|

Europe mixed at close

|

|

November 26, 1999: 12:37 p.m. ET

Paris hits fresh record, London and Frankfurt end flat; euro touches new low

|

LONDON (CNNfn) - Stock markets in London and Frankfurt ended flat Friday, though Paris secured a record high close, as European markets concluded a week of strong gains dominated by deal activity in the media and telecom sectors and firmer oil prices.

Traders said weakness in the euro, which touched record lows against the dollar and yen, weighed on bourses in the Friday session.

Though London and Paris both fell back from session highs, both bourses posted intra-day records before some mild profit-taking bit into earlier gains.

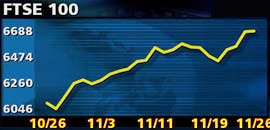

The FTSE 100 ended up 2 points at 6,684.80, having climbed as high as an intra-day record high of 6,743 in early trade. Weak oil stocks were offset by the planned $12.6 billion merger between media companies Carlton Communications and United News and Media.

The increased offer from Bank of Scotland for larger rival NatWest also supported a market split evenly between gains and declines.

The FTSE gained 3.2 percent from last Friday's close.

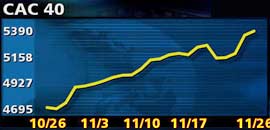

In Paris, the CAC 40 gained 44 points, or 0.8 percent, to 5,396.99, climbing to an intra-day record high of 5,437 before slipping. Telecom and media shares were again supportive as the sector continued to attract strong buying interest. The CAC gained 2.6 percent this week.

Germany's Xetra Dax fell 3 points to 5,958.07, erasing gains that saw the index reach 6,023. Deutsche Telekom's strong surge helped offset weakness in banking stocks. The Dax was fractionally ahead of last Friday's close.

The SMI in Zurich ended 45 points, or 0.6 percent higher, at 7,359.80, helped by firmer drug shares, though the market lost a little ground during the week.

The FTSE Eurotop 300 ended 0.3 percent higher as its technology index jumped 3 percent and media and telecom shares both rose by more than 1 percent.

The euro traded as low as $1.0076, its lowest level ever against the dollar. It also slid to 103.01 yen, its nadir against the Japanese currency. The single currency bounced around $1.01 for most of the session before firming to $1.0160 at the end of European trading.

Bank of Scotland (BSCT) ended down 5.5 percent, the weakest stock on the FTSE, after it raised its hostile bid for rival NatWest (NWB) by almost 7 billion pounds to 27.6 billion pounds ($41 billion). NatWest rejected the offer after the market closed.

Bank of Scotland's move came the day after the U.K. regulator said Thursday he would have no objections to the two companies combining. NatWest shares ended 3.3 percent higher. Royal Bank of Scotland (RBOS) closed down 1.3 percent lower amid speculation it may make a counterbid for NatWest.

The planned $12.6 billion merger of blue-chip media firms Carlton Communications (CCM) and United News and Media (UNWS) pushed Carlton shares up 4.2 percent. United's stock ended 3 percent higher.

Other U.K. media stocks soared on the merger. BSkyB (BSY) gained 5.4 percent higher, while Granada (GAA) was 1.8 percent higher.

Software services provider Logica (LOG) was the FTSE's best performer as the shares soared 16 percent after two analysts' upgrades.

GEC (GEC) gained 8.9 percent on its last trading day before it completes the sale of its defense business to British Aerospace (BA-), due Monday. GEC will then change its name to Marconi to focus on its telecom business. BAe shares closed up 3 percent higher.

South African Breweries (SAB) ended 5.5 percent higher after recent weakness.

The market was stymied by a 2.2 percent fall in oil heavyweight BP Amoco (BP-A), whose shares had risen sharply this week on firmer oil prices. Rival Shell (SHEL) fell 1.1 percent.

Gas supplier BG [(BG) was 4.5 percent lower after a government price review.

In Paris, media and telecom-related stocks led the advance.

Cellular operator Bouygues (PEN) jumped 6.3 percent to head the CAC gainers while conglomerate Lagardere (PMMB) rose 4.6 percent on reports the company is to buy a stake in Europe's largest pay-TV operator, Canal Plus (PAN), whose own shares fell 6 per cent after recent strong gains.

France Telecom (PFTE) shares rose 3.5 percent to a new record high. Its stock got a boost after the company said it planned to upgrade its Internet operations.

Telecom equipment maker Alcatel (PCGE) ended 4.4 percent higher.

Auto maker Renault (PRNO) was again weak as its shares slipped 3.7 percent.

In Frankfurt, Deutsche Telekom (FDTE) pulled the index higher with a 1.8 percent advance. Mannesmann (FMMN) closed down 0.8 percent amid expectations that the world's largest ever hostile bid by the U.K.'s Vodafone AirTouch (VOD) could succeed. Vodafone stock ended marginally lower.

Banks were weak again. Deutsche Bank (FDBK) lost 2.1 percent though Dresdner Bank (FDRB) recovered to close just higher.

DaimlerChrysler (FDCX) lost 1.3 percent.

Drug maker Roche was the best performer in Zurich, gaining 2.7 percent..

-- from staff and wire reports

|

|

|

|

|

|

|