|

Xerox warns on 3Q profit

|

|

October 8, 1999: 4:56 p.m. ET

Stock plummets after copy-machine leader says earnings will fall least 10%

|

NEW YORK (CNNfn) - It was a tough day at the office for Xerox Corp. Friday after the company, citing weak sales in the U.S. and Europe, warned that third-quarter profit will be sharply lower than last year's results.

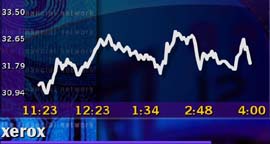

Xerox (XRX) stock fell to a new 52-week low, down 12-1/8 to 30-5/8 in early trading Friday and down 10 to 32-3/4 at the end of the day.

Analysts said the biggest U.S. copier maker is struggling to find its place in a changing office environment and hitting roadblocks in the restructuring of its sales force.

"With this whole digital environment, the company has had to kind of reinvent itself and produce machines that do a lot more than make photocopies," said Brian Eisenbarth, an analyst at Collins & Co., who has a "hold" rating on the stock. "They've got a pretty decent product portfolio, but they're moving into an area where they're not really known."

Eisenbarth said he did not see a recovery in the stock any time soon.

"There's been too much damage at this point," he said. "The market is going to wait and see."

Xerox said earnings for the July-September period will be about 10 to 12 percent below the year-ago figure of 53 cents per diluted share and revenue for the quarter will be flat.

Wall Street analysts polled by First Call had forecast earnings of 58 cents per share. Results will be released Oct. 18.

Besides flat revenue for the quarter, an unfavorable product mix and increased competition have hurt operating margins, the Stamford, Conn.-based company said.

Also, currency devaluation and economic weakness in Brazil continued during the quarter and results at its Fuji Xerox unit will fall below earlier forecasts.

CEO Rick Thoman said despite the third-quarter performance, the company is sticking with its strategy of expanding its product line and distribution channels, which "over time will achieve the revenue and earnings benefits it is intended to produce."

Rudy Hokanson, an analyst at CIBC World Markets, said the company's sales force has been pressured by a restructuring and cutbacks in the administrative staff. Hokanson said CIBC changed its rating on Xerox to "hold" from "strong buy."

"Xerox historically has not had good visibility on a quarter until the end of the third month," he said. "The sales in the quarter are skewed toward the end of the sales period."

He said that while the company's long term strategy makes sense, "coming up with flat revenues and down earnings is discouraging in the near term.

"You don't have any visibility as to when they're going to come out it and what kind of shape they'll be in when they do come out of it," he said.

Hokanson said the sales force often must contend with issues that once were handled by the billing staff. In addition, the sales team is being restructured to look at industries, rather than geography.

"The idea is to eventually show the customer you know their industry," he said.

Both analysts said Xerox will likely be facing its issues for several quarters.

"It's a great company and they've been around a long time," Eisenbarth said. "But things are changing pretty fast and sometimes the bigger and more successful you are, the harder it is make a change."

|

|

|

|

|

|

Xerox

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|