|

Glaxo, SmithKline to tie

|

|

January 17, 2000: 5:18 p.m. ET

U.K. firms plan merger to create world's largest drug maker, worth $177B

|

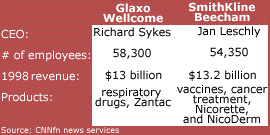

LONDON (CNNfn) - British pharmaceutical companies SmithKline Beecham and Glaxo Wellcome agreed to merge Monday in a stock swap worth nearly $76 billion, creating the world's largest drug maker and signaling that merger activity in the fragmented drug industry is rapidly spreading.

The combined company, to be called Glaxo SmithKline, would hold a 7.3 percent share of the global pharmaceutical market and have a combined market value of about $177 billion (108 billion pounds), based on Monday's closing stock prices in London.

It would have worldwide sales of about $25 billion a year, company officials projected.

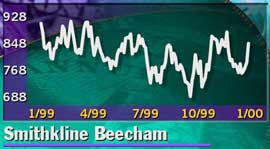

However, shares of the two companies fell on the news, as investors who bid up the stocks in anticipation of the merger sold off out of concern that future cost savings would be lower than expected.

Two years ago, merger talks between Glaxo and SmithKline fell apart over management differences. But success in the latest round of negotiations reflects the increased pressure on drug makers to exploit what analysts term a "biotechnology revolution" in developing the next generation of leading pharmaceutical products.

"It has not been easy ... that is true. On the other hand, today we can honestly say we have a real powerhouse of a new company," SmithKline CEO Jan Leschly said at a news conference announcing the deal.

Analysts say they expect more mergers in the industry, which up until recently has been largely free of the major mergers now reshaping other industries.

"This is a good deal," said analyst Stewart Adkins, of Lehman Brothers. "This is all about freeing up resources to compete with the leading American companies in marketing and R&D," he added, citing Pfizer Inc. (PFE) as an example of a company that is rapidly increasing its research and development spending.

The combined company would have strong positions in such key areas as asthma, HIV and diabetes treatments, as well as antibiotics and anti-cancer drugs.

The combined firm will have almost 20 drugs with annual revenues of more than 250 million pounds apiece. The company's two leading medicines by sales - both developed by SmithKline -- are Seroxat/Paxil, an anti-depressant, closely followed by Augmentin, which combats infection.

Glaxo's best-selling drug, according to 1998 figures released Monday, remains ulcer treatment Zantac, formerly the world's top-selling drug but now no longer protected by patent. Analysts said Zantac is likely to be well down in the rankings for 1999.

After sharp rises in their respective stock prices Friday when the companies confirmed that they were negotiating a deal, investors were less impressed Monday.

On the London stock exchange, Glaxo stock closed down 4.7 percent, while SmithKline dropped 6.9 percent, in line with the value of the Glaxo offer. There was no trading on the New York Stock Exchange, because the U.S. markets were closed for the Martin Luther King Jr. holiday.

Analysts attributed the sell-off to the fact that the companies failed to come up with any additional positive surprises including job cuts and future earnings growth.

Glaxo and SmithKline said their combination would generate annual cost savings of 1 billion pounds ($1.63 billion) after the third year, of which 25 percent will be reinvested in research and development.

Job cuts in the 107,000-strong combined workforce are "inevitable" the company said, although it's too early to say how many jobs will go, and where.

The new company will be headquartered in London but have a new operational base in the United States, probably in the New York City area.

The companies said they would keep their U.S. operations separate. SmithKline has a research and development unit in Philadelphia and an over-the-counter drug business in Pittsburgh. Glaxo's U.S. operations are based in Research Triangle Park, N.C.

Terms of the deal

Although the deal is billed as a "merger of equals," Glaxo shareholders will control a majority of the new company.

Glaxo investors will own 58.75 percent of the combined company, swapping their shares on a 1-for-1 basis.

SmithKline shareholders will own 41.25 percent of the new company. They will receive 0.4552 share in the new company for each of their SmithKline shares.

The merger marks the latest corporate marriage in the global pharmaceutical business. The combination would be slightly bigger than the company Pfizer (PFE) will create if it succeeds in its hostile offer for Warner-Lambert (WLA). Pfizer hopes to break up Warner's planned merger with American Home Products Corp. (AHP). It also would surpass in size the current world leader, Aventis, formed by Rhone-Poulenc's merger last year with Hoechst.

Pharmacia & Upjohn (PNU) and Monsanto (MTC) also recently announced plans to merge, and last year Britain's Zeneca and Sweden's Astra joined forces to form AstraZeneca, currently the second-largest global drug maker.

"This must put everybody else under pressure," said a London-based analyst who spoke on condition of anonymity. "This company will have almost unparalleled marketing power."

Adkins, of Lehman Brothers, agreed that more deals are likely to follow.

"All the remaining players with aspirations to be in division one must be considering their response."

Who's in charge

A big obstacle to a smooth merger will be removed when Leschly, SmithKline's chief executive, steps down in April. Animosity between Leschly and Glaxo executive chairman Richard Sykes was the main hurdle to an earlier pact.

This time, the companies have come to an agreement on a management structure, with Glaxo's Sykes taking the role of non-executive chairman at the new company, and the chief executive's slot going to Jean-Pierre Garnier, the chief executive-in-waiting at SmithKline.

"This is today. What happened in the past is, in reality, irrelevant," Leschly said at the press briefing in London.

The new board will be evenly split between ex-Glaxo and SmithKline members. Analysts told CNNfn.com that the chances of the deal failing this time because of management incompatibility are "fractional."

The deal requires approval by U.S. regulators and the European Union.

However, one analyst said that although regulators may require some asset disposals, "they won't be deal breakers."

The deal is expected to close by the middle of 2000. The new company will list its stock in London and New York.

The new company will rival BP Amoco for the title of Britain's largest company. Glaxo has a market value of 64 billion pounds ($104.68 billion), while SmithKline's capitalization is more than 43 billion pounds ($70.33 billion.)

-- staff and wire reports

|

|

|

|

|

|

|