|

Online IPOs for the public

|

|

October 2, 1999: 1:40 p.m. ET

Brokerages and investment banks tout individual access, but it's untested

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Robert Eliason isn't sure about investing in IPOs online.

Eliason has accounts with two online brokerages, DLJ Direct and Fidelity. Both boast of the great access they give their customers, so they can get into companies that are going public.

But Eliason, a retired IRS agent who lives in Houston, doesn't buy it, even though he likes investing in IPOs. For starters, both brokerages --much as many of their competitors -- require him to have at least $100,000 in his account before he can get in on the ground floor of an offering. He could meet that if he consolidated his accounts, which the brokerages clearly hope he will, but he figures it's not worth it.

"I doubt that even with $100,000, or a little over, I'd get little more than the crumbs," Eliason said. "They have investors that have 10 times or more than what I have. And they're favored."

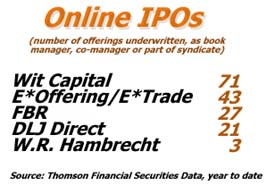

Still, it seems like every online broker touts its IPOs these days. Specialty companies such as Wit Capital, W.R. Hambrecht and Friedman, Billings, Ramsey & Co. devote themselves to offering the IPOs they underwrite online to individual investors.

And who wouldn't want to get in on Foundry Networks (FDRY), which rose 525 percent its first day of trading, Sept. 28, making it the most successful IPO so far this year? Shares in the company, which makes equipment for Internet service providers, leaped from 25 to 156-1/4.

But don't expect many of those Foundry Networks shares to have landed with online investors, says Charles Kaplan, president of Equity Analytics, which analyzes IPOs. He's skeptical about companies selling stock to the public through the Internet, which he thinks doesn't change a thing.

"It doesn't democratize the distribution of IPOs," Kaplan said. "Whatever benefit it has is marginal at best. It's a crock. And people like DLJ will still use it as a selling point to get you to open an account."

IPOs not for the untested

The first risk in investing in IPOs is that they're unproven companies, without much of a track record or analytical scrutiny. And everyone reads the same headlines about Foundry Networks, and about Yahoo! (YHOO), Priceline.com (PCLN), Amazon.com (AMZN).

"It's real easy to say, 'Oh I wish I'd bought Yahoo at $10,'" Eliason said. "But at the time you're thinking about getting in, you don't know that it's going to be an Amazon or a Yahoo!."

Still, on a more-modest scale, Eliason has made a little more than $21,000 off less than $20,000 he put into three IPOs. He gets his shares through Safeguard Scientific, a company he's invested in that operates like a public venture capital fund. Safeguard (SFE) buys into development-stage companies, then gives its investors the chance to buy shares if and when they go public.

Eliason's profits are a study of what it's like to invest in IPOs -- nearly all the gain came from one company, Internet Capital Group (ICGE), which has run up fast since he bought in at $14. His profit was modest from U.S. Interactive (USIT), and the third IPO, DocuCorp International (DOCC), is trading around the $5 price he bought in at.

Still, with IPOs, "it's not too much of a gamble if you can get in on the inside offer," Eliason said. "There's the potential for tremendous gains. … There are also IPOs where you can get burned a lot."

The biggest problem for individual investors is getting access to quality offerings. Eliason figures he wouldn't get the good IPOs through an online broker. Either he wouldn't get shares, he thinks, "or I might get a reasonable number of shares offered to me but in an IPO that's not particularly predicted to be a hot one."

And online offerings don't change much

Kaplan agrees with him. "There are some offerings, the crappy offerings, where the only people stupid enough to buy it are the retail investors," he said. In general at least a third of an IPO, often much more, goes to institutional investors. Some say retail investors get 10 percent to 25 percent of a typical IPO, nearly all reserved for a brokerages' best customers.

Some companies are keen to see a little stock distributed to individuals electronically. Scient Corp., an e-business consulting company, was the first IPO to sell shares to individuals via Discover Brokerage.

"We did it because we believe in electronic trading and electronic commerce," Scient's founder, Eric Greenberg, said. Brokerages also distribute shares electronically to show support, he feels. But the shares still go to the best customers, and it doesn't mark a change from the way IPOs are distributed offline.

"Don't let anybody shock you into this being groundbreaking," Greenberg said. "It has more marketing value than anything else. It gives the incentives for people to put $100 grand in those accounts. It's a customer access issue."

Some specialists boast of better access

Access is better for more run-of-the-mill customers at companies that specialize in online IPOs, of which Wit Capital is the best-known. Investment bank Friedman Billings Ramsey & Co. has been heavily promoting its FBR.com brokerage subsidiary, too. And E*Trade has a large stake in E*Offerings, which gives it 50 percent of its allocation in deals.

Wit Capital, which now has around 100,000 accounts, hopes to attract companies looking to go public by offering analytical coverage and investment bankers to work on the deal.

The company has good connections, including an ownership interest from Goldman Sachs and co-CEOs who headed Smith Barney's investment banking and Charles Schwab's capital markets. By offering its own bankers and analysts, it hopes to get an advantage over DLJ Direct, say, which may underwrite offerings but relies on its parent's research and banking.

Wit's main problem has been getting enough shares to satisfy the huge demand for IPOs with individual investors. Mark Loehr, director of Wit's investment banking, says the company now regularly gets more than 100,000 shares in an offering, which it distributes on a first-come, first-served basis. It discourages "flipping," selling an IPO quickly for a quick gain, by putting flippers bottom of the list.

"Back in March, we were getting a small percentage [of offerings]," Loehr said. In June, it was getting 5 percent of its deals, and that's now closer to 10 percent, he said.

Some investors criticize it for not delivering shares -- one of Kaplan's friends opened a Wit account, has participated in every offering for a year, and still hasn't got in on an IPO. But Loehr said investors who participate get shares in around one in four deals.

The number of shares is likely to be small as Wit spreads its allocation. "We go as broad as possible," Loehr said. The IPO application process, with a number of e-mails back and forth to show you've read the prospectus, to indicate interest and to confirm, is complex, he said, and puts some people off.

Others trying to emulate Wit

But Wit has been quite successful at breaking into the investment-banking ranks quickly. "They've certainly been able to be involved in a number of underwritings," said Linda Killian, a portfolio manager for Renaissance Capital's IPO fund, which gives tips on investing in IPOs on its site.

But don't quit your day job based on those skyrocketing returns you've heard of. "Realistically an individual investor is only going to get a couple of hundred shares," she said, and if you flip them for a quick profit, you might not be invited back. IPOs often drag back after a run-up, but retail clients of the online brokerages will have to live with that, she said. "They want to place the shares in the hands of people who will be the long-term investor."

FBR.com, whose parent also has analysts and bankers to help underwrite IPOs, is just starting its push, with a $25 million ad campaign. It shares the same philosophy as Wit and the lottery strategy for allocating shares to what it calls "wealthy wannabes."

Suzanne Richardson, FBR.com's president, said "we want to democratize the IPO process," pointing out that you can open an FBR.com account for less than $2,000. FBR.com also has a deal with Fidelity to offer shares to its customers. Companies keen not to have too much control from institutional investors and that want to gain "affinity" by giving shares to customers are best-suited to offering IPOs online, she said.

Critics say FBR doesn't get quality companies to underwrite. But these are early days for online IPOs. Performance data for the stocks any of the online underwriters isn't thorough enough to get a full picture of how they're doing, IPO trackers say.

Auction model promising, most untested

The most-untested model is the Open IPO system that W.R. Hambrecht has developed. It uses an auction process, in which investors set the price they're willing to pay for shares. It uses a more-typical online distribution method when it can't control the offering. But it has only participated in a few deals since Bill Hambrecht, founder of discount brokerage Hambrecht & Quist, started it in February.

Many people think the model has potential. "He's breaking an established system," Greenberg, the Scient founder said. Other e-commerce companies have shown that's difficult but can have great benefits.

The challenge for the companies it underwrites is picking up analyst coverage, some think. And its method tends to ensure IPOs don't soar immediately, because they're already priced to the lowest bidder.

But many eyes are on the company, and the other companies offering online IPOs.

"The jury is still out on how good the IPOs are that [online investors] now have access to," said Maria Scott, editor of an investing journal for the American Association of Individual Investors. "It's always better that individuals have more options. But whether this method will really lead to a lot of really good IPOs for individuals is up in the air."

|

|

|

|

|

|

|