|

Bourses end mostly higher

|

|

January 13, 2000: 12:19 p.m. ET

Telecom, media stocks lead Paris and Frankfurt; London flat after rate hike

|

LONDON (CNNfn) - Major European stock markets closed mostly higher Thursday, bolstered by gains in the telecom and media sectors.

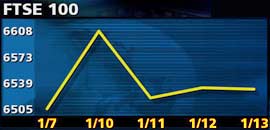

The exception was London, where the FTSE 100 finished down just 1 point at 6,531.50 following the Bank of England's widely expected hike in interest rates to 5.75 percent. Telecom shares climbed but oil and drug stocks lost ground.

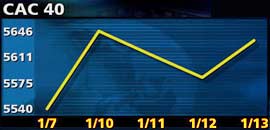

In Paris, the blue-chip CAC 40 rose 0.9 percent to 5,633.24, helped by a deal in the television sector. Frankfurt's electronically traded Xetra Dax ended 0.6 percent ahead at 6,955.98. Zurich's SMI was marginally lower at 7,436.90.

The Dow Jones industrial average was 0.2 percent ahead at the close of business in Europe, helped by the release of data showing a modest rise in producer prices in December.

The FTSE Eurotop 300, a pan-European gauge that reflects the broader market mood, was up 0.6 percent at 1,520.51. Its telecom component advanced 2.8 percent while media shares were 2 percent higher. Oil stocks lost 1 percent,

Telecom leaders across Europe gained ground after recent weakness. Spain's Telefónica rose 6 percent after it said it would invest $20 billion to expand its Latin American operations.

The euro was little changed from its New York close at $1.0270.

The telecom sector propped the London market, led by a 4.9 percent rise in Cable & Wireless [LSE-CW-] after it bought eight European Internet service providers as part of a $1 billion Web investment program. The stock gained 7 percent Wednesday ahead of the announcement.

Other telecom components also firmed. Energis (EGS) rose 2.9 percent as did British Telecommunications (BT-), while Vodafone AirTouch (VOD) gained 1.4 percent and Colt Telecom (CTM) outperformed its peers with a 5.2 percent advance.

Accounting software firm Sage (SGE) topped the FTSE gainers, up 11.8 percent after analysts raised their forecasts for the company's earnings.

Retailers were mixed following a round of upbeat sales statements. Pharmacist and household goods retailer Boots (BOOT) was worst hit, with a 6.4 percent decline. Electronics retailer Dixons (DXNS) slid another 6 percent after its 21 percent fall Wednesday.

But GUS (GUS), the country's largest mail-order retailer, gained 8.5 percent after it said trading had improved since its profits warning in December.

Most media shares fell back after strong gains in the wake of the Time Warner-America Online merger announcement Tuesday. Granada (GAA) headed the FTSE decliners, off 9.2 percent. Reed (REE) lost 1.1 percent but Carlton Communications (CTM) bucked the trend with a 5.2 percent advance.

Oil heavyweight Shell (SHEL) lost 2.4 percent.

Declines among the FTSE 100 outnumbered gains by two to one.

In Frankfurt, DaimlerChrysler (FDCX) rose 1.9 percent after the company spelled out its objectives for 2000, including a possible plan to spin off part of its aerospace unit, Dasa.

Financial stocks also gained ground after recent weakness, led by a 3.7 percent rise for Deutsche Bank (FDBK).

Deutsche Telekom (FDTE) ended flat and telecom rival Mannesmann (FMMN) rose 1.7 percent.

BMW (FBMW) suffered the largest drop, down 2.8 percent after expressing doubts about sales at its Rover unit.

Canal Plus (PCAN) led Paris shares ahead, rising 9.2 percent after conglomerate Lagardère (PMMB) paid $1.1 billion for stakes in two of the pay-TV firm's units. Lagardère shares rose 7.1 percent.

Luxury goods maker LVMH (PMC) climbed 6.1 percent ahead of 1999 sales figures due out next week and interest in the offering of its Internet ventures.

France Telecom (PFTE) rose 0.8 percent while Bouygues (PEN), which has cellular interests, rose 3.3 percent, and Vivendi (PEX) gained 5.7 percent.

Thomson-CSF (PTHO) lost 2.6 percent after agreeing to pay $2.17 billion for U.K. rival Racal Electronics.

Retailers Carrefour {PAR:PCA] and Casino (PCO) weakened on speculation of a government competition review. Carrefour slipped 3.4 percent and Casino dropped 1.4 percent.

-- from staff and wire reports

|

|

|

|

|

|

|