|

Intel shreds 4Q forecast

|

|

January 13, 2000: 8:16 p.m. ET

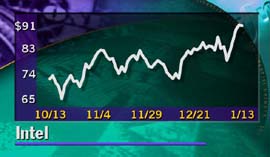

Stock soars in after-hours trade; analysts eye spillover effect

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Shares of Intel surged more than 6.5 percent in after hours-trade on Thursday after the microprocessor giant posted fourth-quarter earnings that far exceeded Wall Street's expectations.

After the closing bell, Intel (INTC) said that, before acquisition-related charges, it earned $2.4 billion, or 69 cents per share, handily beating earnings tracker First Call's consensus estimate of 63 cents per share. Earnings even topped the so-called "whisper numbers" that had been as high as 65 cents per share. The company credited better than expected demand for its products for the strong showing.

And since Intel can be see as an indicator for the chip business, some analysts said Intel's rivals could benefit from Intel's good news.

Including the charges, Intel's earnings came in at $2.1 billion, or 61 cents per share, up 2 percent from last year's fourth quarter and 45 percent sequentially.

The company toted up revenue of $8.2 billion during the quarter, up 8 percent from last year's fourth quarter and 12 percent sequentially.

For all of 1999, Intel said its net income rose 21 percent to $7.3 billion, including acquisition related costs. Earnings per share rose 22 percent to $2.11 from $1.73 in 1998.

Full-year revenue rose 12 percent to $29.4 billion.

After ticking down 3/16 to 91-1/16 in regular Nasdaq trade Thursday, Intel shares surged up 5-15/16 to 97 at 7:55 p.m. EST.

Analysts said they expect the rest of the chip industry to gain momentum in Friday's session as well.

During each of 1999's previous three quarters, Intel has fallen short of analysts estimates for revenue, earnings per share, or both.

Most analysts were expecting a strong showing from Intel during the most recent quarter.

On Wednesday, RobertsonStephens analyst Dan Niles upgraded his rating on Intel to a "buy" from a "long-term attractive." Charles Glavin, an analyst at Credit Suisse First Boston also changed his outlook on Intel Thursday, raising his rating to a "strong buy" from a "buy."

But more important than the reported results, observers said, is the guidance Intel management provides for 2000.

In a conference call Thursday evening Intel executives said the company expects to post roughly $8.2 billion in revenue during the first quarter of this year, a sequential drop-off that analysts said is actually smaller than its has been in the past two years.

The fourth quarter is typically the strongest for semiconductor companies because of an increase in sales of PCs during the holiday season.

In a statement Intel's president and chief executive Craig R. Barrett said he expects Intel's revenue from its networking, communications and wireless businesses to grow by 50 percent in 2000.

Unit shipments set new records

Intel executives said that unit shipments of microprocessors, chipsets, motherboards and flash memory all set new records during the quarter and that because of the stronger-than-expected demand, average selling prices rose slightly during the quarter.

"Because of the acceptance of these products, ASPs moved up slightly from the former quarter," said Paul S. Otellini, executive vice president and general manager of Intel's Architecture Business Group.

Intel's gross margins, a measure of a company's efficiency, came in at 61.3 percent during the quarter and 59.7 percent for all of 1999.

Andy Bryant, Intel's chief financial officer, said gross margins in 2000 should be about flat with 1999.

"Our estimate is a gross margin for all of 2000 of 61 percent, compared to 59.7 percent for 1999," he said.

In 1999, Intel acquired 12 companies and businesses for roughly $6 billion, mostly centered on building the company's company's networking and communications businesses.

Moving ahead, Bryant said the company has no plans to slow down on the acquisition front.

"Intel plans to invest heavily in all of its businesses in 2000," he said.

The company also intends to beef up its capital spending in 2000 to $5 billion from

Intel plans to boost its capital spending to a record $5 billion, up from $3.4 billion in 1999. The chip giant also plans to boost research and development spending to $3.8 billion, up from $3.1 billion in 1999

A spillover effect?

Intel was the first of the semiconductor companies to report its fourth-quarter earnings. And because the company is largely used as a barometer for the industry, some analysts expect other chipmakers to benefit from Intel's good news.

"The quarter was quite solid and pretty much in line with our expectations," said Mark Edelstone, an analyst at Morgan Stanley Dean Witter. "We think this is a positive for the whole group and we are quite positive on the sector for 2000."

"The capital equipment suppliers are going to be up, considering that their spending levels are going to be enormous," said RobertsonStephens' Niles

The better than expected revenue and earnings combined with a projected first-quarter revenue decline that is smaller than usual and the reported increase in average selling prices will likely have a strong impact on the rest of the industry as well, considering Intel's track record recently, Niles said.

"It doesn't get a lot better than that, especially for a company that just hasn't been doing very well for the last year," Niles said. "It's going to be good for them tomorrow, and that should have a positive affect on a lot of the other chip makers, especially guys that are closely related. It will have generally a positive affect on the overall market."

Supply constraints in the past

Intel executives said that the company has overcome the problems that caused a shortage of some of their low-end microprocessors, which PC maker Gateway earlier this month said would cause it to fall short of its fourth-quarter targets.

Gateway, which relied entirely on Intel for its PC microprocessors, recently tapped Intel rival Advanced Micro Devices (AMD) as a source for the parts as well.

"We believe that we'll be able to satisfy demand overall for the quarter, and we are in a position to be able to take some upside business toward the latter part of the quarter."

Analysts have said that the shortages were caused, in part, by the company's shift to a 0.18 micron manufacturing process, which uses advanced technology that yields more chips per wafer, but is being used so far mostly for its higher-end products.

Intel said that all of its manufacturing facilities will be using the 0.18 micron process by the end of the year and credited the more efficient technology for helping it achieve the better-than-expected results.

|

|

|

|

|

|

|