|

Take a breather, Alan

|

|

October 4, 1999: 7:29 p.m. ET

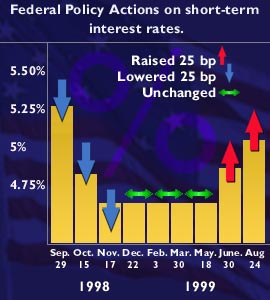

Most analysts expect another Fed interest rate rise, but not just yet

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Take a breather, Alan.

That's what Wall Street's analysts and economists are suggesting Federal Reserve Chairman Alan Greenspan do when he meets with his colleagues Tuesday to discuss the U.S. economy and debate whether another interest rate rise may be needed to cool growth and keep inflation away.

"I don't think we're going out on a limb in suggesting that the Fed will leave rates unchanged this time around," said Robert Mellman, a senior U.S. economist with JP Morgan in New York. "We expect the Fed may bide the time it has and wait to see how the economy looks before moving again, particularly with no solid evidence of rising inflation."

Unlike four months ago, when the economic horizon looked clear from inflation, recent indicators suggest prices may not stay subdued forever -- at least without a few more taps on the brakes from the Fed.

Change in scenery

Part of that is the result of consumers' unwillingness to leave home without it. Americans have been buying up homes, cars and anything else they can get their hands on at a frenetic pace, a reflection of the rising values of their homes and investments and particularly their stock portfolios.

The other part of the change in economic scenery comes from an almost miraculous recovery of economies overseas, particularly Asia, which now is beginning to fuel demand for U.S. goods and services even more.

"We've seen a lot of significant evidence lately that the global economy is picking up, particularly in export orders," Mellman said. "There's a lot of evidence coming in that things overseas look good."

That's why most analysts and economists are of the opinion that members of the Federal Open Market Committee won't vote to raise interest rates for the third time this year when they convene in Washington Tuesday.

Crystal ball approach

The yield on the October fed funds contract, which indicates where the market thinks the Fed's trend-setting funds rate will be in the future, is now at 5.30 percent, not far off from the 5.25-percent level of the current fed funds rate.

January, however, shows a different story. The yield on the January contract currently is 5.44 percent, pretty close to a quarter-point higher than the target rate today, suggesting the market is pricing in another quarter-point move in the next three months.

Many analysts point out that the Fed has yet to take back the third rate cut it "gave" during the 1998 Russian debt crisis

"I don't see any way the Fed can avoid raising rates," said Tim O'Neill, chief economist at Harris Bank-Bank of Montreal. "The Fed simply has to make it less desirable for consumers to spend." O'Neill forecasts a quarter-point rise in short-term rates at the Fed's Nov. 16 policy meeting and then two more quarter-point increases in 2000.

And there are a lot of indicators pointing to robust growth. Employment growth remains brisk. The housing market is on rails. Manufacturing output won't quit. And productivity -- the one thing that offset concern about growth and convinced the Fed the economy could keep growing with sparking faster inflation -- slipped in the second quarter.

Where's the inflation?

To be sure, the most noticeable missing ingredient has been inflation, the nemesis of financial markets and the enemy of savvy consumers.

Consumer prices rose at a moderate 0.3 percent monthly pace in August, matching analysts' expectations and confirming that strong economic growth, for a variety of reasons, is not translating into higher prices. The consumer price index, the nation's primary gauge of inflation, is up 2.6 percent on an annual basis so far in 1999, compared with a 1.6 percent rise for all of 1998.

Even though it's up, it's still pretty good, according to analysts and economists. Here's why: Real interest rates -- what it really costs you to borrow money and how far those dollars stretch when it comes to buying things - haven't really changed.

A year ago, the benchmark 30-year Treasury bond had a yield of just under 5 percent, indicating the market was willing to buy the bond and earn that amount of interest on their fixed investment.

Throttling down?

Inflation, meantime, which erodes the fixed value of a bond, was hovering around 1.5 percent, leaving what analysts call real interest rates -- the market-determined rate on bonds minus the inflation rate -- around 3.5 percent.

As of Monday, the 30-year Treasury bond's yield was 6.12 percent and inflation on a year-to-year basis was 2.3 percent. That leaves the real interest rate at 3.82 percent, remarkably close to what it was a year ago.

What that indirectly suggests is that the purchasing power of consumers and businesses is almost the same as a year ago, even though the Fed has raised short-term rates twice in the past year.

And, if the economy keeps going at the 3.5-percent-to-4.5-percent pace analysts and economists are expecting for the rest of 1999 and through 2000, more rate rises can be expected, said Adam Blankman, a senior market analyst with Standard & Poor's MMS in San Francisco.

Some helpful hints

"The best bet on the FOMC meeting is a 'steady but ready' announcement," he said. "Steady rates, but ready to tighten quickly if inflationary pressures emerge," probably in the form of a "tightening" bias disclosure -- a caution flag the Fed waves to tell the world that it's leaning toward raising rates in the near future. The Fed's bias is currently "neutral."

Indeed, several Fed officials including Chief Greenspan himself have had ample opportunity in recent weeks to warn of a pending rate rise.

"When there's a high degree of uncertainty about forecasts, it could be best for policy to be more cautious -- in the extreme, to wait until inflation actually starts to rise" before raising rates, Robert Parry, president of the Federal Reserve Bank of San Francisco, said last week.

With "the increase in productivity over the last four

quarters, it would appear you can grow the economy at a 4 percent rate" without prompting unwanted inflation, William McDonough, president of the New York Federal Reserve Bank said Friday.

|

|

|

|

|

|

|