|

Merrill: Managers bearish

|

|

August 10, 1999: 1:20 p.m. ET

Fund managers losing faith in the dollar, flocking to Japan in August

By Staff Writer Robert Scott Martin

|

CITY (CNNfn) - U.S. fund managers are pulling their support from the dollar in record numbers in order to jump aboard Japan's economic recovery, according to a Merrill Lynch survey released Tuesday.

In the survey conducted by Gallup for Merrill Lynch's London-based global unit, 74 percent of the 36 U.S. managers surveyed don't expect the dollar to be the strongest global currency in the coming year.

This lack of support for the greenback -- which ranked second behind the euro -- was the lowest the dollar had scored in the 3-1/2 years Merrill Lynch has tracked currency sentiment in this manner.

A total of 251 managers worldwide handling assets worth $7.7 trillion took part in the survey between July 30 and August 4.

In particular, both U.S. and overseas managers saw the yen as continuing its recent upward trend despite the Bank of Japan's efforts to keep the Japanese unit under control.

"Japanese fund managers expect the yen to be the strongest major currency on a year's view," Trevor Greetham, Merrill Lynch Global strategist, wrote in his comments on the survey results. "We think they are right to be skeptical about intervention to weaken the yen. Japanese capital repatriation is likely to continue undermining the dollar as U.S. stock valuations de-rate."

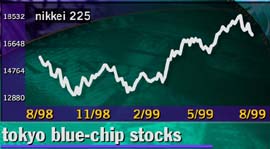

This flood of global money into yen is largely due to increasing demand for Asian securities, especially Japanese stocks, at the expense of U.S. assets.

The likelihood of a rate hike

Institutional investors have grown increasingly unwilling to broaden their exposure to Wall Street as the certainty of an interest rate hike looms, Greetham said.

Europe and the United States were neck and neck in the rating game, with about 70 percent of global managers forecasting rising rates in both regions.

However, higher rates -- combined with the stock market slowdown that would likely follow -- will only slow U.S. economic growth in 2000, trapping financial markets in a self-reinforcing cycle.

"The threat of higher interest rates is most acute in the U.S. where overseas recovery, rising commodity prices, dollar weakness and rising unit labor costs pose growing risks of higher inflation," said Greetham. "A combination of falling equity prices and rising Fed funds (interest rates) is likely to slow the U.S. economy going into 2000."

By contrast, Japan's crusade to keep the yen trading at subdued levels "should ensure ultra-loose monetary policy continues in Japan," producing an economic boom that should push Tokyo stocks even higher. Japanese interest rates currently are stuck at near zero as any increase would inexorably push the yen higher, hurting Japan's crucial export sector.

As a result of these factors, the managers surveyed picked out the United States as the only economy likely to slow down in 2000, a forecast Merrill Lynch agreed with in its decision to back Japanese stocks over U.S. issues.

"Poor environment"

However, Greetham said interest rate expectations were worsening worldwide, prompting a global bond sell-off and leading to a more bearish picture for international stock markets.

"This is a poor environment for financial assets," he said. "We recently cut our exposure to global stocks and bonds, raising cash further overweight."

A massive 72 percent of U.S. fund managers still see U.S. stocks as overvalued, especially moving into 2000, which a large number -- 31 percent -- now see as having a "slightly unfavorable" outlook for corporate profits. In the July survey, most managers considered 2000 profits to be "slightly favorable."

The survey found interest-rate sensitive sectors suffering particularly heavily from the sea change in managers' sentiment. Managers turned away from financial shares, but also shunned utility stocks.

The possibility of explosive growth outweighed the likelihood of more costly capital loans for technology companies, leaving that sector as the survey's top pick for the month.

Still, Merrill Lynch noted that the fund managers were turning away from the large-cap companies in all sectors -- for technology, the Microsofts (MSFT) or IBMs (IBM) -- to dive back into the previously neglected small-cap universe. Two out of three U.S. managers now prefer small caps to their big-name brethren as investments.

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|