|

Investing in cancer drugs

|

|

September 20, 1999: 6:08 a.m. ET

As success is achieved, some who back biotechs reap the benefit

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - It's been nearly three decades since President Richard Nixon declared war on cancer, and the anniversaries of that 1971 declaration come and go.

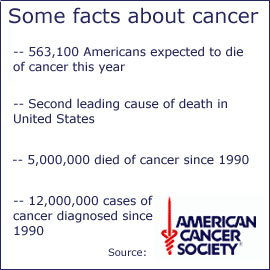

But bolstered by new-generation research and advanced gene-hunting techniques, drug makers are developing a cornucopia of promising treatments to battle the disease, still the second leading killer of Americans after heart disease. Already, a few of these treatments have come to market.

While Wall Street isn't pinning its hopes on a miraculous, all-in-one cancer cure, analysts say that years of research and billions of dollars in funding are beginning to show results -- both for cancer patients and investors.

In the biotech sector, where much of the innovation is being driven, the focus is on genes and proteins that can stimulate the body's resistance to the disease, minimize the harsh effects of traditional treatments such as chemotherapy, and even perhaps stem the growth of cancerous tumors by choking off the blood supply that feeds them.

Today "we're seeing all the benefits of all that research coming to fruition," said Alan Auerbach, an analyst at First Security Van Kasper who follows the biotech industry. "I think Wall Street's attitude is that 10 years out, cancer will be much more of a chronic, manageable disease than it is today, similar to diabetes. I think that's what people are really looking at."

As many as 150 -- or one-third -- of the approximately 450 biotech drugs now in clinical development are cancer treatments, according to Prudential Vector Healthcare, a division of Prudential Securities. A few small biotech firms that have brought products to market, such as San Diego-based Idec Pharmaceuticals, have seen their stock prices catapult several fold just since the beginning of the year.

An investment opportunity?

But investors wonder how to choose the right investments in this risky and highly technical field.

News about research results and drug approvals can be dizzying, and biotech stocks are famously tumultuous, as the drug discovery and development process typically costs hundreds of millions of dollars and involves years of research.

Even then, only about one in five of all drugs that undergo clinical trials ever makes it to the market, according to statistics from the Tufts Center for the Study of Drug Development. Much like the latest investment craze, Internet stocks, few biotech firms have yet turned a profit.

"Picking out the right companies is the tough part," said David Batter, an analyst at Mehta Partners, a pharmaceutical stock research firm. "Most biotech companies -- especially when they're in the early stages -- they're really tough to predict."

And experts caution that while advances in cancer research are being made at a rapid clip -- the announcement of promising research results does not necessarily mean it's a great time to make an investment.

Shares of EntreMed have swung

sharply over the past year.

A case in point is Rockville, Md.-based EntreMed Inc. (ENMD), which was thrust into the limelight and saw its stock price rocket to 85 from 12 in just one day in May 1998 after the New York Times reported that the firm was developing two tumor-blocking proteins that cured cancer in laboratory mice.

But the stock retreated sharply in the subsequent months as work on the proteins inched forward, and only now is the company readying to launch human trials of its discovery. In the meantime, other firms are racing forward with similar technologies. Today, shares are trading around 22.

"The one rule I think is really important when you hear about a scientific discovery is don't buy any stock then -- but you may want to start investigating the company," advised Jim McCamant, editor of the Medical Technology Stock Letter in Berkeley, Calif.

A huge market

But experts say they are particularly bullish on the cancer drug sector because it is such a huge market and new treatments are so desperately needed. The financial cost of cancer is estimated at about $107 billion annually, including about $37 billion in direct medical costs, according to the American Cancer Society.

Analysts say that with the development of more targeted and potent medicines, more of this $37 billion may go specifically toward drugs -- a huge market potential for companies working on new treatments.

And while biotech stocks always pose risks, analysts say cancer-drug firms can be among the safest investments in the sector because so many types of cancer are so poorly addressed.

They also note that researchers are discovering that perhaps the best way to battle cancer is a multi-pronged offense in which a biotech treatment can work alongside traditional chemotherapy, radiation or surgery. The problem with these existing remedies isn't that they don't work, but that the body can't handle the harsh side effects.

"We have many good drugs to kill cancers - unfortunately, they kill us too," said William Haselton, CEO of Rockville, Md.-based Human Genome Sciences Inc. (HGSI), which is using its massive database of genes to develop experimental new drugs for a wide range of diseases.

The firm is developing a drug designed to safeguard patients' blood tissue while they undergo cancer therapy. "If this drug works as we hope it will, we will allow many more doses of cancer therapy to be administered and higher doses without risking a patients' life," Haselton said.

Meanwhile, changes in the Food and Drug Administration's review process for proposed treatments has helped spur Wall Street's interest in cancer-related drugs. The FDA has instituted a priority review procedure for drugs in key development areas. The approval process isn't easier, but it does put these drugs on the fast track, experts say.

"It cuts years a lot of time off of the development of the compounds, and as an investor, hopefully you get a return sooner," Batter said.

Major areas of development

There are three main areas of cancer drug development: monoclonal antibodies, which are designed to attack cancer at its genetic roots and can work alongside traditional cancer treatments such as chemotherapy; cancer vaccines that attempt to boost the immune system against a recurrence of the disease, and the highly touted anti-angiogenesis compounds, protein-based treatments that could potentially starve the blood supply to tumors.

The most advanced area so far is the monoclonal antibody sector. Two such treatments are already on the market: Genentech Corp. 's (DNA) Herceptin, a drug for metastatic breast cancer, or cancer that has spread outside of the breast, and the non-Hodgkin's lymphoma medication Rituxan, which it developed and co-markets with Idec Pharmaceuticals (IDPH).

Sales of Herceptin totaled $46.2 million in the second quarter, while Rituxan sales reached $74.4 million, rising 114 percent over the 1998 period. The companies are involved in some key studies of these drugs, hoping to expand their use to other types of cancers.

"It's very clear that this is the first wave of value that's come out of biotech in terms of cancer," said Robert Toth, who studies cancer drug firms for Prudential Vector Healthcare.

Shares of IDEC have dropped off after a steady rise.

Idec's stock soared recently, amid a sharp climb in its second-quarter profits. The San Diego-based company's earnings rose 97 percent during the three months, making it one of the few profit-making biotech firms.

The stock recently dropped from its highs -- it hit a 52-week high of 145-1/2 a few weeks ago -- over valuation concerns and warnings that third-quarter sales of Rituxan would not be as high as Wall Street anticipated. But the stock is still a high-flyer at around the 108 level.

Stock in Genentech, which is about 84 percent controlled by Switzerland's Roche Holdings AG, also has shot up after a stock offering earlier this summer -- rising to a high of 179-1/2 from 116-1/2. It was trading at around the 160 level last week.

Another company to watch in this field is ImClone Systems (IMCL). The New York-based company's proposed C-225 antibody treatment for head and neck cancers has entered some pivotal clinical trials, and could be on the market by late next year, McCamant said. He says it has the potential to be a blockbuster $1 billion drug.

Analysts also point to Coulter Pharmaceuticals (CLTR) of Palo Alto, Calif. Its stock recently slid over news that the FDA wants more information about its proposed antibody Bexxar, which it is developing with London-based pharmaceutical giant SmithKline Beecham (SBH). Analysts expect the drug ultimately will be approved, but probably not until the middle of next year.

Coulter stock fell sharply after an FDA ruling.

Another area being watched is the development of so-called cancer vaccines. These are not preventative vaccines in the traditional sense, such as those for measles or polio, but compounds that try to stimulate and strengthen the immune system and help fight off a disease already in the body, boosting the immune system to fight a recurrence of cancer.

Progenics Inc. (PGNX) of Tarrytown, N.Y., Seattle-based Corixa Corp. (CRXA) and Titan Pharmaceuticals (TTP) of San Francisco are among the firms working on such vaccines. But they are not on the market yet and there's no clear evidence showing whether they will work. Toth said it likely will be at least a year before they could be ready for market.

Meanwhile, perhaps the most hotly followed area is research into anti-angiogenesis, a process that could potentially cut off the lifeline to tumors. In addition to EntreMed, many other companies are racing to develop these proteins. These include Genentech, Agouron Pharmaceuticals - which has been purchased by major pharmaceutical house Warner-Lambert (WLA) -- and Sugen, which Pharmacia & Upjohn (PNU) has acquired.

Industry experts say that anti-angiogenesis compounds are likely about two years away from going on the market. "There will be a lot of competition out there by the time these products get to market -- if they do," McCamant said.

What investors should know

Analysts say that while interpreting news of medical studies can be confusing, even the lay investor can get a decent understanding of drug research and the investment risk involved by learning more about the firms themselves as well as some basics about the clinical trial process.

Investors should assess what stage the drug is in -- if trials have begun on humans or researchers are still performing tests on laboratory mice Results based on animal research can be radically different when a drug is then tried on people. And, if human trials have begun, how advanced are they -- in the tentative first stage or the more advanced second or third stages?

"Especially for folks that don't have technical expertise, look for drugs that are already in a late-stage development," advised Peter Ginsberg, an analyst at US Bancorp Piper Jaffray.

Also, look at what other drugs the company has in its pipeline -- are all of its eggs in one basket, or does it have other prospects?

A company such as Warner Lambert's new acquisition, Agouron, was engaged in experimental cancer research, but also has had the successful HIV treatment Viracept on the market, McCamant said.

Toth said good bets for investors looking for safety are companies that are in partnership with major pharmaceutical firms - who themselves have decided the companies are worth the risk.

Investors also should look for companies that are addressing "large and rapidly penetrable markets," advised Ginsberg. "You focus on products that are targeting large markets and products that have been proven to work."

Meanwhile, Haseltine, the Human Genome Sciences chief, also advises people to be cautious about predicting the outcome of trials and when a treatment could potentially go on the market.

For patients battling cancer, "people need hope, even when there might not be hope," he said. "But for people like me, we have a responsibility to be tempered in our descriptions of the actual stage of our research."

However, he said these are exciting times to be following the cancer arena.

"I believe that in the next 10 years we will make very dramatic progress in the treatment of most major forms of human cancer," he said. "I am more optimistic than I have been in 30 years."

|

|

|

|

|

|

|