|

Autos end year with a bang

|

|

October 1, 1999: 5:29 p.m. ET

Low prices, strong economy spur 99 model year; same expected for 2000

|

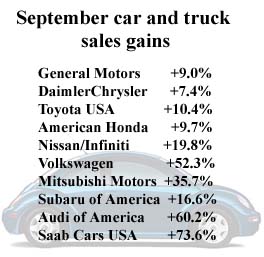

NEW YORK (CNNfn) - The auto industry ended a very strong model year with a record sales month in September, as major car makers reported sales gains near or above double digits.

General Motors Corp. (GM), the world's largest automaker sold more than 5 million vehicles in the United States in the 1999 model year ended in September, its best year in a decade.

And other manufacturers also posted solid sales results with DaimlerChrysler AG (DCX) reporting record sales for the model year and Honda selling more than one million vehicles for the first time in the company's history.

The combination of a strong economy putting money in consumers' pockets and the battle for market share putting pressure on prices should keep sales strong going into the 2000 model year said John Casesa, auto analyst at Merrill Lynch. Despite the strong demand for vehicles, automakers aren't likely to be able to raise prices significantly, he said.

"The reason that there is a market share war, while demand is terrific, there is lots of capacity," he told CNNfn Friday. "The world has at least 40 too many automobile plants and GM is trying to regain the share it lost with last year's strike. So when the biggest company in the market, almost a third of the market, cuts prices, everybody has to follow."

Casesa said the GM's efforts to recapture market share are likely to keep pressure on that stock. DaimlerChrysler stock will be held back in the short-term by merger and integration pains, such as last week's announced departure of its American-based president. Ford Motor Co. (F) is the domestic car maker to watch right now, he said.

"They have a lot of new truck product - a big truck called the Excursion, and something called the Explorer Sport Track, which is half sport utility, half pickup," he said. "They are on the leading edge of developing new products for what is a profitable and growing part of the market."

Despite the positive sales report, GM was off 11/16 Friday to close at 69-5/8. But other auto stocks gained. The American depositary receipts of DaimlerChrysler were up 3/16 to close at 69-5/8. Ford, which will release its sales numbers Monday, gained 3/8 to 50-5/8.

The ADR's of the three major Japanese makers did better, with Toyota (TM) up 2-1/16 to 64-7/8, Honda (HMC) gaining 9/16 to 82-3/8 and Nissan Motor Co. (NSANY) up 7/16 to 12-1/2.

Light truck sales, including the popular sports utility vehicles, were again the strong sellers. This was the first non-strike month that GM sold more trucks than cars, as light trucks sales were up 30.2 percent, while car sales fell 6.4 percent. At DaimlerChrysler truck sales were up 10 percent for the model year, while car sales were up only 2 percent.

The strength of trucks was apparently bad news for luxury car models. GM's Cadillac division had a poor performance compared to last year, with September sales off 9.6 percent and only a 2.1 percent gain in year to date sales. Only GM's Saturn division posted a larger year-over-year decrease in sales.

Meanwhile, Toyota's Lexus division reported a 2.4 percent drop in September sales, and a 4.4 percent drop for year-to-date, compared to 10 percent gains in both periods for the company's overall U.S. sales. And Honda's Accura division had a 4.9 percent fall in sales for September.

But some luxury modes did relatively well. Mercedes Benz, whose U.S. sales numbers are now included in the DaimlerChrysler report, saw a 9.5 percent gain, and Infiniti, Nissan's luxury division, posted a 30 percent gain in sales. Among independent auto luxury automakers, Audi posted a 73.6 percent gain for the month to post a company record.

|

|

|

|

|

|

|