved in international trade and that's just not true," said Willard Workman, vice president of international affairs for the U.S. Chamber of Commerce. "It's growing."

The reasons, he noted, don't just center around profit.

"The reality is it's important to spread your risk across different markets that experience different business cycles," Workman said. "The U.S. economy may be booming now, but at some point down the road there's going to be a downturn and you don't want to have all your eggs in one basket."

Exporting

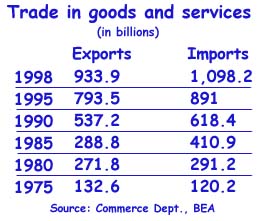

The vast majority of U.S. businesses break into international sales by exporting goods and services abroad.

Ben Kedia, professor of international business and director of the Wang Center for International Business at the University of Memphis, said that's a much less risky and far less expensive proposition than opening up offices in other countries.

"That gives you a chance to learn about the customers and their desires and examine the product potential," he said. "That's a good strategy for small businesses, since any significant loss of capital in a foreign market could be pretty damaging."

Kedia said many also start by selling their goods or services in countries that closely mirror the economic cycles and customs of the United States, including Canada and England.

Indeed, Perdue said that's the strategy he followed.

"We started with a distributor in England," he said. "We wanted a country where we shared a common language."

Don't be afraid

Almost anyone involved in international trade will tell you, the learning curve can be steep.

Before you even think about exporting goods and service, you've got to research your target markets, track down and price a few distributors, locate a shipping company and test your product's market potential.

U.S. companies doing business abroad are also required to obtain customs clearance for their products, pay insurance fees to ship their goods, and file a slew of export documentation.

And that's not even touching on business etiquette and financing obstacles.

Luckily, educational resources abound.

The Small Business Administration is a good place to get started.

The agency provides one-on-one counseling services from international trade experts through its Office of International Trade.

Willard Workman, vice president of international affairs with the U.S. Chamber of Commerce in Washington, said that's the kind of assistance that can help make an intimidating process that much easier.

"I think some American business people are intimidated because the terms of business are a little different," he said. "We don't use letters of credits here in the U.S. We use lines of credit. But it's the same thing."

He said part of the barrier to international trade entry really comes down to language.

"Part of the barrier to small companies getting involved in international trade is the language," Workman said. "And I'm not talking about foreign languages, but the English language (and international trade jargon)."

Once they get comfortable with that, he said, "it's just like doing business between North and South Dakota."

The SBA also helps small- and mid-sized businesses secure financing through its Export Working Capital Program .

The program provides financing for loans of $833,333 or less. Small businesses that qualify can use the money to help pay for pre-export labor and materials, and the financing of receiveables generated from these sales.

They also can use it as standby letters of credit for payment guarantees to overseas buyers.

Kedia, of the University of Memphis, said that's perhaps the greatest obstacle facing would-be exporters.

"The small business owner still confronts a considerable barrier in trying to arrange," he said. "But you have to have some sort of help, because by the time you ship it and receive payment there could be a two or three month delay. Small businesses simply can't afford to wait that long."

In addition to the SBA loan program, which approved $284 milliom in 5-year loans last year, the Export-Import Bank of the United States also offers assistance. Its loan programs are set up for U.S. companies involved in international trade.

Kedia, however, said the SBA and Export-Import Bakn loans can be tough to come by. "Most small businesses find it terribly difficult to arrange them," he said.

Often, business owners turn to their local banks, which charge higher interest rates and sometimes have trouble understanding the intricacies of international trade, he said.

"Many small businesses will tell you the local banks are not very sympathetic," Kedia said. "They can't judge the risk of loss on their loans, since the money is coming from different countries, they may or may not know the clients overseas and currency fluctuations could be a factor."

Be prepared, he said.

Other resources

Another good source for small businesses is the International Trade Association, run by the Department of Commerce.

In addition to its own version of an Export Assistance Center, the association hosts a slew of educational Web sites that help U.S companies explore trade opportunities in Japan and South Africa, Latin America and the Caribbean, Western Europe, and Asia Pacific.

Its online trade statistics also can help you track the export potential of specific countries. Moreover, ITA's Matchmaker Trade Program puts small- and mid-sized U.S. companies in contact with distributors, sales representatives, licensing partners and joint venture candidates overseas.

It also has an online database of international and regional trade offices.

Database of ideas

If it's market research you're interested in, the National Trade Data Bank has compiled data on all things involving trade -- including market research reports, updated country commercial guides on the trade situation and economic history of each country, trade data, contact names for buyers and leads on international importers looking to buy American goods.

The database can be accessed for free at all Federal Depository Libraries, which are found on some college campuses and include some public libraries, but access to the online database will cost you $50 per quarter or $150 per year.

(Click here for locate the Federal Despository Library nearest you.)

Eye contact is everything

But Workman, of the U.S. Chamber of Commerce, said business owners should do some old-fashioned networking, too.

"Go to the trade fairs," he said. "You are there in person and you make contacts with people you are going to need to help you, from freight forwarders, to insurance companies that can insure your shipments, to distributors."

Being there in person, to shake the hands of prospective clients, will also give you a better sense of who you are dealing with, Workman added.

"You'll get a feel for whether these people are for real," he said.

Kedia said that's good advice.

"Most small businesses say finding a reliable distributor to represent their products in foreign markets is a real problem," he said.

Offshore offices

As your exporting business grows, you may find that its more cost-effective to set up shop in the country or countries in which you do the most business.

Kedia said the greatest advantage of doing so is the ability to compete directly in your chosen markets.

"When you don't have to use a salesman to represent your products for you, you really get the ability to tap that market to the fullest extent," he said. "Local distributors may have some interests of their own, or they may not be representing your product solely."

Moreover, he said, you also gain the advantage of creating your own distribution system -- and being nearby to make sure the job gets done right. That can lead to better customer service and increased business.

"Potential business opportunities are the greatest advantage," Kedia said.

On the flip side, you've got the disadvantage of greater risk and increased cost.

"You have to make an investment in the brick and mortar office and hire personnel," Kedia said "It's a risky proposition."

Like it or not

The bottom line, according to Workman, is that all U.S. businesses today -- from the largest corporations to the Main Street mom and pop shops -- already compete in the global arena.

That's because importers overseas can purchase goods and services from any country in the world and have their shipment the next day. They don't care about proximity. They only care about price and quality.

By the same token, if the customer you've had for 20 years can now order a similar product online from an overseas distributor for less, they're likely to do so.

"In order to be competitive you have to become international," Workman said. "If you are a company doing business in the United States, you are already competing internationally whether you like it or not."

|

|

|

|

|

|

|