|

Bonds gain on stock slide

|

|

January 4, 2000: 3:08 p.m. ET

An equity sell-off, and high yields, bring investors to Treasurys

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - Treasury bonds rallied Tuesday as investors, drawn to the highest yields in nearly two-and-a-half years, fled the plunging stock market for the relative safety of government securities.

Analysts also called the day’s bounce technical in nature, noting the Treasury market’s oversold condition following two sessions of big losses.

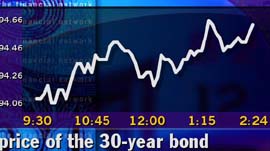

Just before 3 p.m. ET, the price of the benchmark rose 1-2/32 to 94-20/32. Its yield, which moves inversely to its price, fell to 6.53 percent from 6.62 percent Monday, the highest yield since Sept. 11, 1997.

"The weakness in equities both here and abroad is providing a platform of support for Treasurys and other fixed-income products,” said William Sullivan, money market economist at Morgan Stanley Dean Witter. "The weakness in equities is so deep it is affecting the bond markets.”

Fears of higher interest rates sent stocks plunging Tuesday. And in a break from tradition, the Nasdaq composite index also saw a sell-off, sending investors into fixed-income securities, which are seen as less risky.

Still, some of the gains may have occurred without help from the stock market as analysts noted the bond market’s oversold condition. Between Thursday’s and Monday’s close, the yield on the 30-year bond rose nearly 1/4 percentage point. As such, Treasury yields began falling overnight, well before U.S markets opened.

Analysts said bonds Tuesday also got support from news that President Clinton re-nominated Alan Greenspan, a favorite among bond traders for his inflation-fighting vigilance, to a fourth term as Federal Reserve chairman.

The bond market ignored a report showing a rebound in November construction spending, as the two-month old news was overshadowed by the immediacy of plunging stocks.

Rally may not last

But analysts say that when the stock sell-off ends, bond investors will continue to focus on a series of inflation-suggesting economic fundamentals that are expected prompt the Fed to begin a series of interest rate hikes in February.

"As soon as the weakness in equities ceases, the focus of the attention will again be on strong economic fundamentals,” Morgan Stanley Dean Witter’s Sullivan said.

The Fed, the nation’s central bank, hiked interest rates three times last year in an effort to slow the economy and preempt inflation. But the moves, which brought the Fed’s main lending rate to 5.50 percent, have had little apparent effect. Unemployment remains near a 30-year low, and stock prices, despite the day’s sell-off, remain near record highs.

Dollar mixed

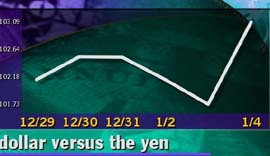

The dollar was mixed against the major currencies Tuesday, falling against the euro but rising against the yen after Japan took steps to weaken its resurgent currency.

Just before 3 p.m. ET, it cost $1.0292 to buy a euro, up from $1.0236 Monday, a 0.55 percent fall in the dollar’s value.

But the dollar rose to 102.72 yen from 101.73 Monday, a 0.97 percent gain in the dollar’s value, following an intervention by Japan.

Concerned that the strengthening yen will hurt the country’s exporters and damage the nation’s fragile economic recovery, the Bank of Japan bought dollars and sold yen Monday

One of more than a dozen of such interventions since last year, the move was immediately effective, but analysts questioned its long-term impact.

"In order to really stymie the yen bulls, officials

need to drive the dollar above the 103.75 (yen) area,” said Marc Chandler, chief currency strategist at Mellon Bank.

The yen has historically ignored these interventions, moving as investors pour money into Japanese stocks

In a sign that trend is continuing, Tokyo’s Nikkei rose 68.52 points, or 0.36 percent, to 19,002.86 Tuesday, ending above 19,000 for the first time since Aug. 21, 1997.

"Since the market's outlook for the world's second-largest economy remains bullish, the yen's retreat is likely to be short-lived,” Ruesch International said in a note to clients Tuesday.

The euro’s strength, meanwhile, continued a trend from Monday, when strong manufacturing data out of the 11-nation region sparked optimism over the euro zone’s economic recovery. Analysts said the euro also found support from the weakness in U.S. stocks, which must be bought in dollars.

|

|

|

|

|

|

|