|

Insuring college students

|

|

September 16, 1999: 7:18 a.m. ET

If you're not thorough, you may overlook some important needs

By Staff Writer Nicole Jacoby

|

NEW YORK (CNNfn) - In the whirlwind of tasks that precede most college departures, an insurance evaluation probably doesn't make many to-do lists.

Most parents assume their homeowners, auto and health polices will provide for their campus-bound children -- and in many cases, they do.

But more often than not, insurance policies are accompanied by caveats, with age, residence and academic standing helping determine to what extend your child is covered, if at all.

"There are a lot of students that are going to college uninsured," said Richard Flaherty, president of College Parents of America. "And for those that are insured, there is not a lot of knowledge about what scenarios can effect that coverage."

Shielding personal property

Many parents underestimate the need for insurance - especially property coverage -- during the college years in the belief that their child simply doesn't own enough to warrant a policy.

But high-priced items, such as computers, monitors, jewelry and sports equipment, have become common fare on most college campuses, leaving many students open to the risks of theft and damage.

"Students today are going to college with a lot more valuable articles than their parents did… it can add up," Flaherty said. "Parents need to make a decision about whether they want to take a chance with that."

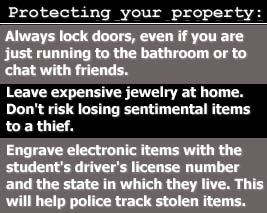

Leaving valuable items at home can minimize some potential loss. But when it comes to necessities like computers and sports equipment, that option may not be practical. And the cost of replacing these items can become a financial burden to already cash-strapped students.

"An uninsured loss such as the theft of a laptop or a liability claim stemming from a party mishap can deal a devastating blow to a college students' limited bank account or the livelihood of a parent already struggling with high tuition bills," said Madelyn Flannagan, consumer advocate for the Independent Insurance Agents of America.

While the personal belongings of students living in dormitories are commonly covered by their parents' homeowners' insurance, parents sometimes miscalculate the extent of this coverage.

The coverage for students under their parents' homeowners policies is typically limited to a certain percentage of the parents' coverage, usually about 10 percent. So depending on the policy, only between $2,500 and $10,000 of a student's belongings may be covered. With many computers and related equipment costing upwards of $2,000, this may not be sufficient if the student also owns other expensive electronics.

Students who live off campus, or in sorority or fraternity houses, are usually not covered by their parents' homeowners policies. And even parents who co-sign their child's apartment lease cannot usually extend their coverage to these properties.

Call your insurance provider to find out what is and can be covered under your policy. Be as specific as possible about your child's situation, as policies may have special provisions regarding high-crime urban campuses, students who travel frequently or those who own expensive electronics, sports equipment or jewelry.

Liability protection

Theft and damage are just a few of the concerns associated with property insurance. But renters policies can also safeguard you and your child against liability claims.

No matter how responsible your child, the chances of mishaps during the college years are likely to increase, especially given the prevalence of alcohol on college campuses. The student might be held liable for damage to someone else's property during a party or other social event held in your child's home. Even an incident as simple as the pizza delivery guy slipping and falling on your child's front porch can result in you paying thousands of dollars of medical bills.

The risks are particularly high if you co-sign your child's lease as you might be held responsible for damage caused by your child and be sued for "vicarious liability."

These risks can be difficult to justify given the low-cost of renters' insurance. In many cases, annual premiums total as little as $100 to $150 a year for $15,000 of personal property coverage and $100,00 to $300,00 in liability protection. Some insurance companies even let roommates split the cost of a shared policy.

Safeguarding student wheels

Car insurance is another story. Costly but necessary, it can weigh down a student's -- and parent's -- budget.

Leaving the car at home during the college years can greatly reduce those expenses, though that idea may not be particularly popular among most students.

In many cases, the location of your child's university and the availability of public transportation near campus will determine whether a family car can stay at home.

If you decide to keep the extra car at home, you can request a "lay-up" credit from your insurer. This option is not limited to students but can be applied to any car that is not being used. With a lay-up credit, the student pays only 10 percent of the regular liability premium, so a 6-month premium of $500 would be reduced to $50.

If you are sending a car to college with your child, be clear on the conditions of coverage.

Find out if insurance company offers "children-away-at-school" credits. This option is sometimes available to students who are on their parents' policy and who go to school more than 150 miles from home. Students are charged the same lower premiums they would pay if they were married -- usually a savings of about 25 percent.

Additional premium savings often can be realized by students who maintain good driving records, as well as those who make good grades. Bear in mind that cars that are titled only under the student's name will have to have their own insurance policy.

In sickness and health

When it comes to their children's health, few parents are willing to skimp. However, nearly one in six college students still head to campus without health insurance and many more probably don't fully understand the rules regulating the coverage they do have.

"If your parents have a good policy and you (the student) are included, you'll usually be okay," said Jayne Neagle, spokeswoman for Insurance Information Institute. ""But you don't want your son or daughter to call you from college really sick and then start to wonder."

Health polices are often not as wide-ranging as parents may think. Many policies require that dependents over the age of 18 maintain their full-time status as students to be eligible for coverage, so part-time students, as well as those dropping credits or withdrawing from classes mid-semester, should check with their insurance companies to make sure those actions won't effect their coverage.

Age is also commonly taken into account. Coverage for those 23 and over is usually not available under parents' policies, regardless of the student's enrollment status.

Finally, some families mistakenly believe that their medical policies will apply overseas, when they are, in fact, limited to the United States or North America. Students studying or traveling abroad may need to buy additional insurance for those periods of time. Often the university sponsoring the study abroad program will have offer special health policies or information on where they may be available.

|

|

|

|

|

|

|