|

Suits still loom for AHP

|

|

December 22, 1999: 6:36 p.m. ET

Despite deal, fen-phen suits remain a wild card in bid for Warner-Lambert

By Staff Writer Jamey Keaten

|

NEW YORK (CNNfn) - Despite a new settlement over the ‘fen-phen’ diet drug combination, looming lawsuits remain a factor that could hinder American Home Products Corp.’s $54 billion merger deal with Warner-Lambert Co., analysts said Wednesday.

On Tuesday, AHP announced a settlement, for an undisclosed sum, with 1,400 plaintiffs who claimed fen-phen led to lung illness. The deal followed a jury decision in Mississippi to award $150 million to five plaintiffs. A judge threw out the award after the settlement was announced.

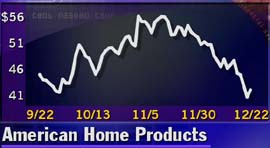

At first, many investors saw the move as helping AHP defend its proposed merger in the face of competition from Pfizer Inc., which has made an unsolicited $72 billion offer for Warner-Lambert. That helped lift the shares of AHP (AHP).

But by the close of trading, AHP slipped 9/16 to 40. Warner-Lambert (WLA), of Morris Plains, N.J., rose 1-1/8 to 82-15/16; Pfizer (PFE), of New York, added 1-1/8 to 33-3/4.

In a conference call Wednesday, AHP told analysts that the settlement is "substantially less” than market speculation of about $500 million, said Alex Zisson, a pharmaceuticals analyst at Chase H&Q. That led him to believe the settlement was between $200 million and $300 million, Zisson said.

As for its impact on the Warner-Lambert deal, Zisson said: "The settlement won’t really affect the outcome.”

Larry Smith, an analyst at Sutro & Co. said the fallout from fen-phen, which was used by 6 million Americans before it was pulled from the market, is still a wild card in AHP’s ability to carry out its deal.

"I think there are forever going to be issues,” Smith said. "I cannot believe lawyers will want to settle. My experience is that you will never clean these things up quickly.”

Smith suggested that plaintiffs, seeing the big award in Mississippi, might get the idea that they could hold out for bigger sums by withdrawing from current settlements.

Adam Green, an analyst at Wasserstein Perella Securities, said investors are focusing on how the Pfizer bid for Warner-Lambert is about 40-percent richer than the AHP deal. But, he added, "if you’re a Warner-Lambert shareholder, the diet drug litigation is an issue in the back of your mind.”

Madison, N.J.-based AHP pulled the diet remedy Pondimin (fenfluramine), or the "fen" in the fen-phen treatment, and related drug Redux (dexfenfluramine) from the market in 1997 after fen-phen was linked to medical problems.

The settlement Tuesday addresses cases of Primary Pulmonary Hypertension, a lung illness plaintiffs said stemmed from use of fen-phen. The majority of fen-phen suits are related to heart-valve damage, not lung problems.

Last month, a federal judge gave preliminary approval for a $3.75 billion national settlement for people who used fen-phen and reported heart-valve problems. That settlement requires court approval.

Lowell Weiner, a spokesman for AHP, said there are relatively few remaining suits that haven’t been covered by the settlements. The company, Weiner said, is "confident that the range of benefits from settlement is preferable to lengthy litigation.”

The nationwide settlement is open to people who used the combination for at least 60 days. Weiner said that as of Oct. 4, about 11,000 suits had been filed against the company.

Plaintiffs have until late March to opt out of that national settlement. "There are going to be people who opt out, that’s for sure,” said Green. But the key question, he added, is how many will have to pull out before AHP would be forced to scrap the current accord and try to then craft a new settlement.

Fen-phen: one of many issues

AHP already has a lot on its plate in its effort to defend its merger. Shareholders are scheduled to vote on the merger in April - but not before a series of legal tussles between Warner-Lambert and Pfizer plays out.

At issue in Delaware Chancery Court is whether Warner-Lambert properly considered Pfizer’s effort to strike a merger and whether Pfizer violated terms of their lucrative marketing pact on the cholesterol drug Lipitor when it launched its takeover offer.

Due to market fluctuations, and particularly weakness in the drug sector, the values of both AHP’s bid and Pfizer’s offer for Warner-Lambert have fallen. The AHP deal is now worth $54 billion, down from an original valued of $72 billion; Pfizer’s bid is now worth $72 billion, down from $82 billion.

"I think that the market has already said that it wants to go with Pfizer,” said Smith. "And there’s the threat that the litigation will drag on,” he added.

"If you want to get to the net-net, the merger of Warner-Lambert and Pfizer will largely pay for the lawsuit expenses on fen-phen,” added Smith. "It’s a neat little play on the part of AHP, but it’s not so great for Warner-Lambert shareholders.”

That’s because as part of the Warner-Lambert merger with AHP, if either company opts out, the other will have to pay a $2 billion break-up fee. That, said Smith, could help defray AHP litigation costs if Warner-Lambert eventually merges with Pfizer.

|

|

|

American Home Products

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|