|

AT&T eyes wireless stock?

|

|

November 24, 1999: 4:01 p.m. ET

New investment in business seen; spokesman calls reports 'speculation'

|

NEW YORK (CNNfn) - Executives at AT&T Corp. are planning to create a tracking stock to mirror the performance of its hot wireless business, press reports said Wednesday.

Talk emerged earlier this week that AT&T, the nation's top long-distance provider, would form a tracking stock for the wireless unit, much as rival Sprint Corp. (FON) did with its Sprint PCS division earlier this year. AT&T declined to comment, saying the reports were "speculation."

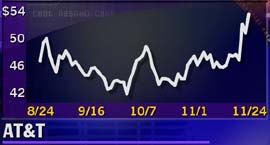

The buzz powered shares of AT&T (T), one of 30 stocks in the Dow industrial average, up 14 percent this week as they tacked on another 2-7/8 to 53-5/8 Wednesday.

AT&T could use money generated through the issuance of a tracking stock -- an increasingly popular way for companies to put the spotlight on their high-growth businesses -- to buy new wireless properties, analysts said. Analysts estimate the wireless unit could fetch between $46 billion and $60 billion.

PaineWebber analyst Eric Strumingher, in a research note Monday, outlined several reasons why he believed that AT&T would bring up the issue at a scheduled Dec. 6 analyst meeting.

AT&T has floated the idea of a tracking stock for the wireless unit during recent conference calls, but never made a firm commitment to do so.

"They haven't said, 'Hey Kevin, between you and me, we're going to issue a tracking stock,' " said Kevin Roe, an analyst at ABN Amro.

Companies facing high debt as they build for the future are better valued according to the cash flow they generate -- not on earnings. For that reason, AT&T's wireless unit, which has a solid growth potential, is better viewed for cash flow -- and a tracking stock would allow that, Roe said.

"The advantage is that it gives shareholders the ability to pick their investment, AT&T or wireless," said Rex Mitchell, an analyst at Banc of America Securities. And for AT&T, he added, "it's free currency to go make other purchases."

Analysts said potential targets, which would help AT&T develop its wireless footprint across the nation, could include VoiceStream Wireless Corp. (VSTR) or Western Wireless Corp. (WWCA).

Issuing a new tracking stock -- which AT&T already has done with its Liberty Media unit -- can be fraught with perils.

AT&T recently ended plans to issue a tracking stock for its broadband, or high-speed Internet, properties, because those networks are so integrated with its regular telephone networks that it would have been difficult to distinguish the assets of the affiliate from the assets of AT&T itself.

"The negatives of a tracking stock are the administrative hassle of deciding which set of shareholders are responsible for what investment, what expenses and what portion of the revenue that they'll get," Mitchell said, "but in the case of wireless it's relatively easy" to tell the assets apart.

AT&T's wireless unit is the nation's largest, with some 10 million customers. The New York Times reported that AT&T President John Zeglis is among the top contenders to take the helm of any wireless unit, and former CFO Daniel Somers, who is now in charge of AT&T's cable TV operations, could be the division's chief executive officer.

The Times also reported AT&T is considering a multibillion-dollar investment to offer high-speed Internet access to customer homes using wireless technology.

The AT&T board would have to approve such a move. Executives of MediaOne Inc. (UMG), the No. 3 U.S. cable TV company, also have a say under terms of a merger agreement with AT&T earlier this year.

|

|

|

|

|

|

AT&T

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|