|

Income, spending tame

|

|

November 2, 1999: 12:30 p.m. ET

September spending up 0.4%; income flat due to Hurricane Floyd effects

|

NEW YORK (CNNfn) - U.S. consumer spending rose at a moderate pace in September while Hurricane Floyd flattened income levels by keeping thousands of East Coast workers temporarily away from their jobs, the government reported Tuesday.

Personal income was flat in September, compared to the 0.3 percent gain expected by analysts and the 0.4 percent rise recorded in August, the Commerce Department said. Without the effects of Hurricane Floyd, personal income would have risen 0.3 percent, the report said, in line with forecasts.

Consumer spending, meantime, advanced 0.4 percent, just above analysts' estimates of a 0.3 percent increase but half the 0.8 percent gain registered the month before. Consumer spending fuels about two-thirds of the nation's economy.

Even with the one-time weather-related effects, economists took the numbers as encouraging signs that consumer spending is beginning to slow, reducing the threat of accelerating inflation and another interest-rate rise from Federal Reserve policy makers later this month.

"This anemic rise at the end of the third quarter suggests that consumer spending will rise much more slowly in the fourth quarter," said Stephen Wood, a senior economist at Bank of America Securities in San Francisco. "This is the type of slowdown in spending the (Federal Open Market Committee) has been looking for.

Belated reaction

Fed officials next meet Nov. 16 to discuss the pace of the economy and the direction of short-term lending rates. After raising their benchmark Fed funds rate twice last summer, Fed officials left rates unchanged at their October meeting, though adopting a bias toward raising rates again if they see fit.

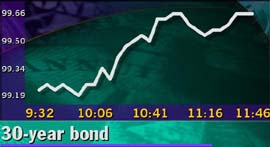

Stocks and bonds initially registered little reaction to the numbers. By mid-morning, though, the Dow rose more than 80 points, the tech-heavy Nasdaq crossed the record 3,000-mark and the 30-year benchmark Treasury bond gained 7/16 as investors concluded the economy isn't in danger of getting slapped back with another inflation-dousing rate rise. Its yield, which moves inversely to the price, fell to 6.15 percent from 6.18 percent Monday.

September's rise in personal consumption reflected a 0.8 percent increase in spending on non-durable goods, the report said. Spending for durable goods, meanwhile, fell 0.4 percent, likely reflecting slower auto sales, analysts said. Services spending also declined 0.4 percent during the month.

Click here for more bond prices and information

The Commerce Department said the savings rate -- the rate at which Americans put away their earnings -- rang in at 1.6 percent of disposable after-tax income in September compared to 2.3 percent in August. That's the lowest savings rate since the department began compiling the numbers in 1959.

U.S. Treasury Secretary Lawrence Summers addressed that issue Tuesday, saying it's crucial to boost the U.S. personal saving rate in order to promote the health of the economy and reduce the nation's dependence on overseas capital.

"Raising personal savings is an imperative for American families and an imperative for the national economy," Summers told reporters at a news conference to launch on-line sales of U.S. savings bonds.

October's employment report

September's report included several comprehensive revisions, many of which were disclosed in last Thursday's gross domestic product report. The revisions included reclassification of government pensions, which shifts savings of those funds from the government sector to the private sector, dramatically boosting personal income levels.

Despite the moderate numbers, some economists still anticipate the Fed will raise rates by another quarter point later this month to ensure the rapid pace of the economy tempers.

"We believe the Fed will raise rates on Nov. 16," said Marc Wanshel, a senior economist at J.P. Morgan. "The only indicator we've seen that shows any significant response to higher interest rates is home sales, which will not be enough to convince the Fed the economy is slowing down."

That's why Friday's employment report will be a crucial number for financial markets, Wanshel said.

Analysts polled by Reuters expect that 313,000 new jobs were added to the economy in October after 8,000 jobs were lost in September. The unemployment rate probably remained at 4.2 percent while average hourly earnings probably rose 0.3 percent after posting a 0.5 percent gain in September. The report will be released at 8:30 a.m. ET.

-- from staff and wire reports

|

|

|

|

|

|

Commerce Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|