|

Yahoo! 4Q beats Street

|

|

January 12, 2000: 3:30 a.m. ET

Internet portal posts 375 percent rise in profit, announces 2-for-1 stock split

|

NEW YORK (CNNfn) - Web portal Yahoo! Inc. on Tuesday beat Wall Street's earnings expectations, reporting a fourth-quarter profit of $57.6 million.

The company also announced plans for a 2-for-1 split of its common stock, payable on Feb. 14 to shareholders of record on Jan. 20.

After the closing bell on Tuesday, the Santa Clara, Calif.-based company said it logged earnings of 19 cents per share, up more than 375 percent from 4 cents per share during last year's fourth quarter, on revenue that increased 120 percent to $201 million.

Analysts polled by earnings tracker First Call had expected Yahoo! (YHOO) to earn 15 cents per share during the quarter. But the so-called "whisper numbers" -- estimates provided by some analysts to major clients and posted on investor Web sites -- have reached as high as 21 cents per share.

For the full year, Yahoo! said it earned $142.8 million, or 48 cents per share, up from 14.7 million, or 5 cents per share in 1998.

All of the reported figures exclude acquisition-related charges and employer payroll taxes on employee stock options, Yahoo! said.

"In the fourth quarter, as in the rest of 1999, we focused on two significant objectives -- serve the world's largest audience through integrated communications, commerce and media services, and provide the most effective interactive marketing platform for advertisers and merchants to connect with our users," said Jeff Mallett, Yahoo!'s president and chief operating officer.

"As a result, we achieved the most successful quarter in our company's history in terms of record revenues and number of users and customers," Mallett added.

During December, Yahoo!'s global audience grew to more than 120 million unique users, doubling the 60 million users it served during the same period in 1998. The company also said its user base outside the United States now exceeds 40 million.

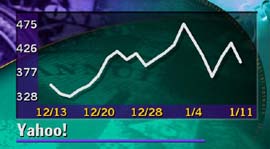

Shares of Yahoo!, which have risen more than 22 percent since the stock was added in December to the widely mirrored S&P 500 index, slipped sharply in Nasdaq trade Tuesday, ending the session down 38-11/16 to 397-3/8, a near 9 percent decline.

But the positive earnings surprise offered Yahoo! shares no relief. In after-hours activity, they extended those losses, slipping another 14-3/8 to 383 around 6 p.m. ET in extremely volatile trading.

Looking ahead, Timothy Koogle, Yahoo!'s chairman and chief executive, said the company will continue this year to focus on expanding its franchise globally; boosting its presence as a provider of electronic commerce services; building partnerships to enhance the progress of high-speed Internet access; adding to features such as voice communications on its sites; and accommodating

users of "alternative" Web connection devices, such as Palm handhelds.

"In all those areas you can expect us to extend our franchise pretty aggressively," Koogle told investment analysts in a conference call Tuesday night.

"Throughout the year, we leveraged the inherent scale in our business and carefully managed our business model to deliver superior results to our users, clients, partners and stockholders," Koogle said. "We are well positioned to continue our leadership position in the year ahead, and will continue to invest in growing our business on all fronts."

During the fourth quarter, Yahoo! users conducted more than $6.7 billion of transactions on the Internet, the company said.

|

|

|

|

|

|

|