|

Trade deficit hits record

|

|

August 19, 1999: 4:02 p.m. ET

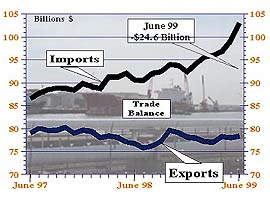

June gap widens to record $24.6B suggesting rate rise may be imminent

|

NEW YORK (CNNfn) - Americans' voracious appetite for goods produced abroad resulted in a record trade deficit in June -- another sign that the red-hot U.S. economy may need to be doused with another interest rate hike from the Federal Reserve.

June's deficit widened to $24.6 billion from $21.2 billion in May, which was revised downward from the $21.3 billion first reported, according to a Commerce Department report released Thursday. The June trade gap was about 20 percent above the $20.5 billion deficit economists had expected.

The report sent the already weakening U.S. currency to a seven-month low on expectations that international investors aren't pouring enough money into the economy to offset the cash that's leaving it. It also provided another sign to analysts and investors that the resilient economy may need to be tempered with another rate rise to avoid inflation.

"It clearly shows that the U.S. economy is very strong and isn't slowing down," said Doug Porter, a senior economist at brokerage Nesbitt Burns Inc. in Toronto. "That doesn't bode well for the possibility of inflation and it doesn't bode well for the outlook for the U.S. dollar."

Stocks, bonds and the currency all declined following the report's release. The dollar hit a seven-month low against the Japanese yen, while the benchmark 30-year Treasury bond fell 3/8 of a point in price for a yield of 6.02 percent. Stocks traded lower as well, with the Dow Jones Industrial Average falling almost 70 points.

Imports top $100B

Imports rose to a record $103 billion in June from $99.1 billion a month earlier as U.S. manufacturers and consumers scooped up all kinds of international goods, services and investments. Exports, meantime, inched upward only slightly to $78.4 billion from $78 billion in May.

In terms of goods alone, the deficit climbed to $31.4 billion, up from $27.9 billion in May as demand rose for imports such as telecommunications equipment, computers and their accessories as well as various consumer goods.

More goods from abroad docked into the U.S. than economists expected

But the U.S. billed out for more services abroad in June, posting a slightly higher trade surplus of $6.8 billion, the Commerce Department said.

"The U.S. deficit is growing faster than someone who spent too much time at the all-you-can-eat buffet," said Andrew Pyle, chief strategist at ABN Amro in Toronto.

Job market strong, economy surging

Other numbers showing the U.S. labor force remains resilient also suggested the economy isn't slowing enough to prevent inflation.

Initial jobless claims rose to 287,000 for the week ended Aug. 14, compared with a revised 283,000 the prior week and estimates of 291,000.

But the four-week moving average, which provides a more accurate picture of the trend in initial claims, fell to 281,250 from 288,250 a week earlier, suggesting more Americans are working and not receiving jobless benefits than at any other time in the past quarter century.

The lowest level of claims, according to the Labor Department, was 280,000 recorded on Dec. 22, 1973.

All told, the numbers point to an interest rate rise following next Tuesday's Federal Open Market Committee meeting, and possibly a follow-up rate rise at its October meeting, analysts said.

"It shows that the Fed still has some work to do to cool off domestic demand," said Ram Bhagavatula, chief economist at Natwest Global Financial Markets. "A 25-basis point rate hike at least seems a certainty next week."

At the same time, however, economists said the burgeoning U.S. trade deficit would likely continue to drag on economic growth, leading to a downward revision for second-quarter gross domestic product.

Revised second-quarter growth

"It looks as if second-quarter GDP will be revised downward to 1.5 percent or slightly less than that," Bhagavatula said. Initial numbers released at the end of last month pegged U.S. economic growth at 2.9 percent in the second quarter.

To be sure, the slight rise in June's exports may also be bad news for U.S. financial markets. That's because increasing demand for American goods abroad suggests a recovery in overseas markets, prompting some investors to invest in those countries rather than in the U.S.

"Things are improving overseas," said Paul Kasriel, chief domestic economist at Northern Trust. "It's likely that the rest of the world, including Japan, is going to start competing for some of the capital that's been flowing" into the United States.

That could prompt further weakening of the U.S. currency, driving cash away from U.S. stocks and bonds and diverting those funds to other markets, Kasriel said.

As for the United States' trading partners, the deficit with Japan leapt to $6.3 billion from $5.3 billion in May, while with China it increased to $5.7 billion from $5.3 billion a month earlier. With Canada, the U.S.' largest trading partner, the gap widened to $2.8 billion in June from $2.3 billion a month earlier.

In U.S.-Mexico trading, the deficit rose to $2.5 billion from $2.3 billion in May, and the deficit with Western Europe expanded to nearly $5 billion, the highest since a July 1998 deficit of $5.3 billion.

|

|

|

|

|

|

Commerce Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|