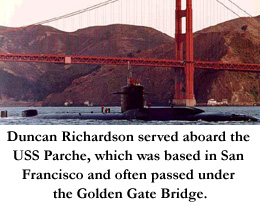

NEW YORK (CNNfn) - Information has been a precious commodity to fund manager Duncan Richardson since his days as a Navy lieutenant aboard a nuclear attack submarine.

Away at sea for weeks at a time, he was cut off from the world except for what he could glean from his instrument panels. It wasn’t until the vessel surfaced in San Francisco Bay, dolphins dancing in the bow wave, that he could get his fill of the latest news.

Perhaps that’s why he’s having so much fun at the helm of the Eaton Vance Information Age Fund, one of the top ten world stock funds tracked by Morningstar. He can’t think of a better assignment heading into the new millennium.

"In a submarine, you’re so deprived of information and you’re striving to piece together as much as you can,” he said. ”In the market, it’s exactly opposite. It’s information overload. It’s a question of filtering it.”

The fund, with $200 million in assets, is up 77 percent year to date through Dec. 27, Richardson said. It has a five-star rating for risk-adjusted returns from Morningstar and invests in stocks around the globe that "create, process or distribute” information.

"We felt this is a major trend that would be around for years,” Richardson said.

(Photo from USS Parche Web site)

Richardson, 42, a marathon runner and father of three boys, almost seems too easygoing to have been a Navy officer aboard one of the nation’s most lethal fighting machines. He graduated from the U.S. Naval Academy in 1979 and spent five years on submarine duty before graduating in 1987 from Harvard Business School.

He had always wanted to get into investment management, and saw the academy as a means to get a good education, rather than a lifelong career path.

"Being trained as a nuclear engineer doesn’t qualify you to manage money or analyze stocks,” he joked. He joined Eaton Vance after he got his business degree.

In 1995, before many people had heard much about the Internet, Eaton Vance and the U.K.’s Lloyd George Management decided to team up on a fund that could capitalize on the new information age.

"We saw two trends: the relentless advance of technology, and deregulation as capitalism spread through the world and markets opened up to competition,” Richardson said. "We thought this would create new investment opportunities.”

Richardson manages the U.S. portion of the portfolio, while Jacob Rees-Mogg of Lloyd George is in charge of the international holdings.

(Richardson defers to Rees-Mogg any discussion of specific international holdings, he sees the same themes as with the U.S. stocks in the portfolio -- cross-border mergers, exploding demand, and heightened competition.)

"Information is a huge part of most economies,” Richardson said.

The team looks for "growth at a reasonable price,” so Richardson looks for ways to capture the growth without being buffeted by volatility. The fund can invest in stocks of any size and keeps its sector bets to 25 percent or less to stay diversified.

"We like earnings growth of 15 to 25 percent or more a year for more than one year,” Richardson said. "I love running this fund because it really is flexible. It can respond to market volatility instead of being a victim of it.”

For example, Richardson forces himself to stay away from stocks that have reached peak valuations. In 1995, he steered clear of high-flying semiconductor stocks and escaped big losses when the sector plunged 50 percent.

Another key move was to avoid soaring emerging markets stocks that plummeted in 1998 during the Asian crisis. Instead, he found good values in cable stocks, media companies and telecoms.

These days, with the Nasdaq barreling past 4,000, Richardson sees potential danger as investors chase the same stocks. He compared the trading frenzy to a person drinking alcohol -- drink a little and you feel great; drink too much and you get a hangover.

"The market is just partying,” Richardson said. "It tends to end badly if you keep going down that route.”

In technology, his recent holdings include Internet infrastructure companies such as Cisco Systems (CSCO) and Silverstream Software (SSSW). Silverstream debuted at 16 in an initial public offering and Richardson completed his position at 30. The stock is trading above 100 this week.

But he recently sold his stake in Qualcomm (QCOM), which has already risen 21-fold in the last year.

He’s been finding more value in "advertising-driven” businesses that are helping dot.com companies build brands on the Internet. For example, he owns ad agencies Omnicon Group (OMC) and Interpublic Group (IPG), which are both benefiting from planning for the Olympics and U.S. elections in 2000 as well as other Y2K spending.

Likewise, Richardson owns broadcasters such as Clear Channel Communications (CCU), and newspaper stocks such as the New York Times (NYT).

He’s also optimistic about Xerox (XRX), despite its warning about lower fourth-quarter earnings that sent its stock price tumbling in early December. The company blamed Y2K-related problems for lower sales. Richardson thinks the problems are short-term, and that Xerox will resolve them in the next several years.

"It’s one of those stocks that has a lot of bad news out there, but they have a great global franchise that's benefiting from a lot of the trends in the information age,” Richardson said. "It’s a great entry point for the stock (trading) down here in the low 20s.”

As far as Y2K glitches, Richardson isn’t worried about computers malfunctioning as he is about the human response.

"I just found out my wife is putting cans in the basement,” Richardson said. "So what have purchasing managers done? You multiply that instinct by the thousands. You order more laptops, putting more inventory into the system.”

The stockpiling in the third quarter may result in a lull in demand for products like computer and software products in the fourth quarter, he said.

But that could create opportunities for the information fund if overall demand drops in the technology sector, Richardson said.

"Y2K has the potential to create incredible opportunities just because of these misperceptions,” Richardson said.

Wall Street, Richardson said, is practically drowning in information. And more people than ever before are using that information to make trading decisions, leading to more volatility than ever.

But Richardson says he won’t take too many risks. He recalled that during his Navy days, the sub crew would take a new vessel deep below the surface to test its seaworthiness (the exact depth level is classified). You could hear creaks and groans as the submarine withstood the tremendous force from the water. At that level, any risks could be deadly.

"That’s an environment where you don’t like surprises,” Richardson said. "Maybe I take a little of that in managing my portfolio. I don’t like surprises.”

|