|

U.S., Canada rails to merge

|

|

December 20, 1999: 5:14 p.m. ET

Canadian National and Burlington Northern couple in $19.45B deal, industry's largest

|

NEW YORK (CNNfn) - Canadian National Railway Co. and Burlington Northern Santa Fe Corp. disclosed plans Monday for the largest railroad merger in history, sparking concerns among weary rail customers, speculation on what merger could shake the industry next as a result and a plunge in the price of BN stock.

The deal was accepted by the companies' boards Saturday and announced Monday. It still needs regulatory approval, which is expected to take at least 18 months.

The deal entails the formation of a new holding company, North American Railway Inc. Canadian National will continue to have its own stock as well, and shareholders in each company will have ownership and voting rights in the other as the stocks continue to trade separately.

But while company officials promised hundreds of millions of dollars in annual savings and additional revenue without the service disruptions seen in other recent rail mergers, investors in Burlington Northern (BNI) turned thumbs down on the stock's short-term prospects. They sent the stock down 3-9/16, or 12.6 percent, to 24-13/16 at the 4 p.m. New York close. CN shares on the Toronto exchange, where it trades under the symbol CNR, fell a more modest 1.25 Canadian dollars, or 2.8 percent, to C$42.95.

Savings seen without staff cuts

The combined company has a market capitalization of $19 billion, or C$28 billion, based on Friday's closing prices.

Company officials said the deal should add to earnings per share from the first year, and should increase earnings per share by 15 percent by the third year. Much of the gain is seen as coming from capturing more traffic now moving on competitors or on trucks. Cost savings of about US$300 million annually will result from reduced capital spending, greater efficiency in purchasing and equipment utilization and other administrative action rather than staff cuts, officials said. The combined company will have 67,000 employees and expects to handle any job cuts through normal attrition. No jobs are being shifted over the border in either direction, officials of the companies promised.

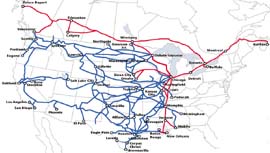

source: Canadian National

The route map of the proposed North American Railway Inc., with Burlington Northern's current routes in blue and Canadian National's current routes in red.

The deal gives a western U.S. railroad direct access to the Atlantic for the first time. Each railroad is to continue to operate in its own areas under its existing name. The combined roads will have 50,000 miles of track stretching from Halifax, Nova Scotia, to Los Angeles, and from Port Rupert, British Columbia, to Mobile, Ala.

"I think it's a good deal for shareholders longer term," said Terry Gardner, analyst at Deutsche Banc Alex. Brown. "The BN shareholders are disappointed because the premium is pretty far down the road. But rail growth today is coming from expanded networks."

The new company is to be based in CN's Montreal home and have CN officials as the top day-to-day executives. Officials promised it will improve service for customers on both sides of the border.

While analysts on a conference call with executives were generally pleased with news of the deal, the initial reaction from customers' representatives was skeptical.

Customers concerned about service

Rail shippers have seen almost three years of service problems from mergers of Union Pacific Corp. (UNP) and Southern Pacific in 1997, and the split of Conrail between CSX Corp. (CSX) and Norfolk Southern Corp. (NSC) earlier this year. Problems with the UP-SP deal actually hurt the gross domestic product of the United States in 1997 due to problems it caused manufacturers.

"What rail shippers want is consistent service," said Ed Emmett, president of the National Industrial Transportation League, a trade group of rail and truck customers. "They haven't had consistent service for a long time. What we have here is something that would add to the uncertainty."

Emmett said the concern is not just that the merger could cause problems at the combined company, but that it could force another merger of major railroads as a reaction, perhaps between Union Pacific and one of the major eastern railroads, CSX or NS, even though those railroads are still dealing with service problems from integrating Conrail's tracks and other assets into their own systems.

Emmett said the railroads not involved in this deal need to focus on solving continued service problems, not the next round of mergers. But he said it has long been the assumption that a trans-continental railroad merger would prompt another union almost immediately.

Officials at UP said they are studying the implications of the deal and contacting customers for their reaction.

"The one question that comes to our mind is how will the merger be viewed by rail shippers overall," said UP's Mark Davis. "Many have made it clear they don't support further mergers at this time." Davis said it is too soon to say if the proposed deal will prompt UP or other major railroads to make a bid for another railroad.

Analysts think that UP will have to respond in some manner, though.

"UP has some things to consider," said Michael Lloyd, analyst at Merrill Lynch. "You could see this as CN putting itself in play. They might also look at CP's rail operations." He said that continued service problems at the two eastern U.S. railroads may stop anything from happening with either of them in the near term.

But Lloyd and others believe this deal will accelerate the industry to a final round of mergers that would leave it with only two major railroads on the continent, with each serving almost all of the United States and Canada.

"If the east gets fixed within six months, one of them (CSX or NS) could very well go to the dance with UP, the other could end up going with CN/BN soon thereafter," said Lloyd.

The deal could have some impact even on railroads not involved in the next round of mergers.

"What does this do to Kansas City Southern?" said Emmett, speaking of the central-U.S. carrier Kansas City Southern Industries Inc. (KSU) "They're in a marketing agreement with CN. Everyone thought CN would try to buy KC Southern. I think KCS becomes the odd man out right now."

Officials promise no service problems

Officials of BN and CN would not answer questions about other possible mergers, either by competitors or by the combined company, during the press conference Monday. They insisted that their track record on previous mergers and the details of this deal should assure customers there will be no problems.

CN’s purchase of Illinois Central Corp. this summer went off without any significant problems, and the purchase of Atchison, Topeka and Santa Fe Railway by Burlington Northern in 1995 also went more smoothly than subsequent U.S. rail mergers. The officials said there is relatively little overlap between the current systems, and the decision to operate the two railroads separately should reduce the chance of service disruptions.

"We feel very strongly we're different from the mergers of the last five years," said Paul Tellier, president and CEO of CN, who will be CEO of the combined company. "The people dispatching trains today in Fort Worth (Texas for BN) or in Montreal and Edmonton (for CN) will continue to do so."

Both Lloyd and Gardner agreed that this deal should go through with far fewer service disruptions that other recent mergers.

Officials from the two railroads also pointed out that CN already operates on the same information technology platform as BN, having bought the software from BN during its most recent upgrade.

Still, Emmett said his members are skeptical about the promises at this stage.

"The rail shippers are not going to take this at face value that it is a holding company to operate two railroads," he said.

Americanization of CN hotly denied

The transaction values CN at about $9.1 billion in stock and debt and provides no premium to shareholders of either company. Shareholders of BN, which has a market capitalization of almost $13 billion, would own about two-thirds of the new company. That may spur some concern in Canada about the Americanization of CN, but Tellier bristled when asked about that Monday.

"This is not the Americanization of CN. This is transforming CN into a true North American company while retaining the strong Canadian National identity," he said. "Our shippers are North American. They have plants and facilities on both sides of the border. GM is our largest customer. We serve eight of their plants in Michigan. We cannot be marginalized and basically pretend we can operate only in Canada. We must become a North American company to retain competitiveness for Canada. I have no time for the nationalists in this country who think we can draw a gate around this country."

Once the merger is completed, Robert Krebs, chairman and CEO of Burlington Northern, will become a non-executive chairman of North American Railways and CN. Besides Tellier becoming chief executive of the new railway, Hunter Harrison, the executive vice president and chief operating officer of CN, will become chief operating officer of the combined company.

The company "will have a strong balance sheet, substantial free cash flow, a shared commitment to consistent on-time customer service, a common operating system and a well-balanced revenue portfolio,” Tellier and Krebs said.

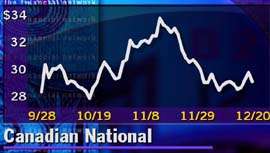

Chart tracks performance of CN's U.S. ADR's

Details of the deal

The deal entails a stock swap, with Canadian National (CNI) shareholders basically getting 1.05 shares of BN stock for each of their own shares, in addition to their own holdings. That allocation is worth a total of US$5.75 billion based on Friday's close. Burlington Northern (BNI) shareholders get one share of CN for each share of their stock, while their existing shares will now take the name of the new holding company. Those CN shares going to BN shareholders will be worth US$13.7 billion, giving the stock component of the deal a total value of $19.45 billion, as of Friday's closing prices, not including corporate debt.

The way the deal is structured means BN shareholders will hold two-thirds of the shares in the new company. But the 15-member board will have a Canadian majority. It will consist of six members from each current board, as well as three additional people.

CN's union with the No. 2 U.S. railroad comes just weeks after Tellier told the Canadian Railway Club in a Montreal luncheon speech that Canadian railroads must face the rising competition from large U.S. rail carriers. Some of those U.S. railways are 2-1/2 times larger than CN and generate the financial returns necessary to justify significant capital outlays, Tellier said.

"Our ability to meet the competition of these rail giants is important to Canada. It's a critical factor in Canadian productivity," he said in the speech. About 40 percent of Canada's gross domestic product depends on exports, with many key sectors such as agriculture and forest products depending upon rail to reach the border.

Critical for Canadian productivity

Once owned by the Canadian government, CN became a publicly traded company in November 1995 in a C$2.3 billion (US$1.6 billion) stock issue, at that time the biggest ever in Canada. It is the larger of Canada's two national freight railroads, the other being owned by energy, shipping, rail and hotel conglomerate Canadian Pacific Ltd. (CP), and is one of the top 10 railways in North America.

Forging ahead under Tellier with a restructuring in which it streamlined its network and workforce and invested in new technology, CN has become a darling of the stock market because of its solid profit performance and improving prospects. In mid-October, CN reported third-quarter earnings of C$199 million, or C96 cents a share, compared with a loss of C$205 million, or C$1.06 a share, after a special accounting charge, in the year earlier period.

Impressive earnings

Burlington Northern also posted impressive third-quarter earnings in October. It reported an adjusted profit of 70 cents a share on revenue of $2.35 billion, compared to a profit of 66 cents on revenue of $2.29 billion the previous year.

Including special items consisting of a gain in connection with prior-period rail line sales partially offset by costs related to those line sales, net income for the third quarter was $348 million, or 75 cents per diluted share.

The two company executives predicted that the combined company could reach a ratio of operating expenses to revenue -- a key measure of a railroad's financial performance -- of 70 percent or less, which would make it a leader in the industry.

-- from staff and wire reports

|

|

|

|

|

|

|