|

A big year for bourses

|

|

December 30, 1999: 3:37 p.m. ET

Spurred by mergers and technology, European stocks surged in 1999

By Staff Writer Douglas Herbert

|

LONDON (CNNfn) - After a relatively weak start marred by Y2K angst and hiccups over economic recovery, European markets bounced back with a flourish in 1999, and appeared poised for even more gains in 2000.

The European year that began with widespread misgivings over the launch of a new single currency, ended with the largest hostile takeover bid in corporate history -- Vodafone AirTouch's cross-border lunge for Germany's Mannesmann. Along the way, telecom and technology stocks garnered top billing in the parade of red-hot sectors to watch.

And analysts hint that the records set by many of the leading European exchange may get an encore in the new year -- especially as investors grow wary about further growth in U.S. markets.

"The outlook for (European) economic growth is for robust accelerating trends, which contrasts with the U.S.,” said Jerry Evans, European equity strategist at Enskilda Securities in London. "This shift in growth momentum will also see a continued shift in the direction of net flows.”

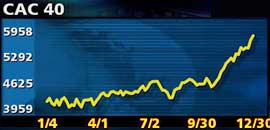

Paris tops major markets

Among major markets, Paris led the way in 1999 -- its benchmark CAC 40 advanced 2,015.16 points, or 51 percent, to 5,958.32 in 1999 as the French market briefly surpassed Frankfurt in market capitalization.

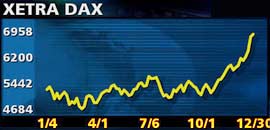

Frankfurt's electronic Xetra Dax also performed well, racing ahead nearly 39 percent to finish just shy of the 7,000 barrier at 6,958.14. London’s FTSE 100, the benchmark for the region’s biggest market, barreled up 17.8 percent to 6,930.2.

Among major markets, only Zurich's SMI, which is seen as heavily weighted with underperforming drug stocks, came out looking lackluster, with a full-year gain of 5.7 percent that carried it to 7,570.1.

Amsterdam advanced more than 22 percent. Stockholm catapulted around 66 percent. Milan's Mibtel all-share index rose 22 percent over 1999 to end the year at 29,005, while Madrid's IBEX-35 gained 18.3 percent to 11,641.4. In the Continent’s most phenomenal performance, Helsinki’s HEX index was blessed with a 161 percent advance.

Limiting the survey to markets in the 11-nation euro-zone, only one experienced a net downturn -- Belgium, which was down around 5 percent.

In recent weeks, the three biggest European exchanges - London, Paris and Frankfurt -- have hurdled lifetime peaks with almost serial ease. Paris alone climbed to 38 closing highs since early January, while Frankfurt posted 11 record finishes in its final 12 sessions.

Tech issues lead the way

The real winners in 1999, and possibly in 2000, were a handful of vanguard sectors such as technology, telecom, advertising, media and banking -- all seen as well-poised to tap into the opportunities of the Internet revolution.

A breakdown of the FTSE Eurotop 300, a pan-European index grouping large-cap stocks from across Britain and the Continent, shows that information technology stocks rocketed more than 160 percent for the year, trailed by telecoms, which leapt nearly 85 percent, and financial stocks, which advanced just under 40 percent.

Vodafone launched the world's largest hostile bid against Mannesmann

On the FTSE 100, technology-oriented shares snagged the top six billings on the full-year advancers' chart. The best performer, semiconductor designer ARM Holdings (ARM) shot up an eye-popping 1,209 percent, followed by accounting software firm Sage Group (SGE), computer services company CMG (CMG), software developer Logica (LOG) and Colt Telecom (CTM).

In Helsinki, wireless phone giant Nokia, which accounts for a fifth of the HEX index's total weighting, soared 245 percent this year amid expectations that the company will play a key role in the rollout of technology for the next generation of handheld wireless devices. Nokia's archrival in the wireless arena, Sweden's Ericsson, which is struggling to regain lost market share, powered up 181 percent.

Other companies in the telecom-information technology-Internet orbit have also enjoyed a bountiful year.

Among telecoms alone, France Telecom (PFTE) has jumped about 90 percent despite the breakdown of its alliance with Deutsche Telekom, as investors have placed high hopes in the company's international expansion.

Mannesmann is up more than 140 percent, making good again on chief executive Klaus Esser's go-it-alone corporate strategy. French pay-TV operator Canal Plus (PAN), meanwhile, has stormed up about 140 percent, while Freeserve (FRE), the pioneering Internet Service provider launched by British electronics retailer Dixons (DXNS), has shot up more than 160 percent since its market debut in July.

Another astounding performer of 1999 was French chipmaker STMicroelectronics (PSGS), which rocketed a whopping 340 percent.

Among the sector losers were utilities -- water, down 24 percent, and electric, down 15 percent - due primarily to pricing pressures from regulators.

Pharmaceutical stocks were only marginally higher over the year, as breakthroughs on the prescription front were offset by troubles in agrochemical businesses, including a growing controversy over genetically modified foods.

Euro, despite weakness, seen as positive

Despite early teething pains that have seen the single currency plummet about 14 percent from its launch at $1.17, the euro is widely hailed as the catalyst behind a wholesale rethinking in the way European business is done across borders.

The upshot has been an unprecedented wave of mergers and takeovers -- deals in which U.S. advisers played an often outsized role.

U.S. investment banks handled the lion's share of Europe's $1.2 trillion in mergers and acquisitions in 1999, according to Thomson Financial Securities Data.

That was more than double the previous year's tally, suggesting the makings of a heady challenge to U.S. dominance. In the third quarter, European M&A activity actually outstripped the United States in total value.

In another significant shift, the role of national governments as the arbiters of corporate fates has, equity strategists say, given way to an acquiescence to the market forces that are a hallmark of globalization.

The hostile takeover -- long viewed as heresy in many a European boardroom -- has become standard operating procedure for determined suitors with their eyes on reluctant targets.

For example, in the three-way hostile takeover imbroglio in which Banque Nationale de Paris (PBNP) sprang a twin $37 billion bid for rivals Société Générale (PGLE) and Paribas (PPM), the French government tried to intervene, albeit feebly.

But the government ended up backing down as the companies appealed directly to shareholders for support. BNP ended up snagging only one of its targets, Paribas.

Among the year's other eye-catching takeover tussles: the $59 billion merger clash between French oil giants TotalFina (PFP) and Elf Aquitaine (PAQ) and, in Italy, Olivetti's David-versus-Goliath struggle for former telecom monopoly Telecom Italia, in which it ultimately vanquished Deutsche Telekom (FDTE) for the coveted prize.

All these pale in comparison with the $138 billion attempt by Britain's Vodafone (VOD) to buy Mannesmann (FMMW), which illustrates the divisions between the freewheeling Anglo-Saxon approach to takeovers and Germany's more insulated corporate culture.

In search of a pan-European platform

At the same time, the creation of the euro as a single currency for 11 nations has spawned a growing demand for "harmonized" trading platforms to stitch European markets together in a seamless network.

But the process of linking a consortium of eight European markets has been sluggish so far, prompting others such as the Belgium-based Easdaq and the U.K.'s Tradepoint, to fill the vacuum. Next year, the U.S. Nasdaq plans to launch a European exchange, turning up the heat on existing exchanges to cooperate more closely in a pan-European trading environment.

That is still an elusive goal, say some traders. "I don't think your typical Frenchman goes home at night and reads about German and Italian stocks," said one London-based trader who wished to remain unidentified.

While that may be the case, Europe's markets are showing increasing signs of paying heed to what's happening in the economies of their neighbors.

Evans, at Enskilda, discerns a sudden upswing in optimism in the latter part of 1999 as market-friendly economic data began coming out of France, Germany and Britain. Fears of higher interest rates hikes in the United States and at home that dogged markets at certain points in the year have also begun to abate.

"The tone (this year) has been a very remarkable diversion between greed and fear, " Evans said.

"You had greed at the beginning, then fear taking over in March and lasting until about October, due to fears of interest rate hikes in the U.S. But at the end of October, people realized 'yes, we might have rate hikes, but we probably won't have any for a while after that.'"

More growth ahead?

Mike Young, an equity strategist at Goldman Sachs in London, said Europe's bourses proved remarkably resilient in 1999. He believes it's remarkable in retrospect that despite a "fairly significant" rise in bond yields, Europe's best-performing stocks seemed hardly affected.

He chalks this stolidity up to "a renewed confidence about the global economic environment,” due in part to a shift in fund managers' attentions towards European markets.

"Many investors in the United States will look abroad (next year) on concerns that their own market is overvalued," Young said. "The general feeling is that they've done very well in the U.S., so their upside is more limited."

That could mean the U.S. stock markets, often the catalyst for activity on the other side of the Atlantic, might be relegated to a supporting role.

"Europe will rely less on Wall Street, as economic trends take over," said Enskilda’s Evans.

--with additional material from wire reports

|

|

|

|

|

|

|