|

Europe stages rebound

|

|

October 22, 1999: 12:49 p.m. ET

London, Frankfurt jump 2% as investors pile back into banking, tech stocks

|

LONDON (CNNfn) - Europe's stock markets ended the week with a firm rally that saw London and Frankfurt jump 2 percent Friday and leave all the major bourses with healthy gains from the week's trade.

Telecom shares continued to provide bourses with most of their upward momentum while banking shares recovered in the week's final session and technology issues rebounded strongly from previous losses.

Soft German inflation data helped curb interest-rate worries while Wall Street's rebound also firmed sentiment near the session close. The Dow Jones industrial average was almost 1.5 percent ahead at the close of business in Europe.

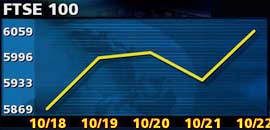

London's benchmark FTSE 100 closed up 120 points, or 2 percent, at 6,058.90 after a surge in the last 30 minutes of trading. The index added 2.6 percent from last Friday's close.

The Xetra Dax was even stronger, adding 111 points, or 2.12 percent, to end at 5,357.75, a 3.4 percent advance for the week.

The CAC 40 in Paris added 75.4 percent as its 1.6 percent gain took the index to 4,677.80, a 3.4 percent rise during the week.

Zurich's SMI marched up 1.4 percent to end at 6,876.90. Amsterdam was the strongest of the smaller markets, adding 2.2 percent.

The FTSE Eurotop 300, a broader measure of the largest European shares, advanced 2 percent Friday as technology shares rebounded 8 percent after sliding Thursday in the wake of IBM's profit warning.

In the currency markets, the euro slid more than 1 cent to $1.0680, a 2 cent loss during the week. The single currency slid after the European Central Bank's decision Thursday to maintain its key interest rate at 2.5 percent.

London's surge reflected broad gains in most sectors, with heavyweight banking, telecom and oil stocks all pushing ahead.

HSBC (HSBA) led the gainers with a 6.7 percent jump while Standard Chartered (STAN) rose 6.5 percent. Both benefited from a strong performance overnight in Asian markets, where they derive the bulk of their profits.

The telecom contingent wasn't far behind, with Colt Telecom (CTM) adding 6.6 percent and British Telecommunications (BT-A) rising 5.2 percent.

The sector was lifted by the $36 billion acquisition of cellular operator Orange (ORA) by Germany's Mannesmann. Orange shares lost 3.3 percent Friday.

In other sectors, chemicals group ICI (ICI) ended 4.6 percent ahead as investors continued to buy into their earnings story following strong third-quarter data earlier this week.

Railtrack (RTK) rose 3.1 percent after firming up its investment plans, notably on rail safety, in the wake of bearish sentiment after the London rail disaster two weeks ago.

The rebound in the technology sector was led by software developer Invensys (ISYS), a major casualty Thursday, which advanced 5.3 percent.

BP Amoco (BP-A) topped off the advance as the FTSE's largest stock gained 3 percent.

British American Tobacco (BATS) led the decliners as it slumped 8.4 percent, weakened by the aftershocks of a Florida court's ruling against U.S. cigarette maker Philip Morris (MO). Imperial Tobacco (IMT) lost 3 percent.

Brewing stocks also pared recent gains, with Whitbread (WTB) down 3.1 percent and Bass (BASS) off 1.7 percent.

Media and information group Reuters (RTR) continued to dip after its profits warning Thursday, losing another 4.8 percent

Telekom boosts Frankfurt

Deutsche Telekom (FDTE) was the focus stock in Frankfurt, ending almost 2 percent higher after an initial surge of nearly 3 percent. This came after it unveiled plans to buy the mobile phone assets of U.S.-based MediaOne Group (UMG) in Poland, Hungary and Russia for $2 billion.

Viag (FVIA) surged 4.5 percent on reports that it may acquire the Swiss and Austrian assets of Orange.

Siemens (FSIE) climbed 2 percent after confirming the sale of its retail banking unit to a U.S. buyout firm for $994 million. Software producer SAP [FSE:FSAP3] rebounded 5.7 percent from its recent lows, inspired by poor third-quarter results earlier in the week.

HypoVereinsbank (FVRB) was the firmest of the financial stocks, with a rise of 2.1 percent ahead of its nine-month earnings next week.

Mannesmann (FMMW) lost another 2.6 percent amid fears that is overpaying for Orange.

In Paris, construction group Lafarge (PLG) topped the FTSE gainers with a 6 percent climb after its U.S. unit posted strong third-quarter results.

Oil producer TotalFina (PFP) jumped 4.6percent while telecoms also continued their run, with heavyweight France Telecom (PFTE) up 1.9 percent and Alcatel (PCGE) up 3.8 percent..

Auto parts maker Valeo (PFR) suffered the sharpest decline, off 3.1 percent after a strong rise in the wake of its third-quarter earnings Thursday.

Metals group Alusuisse was the best performer in Zurich, adding 3 percent, while Credit Suisse firmed 2.5 percent and drug giant Roche Holdings gained 2 percent.

Swedish telecom company Ericsson soared more than 10 percent to an all-time high of 320 euros after the world's third-largest mobile phone maker reported a better-than-expected third-quarter pretax earnings.

-- from staff and wire reports

|

|

|

|

|

|

|