|

Medical savings accounts

|

|

January 12, 2000: 6:18 a.m. ET

Self-employed, small business workers nearing deadline for tax-free health plan

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - It was 1997 and the physicians at Westchester Anesthesiologists were facing a health care crisis of their own.

The health insurance plan they and their staff had been covered by for years had just upped its premiums -- by 150 percent.

For a small business, with 23 employees and cash flow constraints, it would be impossible to absorb.

"It was a great plan, but it just became extremely cost prohibitive," said Mary Beth Wilson, executive director of the New York-based physician group. "We decided to look into medical savings accounts and found that we could cut our costs almost in half. That's a very, very substantial amount."

Moreover, she said, the doctors discovered that pretax contributions made to their MSAs would continue to grow tax-free for future medical expenses. Any money leftover could eventually be used, without penalty, to supplement their retirement.

They made the switch to MSAs later that month -- and haven't looked back since.

"It's worked out well for us and I don't see us changing," Wilson said. "For us, it's become one more way for our physicians and employees to put tax-free money away."

What's an MSA?

Medical savings accounts (MSA), which remain a mystery to many Americans, are part of a Congressional pilot program initiated in 1997.

Put simply, they are individual banking accounts used to pay for routine health care expenses, including doctor visits, hospital care, prescription drugs and dental exams.

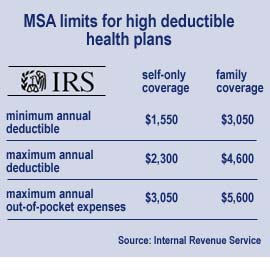

The accounts, which must be used in conjunction with an approved high-deductible insurance plan, are only available on a tax-favored basis to the self-employed and to small employer groups of 50 workers or less.

If you fall into those categories, advocates say you may want to give MSAs a closer look -- before it's too late.

The window is closing

That's because, according to legislation, the MSA pilot program will be closed to newcomers by about the fourth quarter of this year.

For the record, the government also has established a cap of 750,000 medical savings accounts nationwide. Once that cap is met, no new applicants will be accepted.

Those already in the program when it closes may remain there indefinitely.

On a brighter note, there is a bill circulating through Capitol Hill right now that would expand the MSA program in the future. And insiders say there's still room for several hundred thousand new enrollees.

"It's a wonderful deal and it would be a shame not to look into it," said Ray Helton, chief executive officer of Medical Savings Advantage in Peachtree City, GA. "If you wait until the last minute you won't be able to get the (qualifying) insurance in place fast enough to make the transition."

He noted it can't hurt to get the facts on MSAs while they're still around.

"If the program shuts down as it is supposed to, I think we'll be hearing about people 10 or 15 years from now talking about how much money they've accrued in their medical war chest and people will still be wondering what an MSA is," Helton added. "Most people are still unaware of them."

The pros

First and foremost, champions of medical savings accounts point to the cost savings such a program can yield for consumers.

On average, they say, MSAs can save account-holders 20 percent to 30 percent a year on premiums, including the high annual insurance deductible. It is estimated they can save individuals an additional $2,000 in annual taxes as well.

To hear them tell it, the tax-favored accounts could have a profound effect on the nation's economy, too.

Research complied by Milliman & Robertson for the Council on Affordable Health Insurance shows that MSAs, if opened to the general public, would save the U.S. health care system nearly $588 billion in five years.

A similar study conducted for the Cato Institute, revealed that medical savings accounts would reduce the nation's annual health care bill by $300 billion and reduce administrative costs by $33 billion.

But it's not just about the bottom line.

MSAs are hailed by many for their unique role as an alternative to managed care.

The account-holder calls the shots on which doctors they want to see and how they want their money spent. Moreover, if you spend your health care dollars conservatively, the leftover money goes to you - and not the insurance company. Those funds simply remain in your account for future medical expenses or your retirement.

"It's all about patient power," said John C. Goodman, president of the National Center for Policy Analysis and the author of Patient Power: Solving America's Health Care Crisis. "You control your health care dollars and when you go to see the doctor, he or she regards you as their customer."

The National Center for Policy Analysis points out that most Americans are overinsured anyway, using health insurance to pay for nonrisky medical procedures including diagnostic tests and routine checkups.

It notes most consumers use health insurance to pay for small medical bills they could pay for more cost-effectively from personal funds.

Lastly, on the list of MSA benefits, many advocates say these combination health insurance and tax-favored savings accounts allow many small business owners to begin providing affordable health care coverage to their staff. Others who already offer health care benefits can use MSAs to enhance their employee packages.

Indeed, that's what Wilson said medical savings accounts have done for her office.

"We didn't have dental coverage under our old insurance plan and now we do," she said. "Being a small company, it can be hard to get some of these benefits."

The rules

As MSAs currently are structured, funds can be removed from your account at any time, but any money not used for medical bills will be subject to ordinary income tax plus a 15 percent penalty.

Once you turn 65, however, the 15 percent penalty is waived. That means you can use the account to help fund your retirement.

(Click here for helpful information on MSAs from the Internal Revenue Service.)

Despite their many potential benefits, some lawmakers and consumer advocates fear the general public may not be educated enough about the complex field of health care to manage their health care dollars effectively.

Goodman begs to differ.

"Most of the people who say that are talking about someone else, not themselves," he said. "The truth is people are always more careful if they are spending their own money. There's definitely a change of behavior that results in less spending."

Others warn that consumers can get burned if they open an MSA account and experience a "catastrophic injury" in the first few months. The concern is that there may not be enough money accrued in their accounts yet to cover the high deductible insurance.

"In truth, though, that is not as big a risk as it seems," Helton said. "The reason is that you are the self-administrator of that account and you can almost always work out a payment system with the medical providers. You can also pay for that procedure using money from outside the medical savings account."

Wilson said that's been her strategy from the start.

"A lot of people use their MSAs to cover their deductible, but I'm letting mine grow because this is tax-free money working for me," she said.

|

|

|

|

|

|

|