|

Rate hike seen on Aug. 24

|

|

August 6, 1999: 7:41 p.m. ET

CNNfn survey shows increase likely, and economists think it will come this month

|

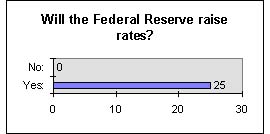

NEW YORK (CNNfn) - A majority of economists now predict the Federal Reserve Board will raise interest rates by a quarter-point at their Aug. 24 meeting, according to a CNNfn survey conducted Friday.

Nearly 85 percent of the 25 economists surveyed Friday said the Federal Reserve will move swiftly later this month to head off inflationary pressures that now appear to be percolating within the U.S. economy.

Nearly three out of four of those economists said Friday's unemployment report -- which showed a larger-than-expected spike in jobs and hourly wages -- would cement the decision to raise rates in the Fed's eyes, although opinions were mixed whether that report alone was responsible for the likely move.

"This really was the nail in the coffin for the Aug. 24 meeting," said Sung Won Sohn, chief economist at Wells Fargo & Co. in San Francisco. "I think it implies interest rates will go up faster in the future."

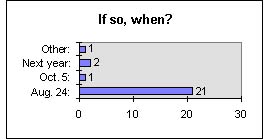

Every economist interviewed said a future rate increase is now a certainty, and 21 of the 25 predicted it would come later this month.

One economist said the increase wouldn't occur until the Oct. 5 Fed meeting, one said before the end of the year and two believed it would happen sometime early in 2000.

Many economists said they reached their conclusions after viewing Friday's job data, which came on the heels of report Thursday showing that growing labor costs had lowered U.S. productivity growth in the second quarter to its lowest level in a year.

"I thought [the job report] confirmed it," said Bruce Steinberg, chief economist with Merrill Lynch. "I thought it depended on today's data."

But seven of the 25 economists surveyed said the Fed governors already might have been predisposed toward a rate hike anyway, given a number of leading indicators that have shown hints of inflation the past two weeks.

"There have been prior indicators that point in the same direction," said Preston Martin, an economist at Martin Associates and a former Federal Reserve vice chairman. "The leading indicators have been almost uniformly pointing toward more employment costs, which is very important to [Fed Chairman] Alan Greenspan."

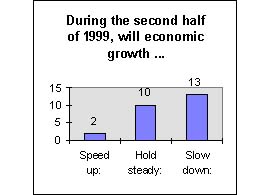

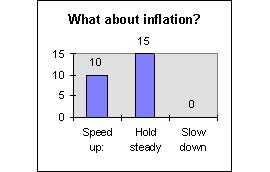

Finally, views were mixed on which direction economic growth and inflation might trend during the second half of the year.

Just more than half predicted economic growth would slow down compared to the first six months of the year, while 15 of the 25 economists said inflation would hold steady during the same period.

"We're looking for a little slower growth and a little higher inflation, but there will be a slower slowdown in growth than a pick-up in inflation," said Robert Mellman, an economist with J.P. Morgan in New York.

|

|

|

|

|

|

Federal Reserve Board

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|