|

Glaxo, SKB to merge?

|

|

January 17, 2000: 2:30 a.m. ET

Deal to be announced Monday on creation of world's largest drug firm, worth $187B, reports say

|

LONDON (CNNfn) - British pharmaceutical giants SmithKline Beecham and Glaxo Wellcome have agreed to merge in a deal that would create the world's largest drug maker, according to published reports.

On Sunday night, the Reuters news agency and the online editions of the Financial Times, the Wall Street Journal and the New York Times said that a deal had been reached and would be announced Monday.

On Friday the two companies announced that they had resumed talks. Talks between the two companies fell apart in 1998 over management differences. But a lot has changed in the pharmaceutical industry over the past two years, and the resumption of negotiations reflects the increased pressure drug makers are facing to consolidate at a time when research and development costs are rising rapidly.

A successful deal would create a combined company worth more than 114 billion pounds. It would have pro forma sales of 16 billion pounds ($26.3 billion), a global pharmaceutical market share of around 8 percent, and strong positions in such key areas as asthma, HIV and diabetes treatments, as well as antibiotics and anti-cancer drugs.

The combination also would be bigger than the current world leader, Aventis, and the new company created by Pfizer (PFE) if it succeeds in buying Warner-Lambert (WLA).

Glaxo and SmithKline issued a brief statement Friday confirming they are in talks aimed at a "merger of equals," but declined further comment.

While earlier talks foundered, a big obstacle will be removed when SmithKline chief executive Jan Leschly steps down in April. Animosity between Leschly and Glaxo executive chairman Richard Sykes was cited as the main hurdle to an earlier merger.

The discussions mark the latest round of restructuring in the global pharmaceutical business, with companies eager to link up to fund huge research and development expenditures.

"There is an inexorable drift toward consolidation in the drug industry," analyst Peter Cartwright of brokerage Williams de Broe told CNNfn.com.

Commenting on Glaxo and SmithKline, he said: "The fit is generally good, with no management issues this time, and there will be significant cost savings."

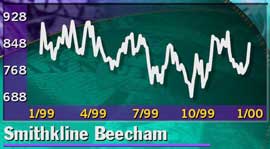

Stock in both companies soared on the announcement.

In London, SmithKline shares closed up 7.71 percent at 850 pence while Glaxo gained 4.54 percent to end the day at 1,820 pence.

On the New York Stock Exchange, SmithKline (SBH) American Depositary Receipts closed up 3-5/16 at 70, while Glaxo (GLX) stock added 2 to 60.

Counter-offer may emerge

Market observers immediately speculated that the talks could force out a counter-offer for SmithKline, citing Bristol Myers Squibb (BMY), American Home Products (AHP) and Switzerland's Novartis as possible bidders. AHP and Novartis each held tentative merger talks with SmithKline last year.

Glaxo has a market value of 66 billion pounds after Friday's share rally in London, while SmithKline's capitalization is 47.7 billion pounds.

In the six months to June 30, Glaxo reported sales of 4.1 billion pounds, up 6 percent, and a 7 percent increase in pretax earnings to 1.33 billion pounds.

In the same period, SmithKline's sales rose 11 percent to 4.2 billion pounds and pretax earnings rose 16 percent to 928 pence a share.

Other deals in the industry pipeline include Pfizer's hostile approach to Warner-Lambert, designed to break up Warner's attempt to merge with American Home. Pharmacia & Upjohn (PNU) and Monsanto (MTC) also recently announced plans to merge, while the current world No. 1 in pharmaceuticals, the Franco-German company Aventis, was formed by Rhone-Poulenc's merger with Hoechst. That deal was completed in November.

Analyst Cartwright said the latest merger, if it comes off, is unlikely to be the last involving the companies, with further growth probably requiring cross-border deals.

Glaxo and SmithKline are likely to face regulatory scrutiny in the event of a merger. However, analysts said the companies have little overlap in terms of the ailments their products treat, so competition regulators probably won't raise major objections.

|

|

|

|

|

|

|