|

Paying for grad school

|

|

August 18, 1999: 12:54 p.m. ET

Financial aid resources abound online, you just have to know where to look

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - So, you're going back to graduate school? Welcome to the club. Some 1.7 million grad school students are expected to wind their way through the halls of Academe this year alone, seeking a higher education and, presumably, better jobs.

They may, indeed, be sharpening their competitive edge, but when it comes to tracking down financial assistance, experts say many of these degree-seeking scholars don't make the grade.

"Some people simply don't want to take the time to go to the library and do all that reading or apply [for dozens of fellowships and scholarships]," said Dallas Martin, president of the National Association of Student Financial Aid Administrators. "They look at the huge volumes of information and think, 'where do I start?'"

Some end their search with a low-interest loan, while others stop at their boss's door, hat in hand, for a tuition reimbursement check.

But thousands of other financial assistance programs, many of which are geared specifically for graduate-level students, are up for grabs each year. And you don't have to be a brainiac or an Olympic-bound athlete to qualify.

You just have to know where to look.

"There are all kinds of ways out there for graduate students to supplement their income," Martin said. "Some loans and scholarships are based on ethnicity and some provide financial assistance for specific programs, like Master's of Business Administration (MBA) degrees."

Thanks to the Internet, he said, those programs are now easier to find.

"The nice thing about the Internet is that most people can access it right from their home and do some comparison shopping online," Martin said.

(Click here for finaid.com's list of scholarships and awards for specific fields of study.)

First step

Martin said you still may want to begin your quest for loans and scholarships the old fashioned way -- with a trip to the financial aid office at the college or university you plan to attend. Most provide a comprehensive database of the various financial aid programs for which you might be eligible.

"That's the very best place to start," Martin said, noting many of the graduate-level fellowships and scholarships are offered through the individual academic institutions themselves.

According to estimates, between 80 percent and 90 percent of awards granted to graduate students come in the form of assistantships or fellowships, rather than scholarships.

Fellowships require the student to work either on a designated research project or for the university in exchange for financial aid. Scholarships, on the other hand, are outright awards that don't need to be repaid. This type of assistance does exist on the graduate level, but it often comes in the form of a smaller check.

Step one

From there, you'll want to cast your net on the World Wide Web.

Online databases that help college-bound students seek out sources of funding abound. And many are free of charge.

Among them, Sallie Mae's CASHE Database, which allows student borrowers to fill out an electronic profile form (takes about 20 minutes) and submit it via e-mail. Within 24-hours, students receive a list of private scholarships, grants, fellowships and work study programs for which they might be eligible.

Denise Rossitto, a spokeswoman for Sallie Mae, the nation's largest student loan institution, said the list leaves behind financial aid plans for which the student wouldn't qualify.

"We only want to match them up with the opportunities that are relevant to them," she said.

From there, Rossitto noted, it's up to students to contact the financial aid sponsor on their own.

Another good online resource is finaid.com , which provides a comprehensive summary of most available loans, scholarships and other types of student aid. The site breaks out the various assistance programs specifically available to MBA-seekers, law students and those enrolled in medical school.

And it provides educational financing advice for women, minorities , Jewish students, older students, gays and lesbians and the disabled.

FinAid's online partner, fastWeb, is a free scholarship search site similar to Sallie Mae's CASHE Database.

"The Net has definitely made it easier to locate funding sources," said Debbie Davis, president of the National Association of Graduate and Professional Students.

She cautioned, however, that not all Web sites update their sites regularly. Therefore, you should always cross-reference your findings with the database at your campus financial aid office as well, she said.

Loans

Regardless of whether you land a scholarship, fellowship or assistantship, chances are you'll still need to borrow some cash. Hey, no one ever said education comes cheap.

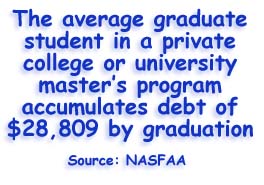

According to NASFAA, the average graduate student in a private college or university master's program accumulates debt of $28,809.

That compares with debt levels of $123,898 for dental programs, $99,225 for medical programs, and $63,078 for law school at private colleges and universities.

A good number of grad school students, regardless of their discipline, are forced to finance their education through a combination of work and loans. Martin said that's because many already have families and therefore have higher living expenses.

The NASFAA data, the first ever collected on grad school financing, revealed that 50 percent of grad school students in business programs received some form of financial aid. More than 80 percent of students in medical, dental and law programs required assistance.

Dept. of Ed

The Department of Education's Student Financial Assistance Programs are the largest source of student aid in the country, having made available more than $40 billion to students in 1997-1998.

The department sponsors a series of low-interest loans, among them direct loans and Stafford Loans. (Pell Grants are specifically designed for undergrads.)

To find out if you qualify for federal financial assistance, you'll have to fill out a Free Application for Federal Student Aid, or FAFSA. Click here for an online version.

For additional information, you also can call the Federal Student Aid Information Center at 800-4-FED-AID

A federal treasure hunt

There are other government-stocked pots of gold as well, including those offered to veterans, reservists, National Guard persons, widows and orphans by the Department of Veterans Affairs .

If you're pursuing an education in the health profession, you also may want to check out the student assistance Web site offered by the Health Resources and Services Administration. HRSA, under the Department of Health and Human Services, provides loans, scholarships and faculty repayment programs to those who qualify.

And lastly, the Department of Education lists Americorps as a potential resource for cash-strapped students. The organization will help cover the costs of tuition for qualifying students in exchange for years of service.

The Labor Department also has a scholarship program, part of the Job Training Partnership Act. This program, partially administered by state and local governments, provides job-training services for economically disadvantaged adults and youth, dislocated workers and others who face significant employment barriers.

Still not enough? The Department of Education has launched a Web site that pulls together information on all 50 state education departments. Click here for their phone numbers.

Desirable

Martin said federal loan programs are the "most desirable" to students seeking financial aid. That's because they offer favorable interest rates, cancellation features and they're government-backed. That means Uncle Sam has agreed to pick up the tab if you default on your loan so it doesn't become a burden on your dependents.

The amount of money you are allowed to borrow each year from the government, however, is capped, and is determined by your existing level of indebtedness. If you borrowed heavily during your undergraduate years, therefore, you may have to seek out other sources of funding to help close the gap.

Enter: private alternative loans.

"The lion's share of loans are generated by the federal loan program, but increasingly, there are a lot of private alternative loan programs offered by banks and savings and loan institutions out there, too," Martin said, adding private lenders have become a good backup resource for students.

These loan programs, such as the one offered by Access Group, offer their own low-interest loans to students, but they are generally not backed by the government and their rates aren't quite as favorable as Uncle Sam's.

Access Group even helps clients apply for federal loans, and sets up a loan to offset the amount still owed.

The Stafford Loan, for example, allows most students to borrow only up to $18,500 a year, and interest rates can go up only to 8.25 percent. Today, rates for loan repayment (after the grace period ends) stand at around 6.9 percent.

"You want to get all the federal money you can because it's cheaper, but the cost of attending some schools can be as high as $40,000 a year," said Access Group spokeswoman Vivianne Bowden. "If you only get $18,500 you need to make up the difference."

Access Group does just that. Like most private alternative lenders, Its loans aren't backed by the government and therefore interest rates are higher. They fluctuate by quarter, but Bowden said they currently range from 7.4 percent for medical students (considered slightly less risky) to 7.8 percent for law students.

The boss

It goes without saying that you should always check with your employer before paying tuition on your own.

The most recent data collected by the Employee Benefit Research Institute shows that 65 percent of full-time employees and 36 percent of part-time employees of medium and large private firms are eligible for job-related educational assistance benefits. About 64 percent of state and local government workers were eligible.

The median payment was $2,000, according to EBRI's latest report.

EBRI reports that eligibility was lower for small private establishment employees, with 37 percent of full-time workers and 15 percent of part-time workers eligible.

Many design the plans so that the benefits apply only to job-related courses. And some require you to get at least a B average.

Be aware, too, that some firms require you to work for the company for a given number of years in exchange for educational assistance benefits. If you leave before that time, you've broken a contract and you'll have to pay your employer back.

Tax Breaks

Lastly, don't overlook the help provided -- in the form of education tax credits -- by the Internal Revenue Service.

The newly created Lifetime Learning credit, for example, amounts to 20 percent of the first $5,000 you pay for qualified tuition and related expenses for all students in the family. In 1998, the maximum amount of credit you could claim was $1,000.

Final warning

With the growing popularity of the Internet, insiders say it's never been easier for students to access information on financial aid. That doesn't mean you'll qualify, of course, but it never hurts to ask. And it might increase your chances if you apply for scholarships and grants you would otherwise have overlooked.

Lenders involved in the business, however, warn that students should avoid so-called scholarship search firms, companies that charge you one-time fees to provide a list of the scholarships and financial assistance programs available. That information already is available online for free.

"Some of the clearest evidence that it's a scam is if the company asks you to send them money and then they supply you with a list of resources," said Rossitto, of Sallie Mae. "You might think $250 is a good investment since they've promised you at least $2,000 in scholarship money, but it's not. This information is available free all over the place, online and in libraries."

That's another tip off right there. Rossitto said no scholarship search firms can guarantee anything. It all comes down to what you qualify for.

(Click here for an earlier CNNfn story on scholarship scams.)

Aside from that, Martin said don't be afraid to use the Web to your advantage. It could save you thousands of dollars in tuition costs.

"There have always been a lot of resources, of course, but there was always that difficulty in finding a central repository to go and find it," he said. "The Internet has done a great job of opening the process up and providing a ready source so people can go in and find out more about the resources available."

|

|

|

|

|

|

|