|

Jobs grow, wages jump

|

|

January 7, 2000: 12:14 p.m. ET

Average hourly pay rises 0.4%; jobless rate remains at 30-year low

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Job growth and wages accelerated at a faster-than-expected pace in December, capping a year of remarkable employment gains but suggesting inflation may be starting to creep into the robust U.S. economy.

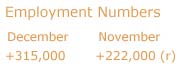

The economy generated 315,000 new jobs last month, the Labor Department said Friday, well above forecasts of a 225,000 gain and the largest increase in five months. Average hourly wages -- a closely watched figure on Wall Street as a harbinger of inflation -- rose 6 cents to $13.46 an hour, a larger-than-expected gain of 0.4 percent. The jobless rate remained at a near 30-year low of 4.1 percent.

The report put the seal on what many analysts and investors had already accepted, that the Federal Reserve likely will raise short-term rates again in February to slow the U.S. economy. Still, because December’s gains came from temporary hiring in the retail sector and because previous months’ gains were revised lower, they also concluded that the Fed will not double-barrel it with a half-point hike.

"Clearly the Fed will go in and tighten policy,” said Charles Lieberman, chief economist with First Institutional Securities. "The inflation news so far hasn't been that bad, so there is no sense of urgency,” he said, adding that Fed Chairman Alan Greenspan likely will raise rates only in quarter-point increments. "It’s just not Greenspan’s style to be that aggressive,” he said.

Rate rise a done deal?

Stock and bond investors largely discounted the report as they breathed a sigh of relief that the Fed’s next move will not necessarily be drastic.

The Fed last lifted short-term rates in mid-November in an effort to slow the economy and keep inflation under wraps. It lifted its benchmark Fed funds rate -- the minimum interest rate that commercial banks must charge for overnight lending to each other -- to 5.5 percent from 5.25 percent.

At its Dec. 21 meeting, the Fed left both rates and its bias toward future rate actions unchanged to avoid causing problems ahead of the Y2K date rollover. However, with nary a glitch to report, investors began to assume the Fed would act at its Feb. 1-2 meeting. Higher rates prompt banks to boost the interest they charge for consumer and business loans, deterring spending.

"Nothing in these numbers would change the outlook for Fed policy, which is to tighten credit and to try to encourage market conditions that would slow growth to a more sustainable pace this year," said David Jones, chief economist at Aubrey Lanston. "The report leaves the Fed on track for a quarter-point hike in February, but there isn't the kind of urgency to warrant a 50 basis point hike."

Limited supply of workers

The lull in job creation could be due to a limited supply of workers. Wall Street economists and Fed officials have expressed concern for months that the robust U.S. job market is leading to a shrinking pool of workers available to produce the goods and services that U.S. consumers continue to demand.

Service-related jobs added to most of December’s gains, with 298,000 positions created. Retail jobs rose by 65,000 as stores took on extra staff ahead of the seasonal holidays. The manufacturing sector shed 1,000 positions, compared with the 10,000 it gained in November.

Labor Secretary Alexis Herman told CNNfn that December’s employment gains confirm the same story that became a fixture of the U.S. labor market in 1999 -- that technology and productivity gains have created more new positions without generating significant wage pressure. (279K WAV) (279K AIFF)

December’s numbers cap a remarkable year in the U.S. job market, a year in which the jobless rate hit its lowest level in a generation, help-wanted signs appeared in store windows across the country and employees benefited from new and creative compensation efforts.

Main Street vs. Wall Street

To Main Street, that is great news. Not since the 1960s have so many Americans had jobs -- and a choice of positions, to boot. Demand for labor in services, retail and technology, among other industries, generated more jobs in 1999 than the number of available workers to fill them, making it a buyers market for job hunters.

However, good news is often bad news on Wall Street, particularly when it comes to job creation.

With so many people in America working, the chances of workers demanding higher wages is significant enough to prompt a rate hike, said Ian Shepherdson, chief U.S. economist with High Frequency Economics.

"The big story here is wages,” Shepherdson said. "We expected wages to be subdued because retail jobs pay much less than the average, so when stores are hiring aggressively, average earnings across the economy should be restrained. This did not happen in December, and it is worrying.”

"Another big increase next month would confirm higher headline inflation is being reflected in pay,” he added.

|

|

|

|

|

|

|