|

Trade gap widens to $24.4B

|

|

November 18, 1999: 11:24 a.m. ET

Deficit growth in September resumes trend as imports hit another record

|

NEW YORK (CNNfn) - The U.S. trade deficit widened to a near record in September, fueled by rising oil imports and a record volume of goods and services coming into the country from China, the government reported Thursday.

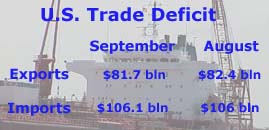

September's trade deficit widened to $24.4 billion, the Commerce Department said, a little less than the $24.5 billion deficit expected by economists. August's deficit was revised downward to $23.5 billion from an originally reported $24.1 billion.

The deficit -- the third-largest on record -- was prompted by a surge in demand for oil and for goods made in China, the report said. At the same time, demand for U.S.-made products excluding aircraft and auto parts also rose, a signal that demand abroad is still fueling the U.S. manufacturing sector.

"Believe it or not, this is a seriously encouraging report," said Ian Shepherdson, chief U.S. economist at High Frequency Economics, pointing to the 16-percent rise in exports excluding volatile oil, auto and aircraft components. "There is a very good chance the underlying deficit has now peaked."

Record imports

The surge in imports resulted, in part, from other countries' growing desire to do business with the U.S., economists said. The rise also reflects Americans' insatiable desire for imported goods, a result of near-record employment, rising wages and stable prices, economists said.

Imports rose 0.1 percent to a record $106.1 billion in September, led by record imports of services, and industrial supplies and materials. A record $6.9 billion deficit with China, the same as in August, helped drive the increase and was the largest deficit ever with any country, the report said.

Click above for the Commerce Department's summary of September's trade figures

U.S. officials signed a historic trade agreement with China Monday that is expected to boost trade between the two countries significantly in the next 10 years. It also is expected to pave the way for China to join the World Trade Organization.

"These data are consistent with still-strong domestic and improving international economic activity," said Steven Wood, an economist at Banc of America Securities in San Francisco.

The deficit with major oil producing countries rose to a record $3.03 billion in September as imports surged to $4.32 billion. The September price per barrel of crude petroleum was $19.52, the highest since February 1997, when the price was $20.48. It was the third consecutive monthly increase in oil prices.

Exports stall

Exports, meantime, declined 0.9 percent in September to $81.7 billion, led by a drop in civilian aircraft and autos. Excluding autos, aircraft and oil, exports surged 16 percent.

Advanced technology exports rose to $17 billion in September from $16.6 billion in August.

The deficit with Japan widened to $6.64 billion from $6.39 billion, the imbalance with South Korea doubled to $879 million from $426 million, and imports from Mexico rose to a record $9.83 billion, more than offsetting record U.S. exports to its southern neighbor of $7.65 billion.

The trade deficit with Canada narrowed to $2.86 billion in September from $3.26 billion the previous month. Canada and the U.S. are each other's, and the world's, largest trading partners.

Imports from Central and South America rose to an all-time high of $5.39 billion. Meanwhile, the total trade gap with Western Europe contracted to $3.54 billion, compared to $4.44 billion in August.

For the first nine months, the U.S. trade deficit totaled $191.6 billion, up from $121 billion a year ago. At its current pace the trade deficit is well on track to topping last year's record of $164.3 billion.

Philly Fed surges

Augmenting the trade figures was the Philadelphia Fed's business activity index, which surged to 15.8 in November from 6.9 in October -- an indication that U.S. business activity remains robust. The index is compiled by surveying conditions at approximately 150 different factories in eastern Pennsylvania, southern New Jersey and Delaware.

The prices received component of the report, a measure of what producers get for their goods, surged to 24.8, its highest level since early 1995, which "may suggest that some pricing power is beginning to return to manufacturers," Wood said.

"These data continue to imply that the manufacturing sector is continuing to heal from the damage inflicted by the emerging market economic and financial crisis of the past two years."

The index of economic activity expected six months in the future rose to 17.8 in November from 7.1 in October. The new orders index rose to 20.3 from 20.2 while the shipments index rose to 27.6 from 19.8, the report said. The index measuring the number of workers on factory floors increased to 13.6 from 3.5 last month.

Jobless claims slip

And in another report, the Labor Department said first-time claims for jobless benefits fell by 3,000 to 287,000 in the week ended Nov. 13. At the same time, the department raised its estimate for the Nov. 6 week to 290,000 from the 285,000 reported a week ago.

The report said the four-week moving average of initial claims slipped to 287,000 in the Nov. 13 week from 288,250 in the prior week, extending its run to 17 straight weeks under 300,000, the longest string since July 29, 1972, to Jan. 5, 1974.

|

|

|

|

|

|

Commerce Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|