|

Fed boosts key rate again

|

|

August 24, 1999: 4:59 p.m. ET

Committee raises fed funds, discount rate by quarter point to cool growth

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The Federal Reserve raised short-term interest rates by a quarter point Tuesday - a move meant to slow the resilient U.S. economy and keep inflation away - and dropped a subtle hint that another rate rise may not happen so quickly.

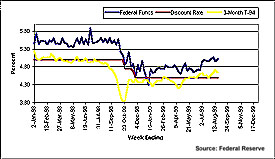

As expected, the Fed hiked the fed funds rate -- the target rate commercial banks lend to each other overnight -- to 5.25 percent, the second quarter-point increase in two months. The less-tinkered-with discount rate -- the rate at which the Fed's 12 district banks lend directly to financial institutions -- was increased to 4.75 percent from 4.5 percent.

It was the first time since April 1994 that the Fed opted to raise the fed funds rate at two consecutive Open Market Committee meetings and the first time since February 1995 that it moved the discount rate -- a sign that it wants to keep inflation in check. At the same time, the policy-making committee announced its decision to keep its bias neutral toward future rate actions, hinting that another rate move isn't necessarily imminent.

"It's a signal to the market that the Fed means business here," said Paul Hancock, a portfolio manager with Investors Group Inc. in Winnipeg, Manitoba. "It suggests the Fed is being tough on keeping inflation away but it also suggests they're willing to wait to see how things go before the move a third time."

Hardline approach

Stocks and bonds, which immediately shot out the gate following the announcement, gave back much of their gains as investors concluded that a third rate rise before year's end is still a possibility. The benchmark 30-year Treasury rose more than 1/2 a point, pushing its yield to 5.95 percent. The Dow Jones industrial average rose more than 45 points to 11,348 before sliding back into negative territory, ending the day down just 16 points.

The rate rise comes in the wake of economic reports showing persistently strong U.S. growth, but little actual inflation - the nemesis of the stock and bond markets. It also follows on the heels of a series of rate reductions that some economists believe the Fed is now taking back.

"From my perspective it leaves the door open to further rate hikes," said Dick Berner, senior economist with Morgan Stanley Dean Witter in New York. "Remember: the Fed is taking back what they gave last year, which suggests they will raise rates one more time and then see what to do after that."

Alan Greenspan and the Fed are determined to keep inflation at bay

At its June 30 meeting, the Fed raised the federal funds rate by a quarter percentage point, but adopted a neutral stance on future rates and left the discount rate unchanged. At Tuesday's meeting they kept the neutral bias but raised the discount rate - an inflation-cutting move also done to keep the spread between the two rates from widening.

With financial markets behaving "more normally," with persistent strength in consumer demand, with an extremely robust job market and with international economies showing signs of renewed vigor, "the degree of monetary ease required to address the global financial market turmoil of last fall is no longer consistent with sustained, non-inflationary economic expansion," the Fed said in its prepared statement.

Taking it back

In September 1998, the Fed embarked on a series of interest rate reductions designed to propel U.S. growth in the face of economic turmoil overseas. It reduced the fed funds rate three times to 4.75 percent from 5.5 percent and the discount rate to 4.5 percent from 5 percent.

Short-term interest rates have been climbing slowly

Since then the U.S. economy has taken off. Wages have risen, imports have surged and personal spending has taken off. Economies in the Far East and Europe are showing signs of recovery too. Even South America's economic outlook has improved, despite reports this week that Ecuador may need additional time to pay some interest owing on part of its outstanding debt.

The more pressing issue for financial markets now, it seems, is whether more rate increases will be on the Fed's agenda down the road, particularly in October and December, or whether this second tap on the brakes is enough to slow the U.S. economy and keep inflation under wraps.

"Today's increase in the federal funds rate, together with the policy action in June and the firming of conditions more generally in U.S. financial markets over recent months, should markedly diminish the risk of rising inflation going forward," the Fed said.

"The markets are assuming that the Fed are finished tightening for the year," said Sherry Cooper, senior economist with brokerage Nesbitt Burns Inc. "That presumption might prove to be premature. We, and the Fed, will wait and see."

Another one coming?

To be sure, the Fed is protecting consumers and financial markets from something it has yet to see - a substantial rise in inflationary pressures. Inflation rose at a tame 0.3 percent pace in July after ringing in flat for both June and May. And economic growth slowed to a 2.3 percent annual rate in the second quarter from a 4.3 percent pace in the first.

And higher interest rates - in the form of higher mortgage rates which are linked directly to the bond market and higher loan and credit rates which are linked more to Fed policy -- will undoubtedly lead consumers to sobering second thoughts when deciding on their purchases, slowing the economy down even more, analysts said.

Financial institutions typically follow the central bank's actions on rates, raising or lowering their prime lending rate in tandem with what the Fed determines they can charge to lend money.

Late Tuesday, Wells Fargo (WFC) announced plans to raise its prime rate by a quarter point to 8.25 percent, effective Wednesday.

All that may work to slow the economy down and keep inflation in check, according to analysts and economists. "The question is whether it would do that on it's own and the Fed seems to be telling us they don't think so," Berner said.

Reports on the U.S. economy will now be the focus for financial markets in the weeks ahead as investors look for more evidence that the economy is slowing and that inflation remains tame.

The National Association of Realtors Wednesday releases data on existing home sales and the Commerce Department releases its figures on durable goods orders. On Thursday, the Commerce Department releases revised GDP numbers and on Friday Commerce will release July personal income and spending figures.

"The markets seem to be interpreting this as the last tightening before year's end, and that may or may not be true," said Investors Group's Hancock. "If we continue to see signs of growth and worse, signs of inflation this could be second of a series. If not, then this could be the last rate rise for a while."

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|