|

Bank 4Q results mixed

|

|

January 18, 2000: 1:57 p.m. ET

Citigroup, Morgan top forecasts; Bank of America, Bank One meet targets

|

NEW YORK (CNNfn) - Profits at investment bank powerhouses Citigroup Inc. and J.P. Morgan soared in the fourth quarter, finishing off a year of strapping earnings aided by record stock market gains and depressed year-earlier comparisons.

Merger costs and other one-time expenses, meanwhile, spurred other big U.S. banks such as Bank of America and Bank One to post mixed results Tuesday. On the brokerage side, Paine Webber Group and Charles Schwab both reported solid increases in fourth-quarter profits.

"Overall, the results are looking pretty good," Lisa Welch, a banking analyst with John Hancock Securities in Boston, told CNNfn. "The valuations of companies in the banking sector look good and I think banks overall will do well this year."

Citigroup profit surges

A jump in consumer and investment banking allowed Citigroup (C) to earn $2.6 billion, or 75 cents a diluted share, in the quarter, up from $1.4 billion, or 40 cents, a year earlier. The results beat forecasts of 70 cents a share, according to First Call Corp., which tracks analysts' estimates.

Separately, Citigroup disclosed plans to buy the investment-banking unit of London-based investment house Schroders PLC for $2.2 billion. Citigroup reportedly plans to merge the unit into its Salomon Smith Barney brokerage operations.

In its first full year as a merged company with Travelers Group, Citigroup posted operating earnings of $9.95 billion, or $2.85 a diluted share, surpassing the $6.34 billion, or $1.77 a share, it earned a year before. Citigroup also increased its annual dividend by 14.3 percent to 16 cents a share from 14 cents.

J.P. Morgan (JPM), the fifth-biggest U.S. bank, reported operating income of $509 million, or $2.63 a share, compared with $175 million, or 86 cents, a year earlier. That beat the average estimate of $2.00 a share, according to First Call.

Citigroup shares rose 3/4 to 58-3/4 in midday New York trading, while J.P. Morgan's stock slipped 3-9/16 to 124-7/16.

Outstanding numbers from Morgan

"Morgan's numbers were outstanding," said Diane Glossman, a banking analyst with Lehman Brothers in New York. "It was all trading," a reflection of income derived from buying and selling securities on behalf of clients and from a strong initial public offering market, she said.

For some banks, exceeding profits from a year ago was a cinch, as markets worldwide slumped in the fourth quarter of 1998 after Russia defaulted on its outstanding debt and devaluated its currency. For banks involved in equity trading on behalf of their clients, record stock market gains in 1999 helped exaggerate the comparisons even more.

Still, while Citigroup and J.P. Morgan managed to exceed expectations, other banks did not, providing a mixed picture of the U.S. banking industry's performance in the final three months of 1999. Bank of America and Bank One both recorded earnings in line with expectations, while Bank of New York posted fourth-quarter profits that missed forecasts.

Bank of America (BAC), the largest U.S. bank, had net income of $1.9 billion, or $1.10 a diluted share, up from $1.16 billion, or 66 cents a share, a year earlier. Excluding a $213 million charge to cover costs associated with its $43 billion merger with NationsBank, Bank of America's operating earnings rose to $2.1 billion, or $1.23 a diluted share, from $1.6 billion, or 91 cents a year ago. The operating results matched forecasts of $1.23, according to First Call.

No surprise at Bank One

For all of 1999, Bank of America earned $7.88 billion including merger-related charges, or $4.48 a share, a 53 percent increase from $5.17 billion, or $2.90 a share, a year earlier.

Bank of America shares declined 2-1/16 to 58-7/16.

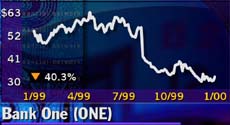

Bank One (ONE), the fourth-biggest U.S. bank, earned $411 million, or 36 cents a diluted share, up from $226 million, or 19 cents, a year ago. Excluding $725 million in charges, Bank One posted operating earnings of $904 million, or 78 cents a diluted share, compared with year-earlier operating earnings of $1.04 billion, or 88 cents a share. The operating results also matched analysts' expectations.

Bank One: down 40.3 percent from a year ago

Bank One warned less than a week ago that its fourth-quarter 1999 and full-year 2000 earnings will trail expectations, reflecting its struggling First USA credit card unit. It was the third warning the Chicago-based bank has issued to Wall Street in less than a year.

"Bank One's earnings came in as expected, but I think people were turned off by lower loan-loss provisions and the fact that their numbers weren't a little bit ahead," Lehman's Glossman said. She currently rates Bank One a "neutral."

Bank One stock fell 3/4 to 31-3/8.

Mellon Financial (MEL), one of the largest U.S. mutual fund management companies, reported fourth-quarter profit of $245 million, or 48 cents a diluted share, up from $222 million, or 42 cents, a year ago.

The Pittsburgh-based bank matched expectations of 48 cents a share, according to First Call. The year-earlier per share earnings were restated to reflect the company's two-for-one stock split. For the year, income rose to $948 million, or $1.82 a share from $861 million, or $1.62 in 1998.

Mellon Bank shares fell 1-3/4 to 32-5/8.

Other banks to report their quarterly performances included Bank of New York (BK), whose fourth-quarter income rose to $327 million, or 44 cents a share, from $313 million, or 40 cents, a year earlier, and U.S. Bancorp (USB), which posted fourth-quarter operating profit of $385.1 million, or 52 cents a diluted share, compared with $377.3 million, or 52 cents, a year earlier.

Bank of New York was expected to earn 43 cents a share, according to First Call, while U.S. Bancorp was expected to earn 53 cents. Bank of New York shares fell 1-5/16 to 37-13/16, while U.S. Bancorp shares declined 11/16 to 22-3/8.

Wells Fargo shares are off their highs, but up from a year ago

Finally, Wells Fargo (WFC) reported fourth-quarter profit of $970 million, or 58 cents a share, compared to a profit before charges of $768 million, or 46 cents, in the fourth quarter of 1998. Analysts polled by First Call had forecast the San Francisco-based bank to earn 59 cents a share.

Wells Fargo, which merged with Minneapolis-based Norwest Corp. a little more than a year ago, took year-earlier merger-related and other charges of $1.15 billion and a $320 million loan-loss provision that resulted in a fourth-quarter 1998 loss of $194 million, or 12 cents a share.

Wells Fargo shares declined 3 to 38-11/16.

|

|

|

|

|

|

|