|

Chase 4Q profits soar

|

|

January 19, 2000: 4:55 p.m. ET

Bank swamps estimates, sets $5B buyback; FleetBoston also beats Street

|

NEW YORK (CNNfn) - Revenue from financing Internet ventures and other startups as well as record investment-banking fees allowed Chase Manhattan Corp. to post fourth-quarter earnings Wednesday that shattered analysts' expectations.

The New York-based bank reported operating earnings of $1.68 billion, or $1.97 a diluted share. That blew past the $1.15 billion, or $1.31 a share, the company earned in the year-earlier quarter and swamped the $1.32 a share expected by analysts polled by First Call Corp.

Solid investments in new companies, a record-making initial public offering market, record-setting stock market gains and a generally favorable interest rate environment all helped the third-largest U.S. bank-holding company to report a stellar quarter and year.

"I think this is a turning point for us, for the new Chase in our private equity business, in us being positioned to benefit from the new economy," Dina Dublon, Chase's chief financial officer, told CNNfn. "The magnitude of the number has something to do with the fact that we have increased the pace of investments, and the markets are as good as they are."

For the full year, Chase reported operating earnings of $5.39 billion, or $6.21 per diluted share, easily beating the $4.02 billion, or $4.51 per share, it earned in 1998.

Aided by a warning

Indeed, the 65 cents per-share increase over analysts' estimates was partially aided by Chase's decision to warn Wall Street in advance. The company warned in November that a miscalculation on its trading gains would hurt fourth-quarter revenue and reduce earnings by roughly 5 cents a share.

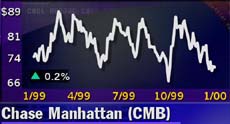

Still, the earnings were well beyond even Wall Street's original expectations, suggesting the investment bank is doing something right to beef up its bottom line. And, investors agreed -- Chase (CMB)'s shares rose Wednesday closing at 3-1/8 to 74-1/8. In pre-market trading on Instinet the company's stock rose as high as 75.

Chase was not the only bank reporting significant gains in fourth-quarter profit. FleetBoston Financial Corp. (FBF) Wednesday reported a fourth-quarter profit before merger-related charges of $726 million, or 76 cents a diluted share, up from $622 million, or 65 cents, in the year-ago quarter. Analysts polled by First Call had expected the bank to post earnings of 75 cents a share.

Boston-based Fleet Financial Group Inc. merged with its rival BankBoston Corp. on Oct. 1 to form the largest bank in New England. The bank took a $760 million merger-related charge that led to a final loss of $34 million, or 5 cents a share. FleetBoston Financial shares rose Wednesday closing at 3/4 at 31-1/8.

Investments, M&A activities drive profits

Chase company officials attributed the dramatic increase in profits to record private-equity gains through its global investment arm, Chase Capital Partners, as well as strong investment banking results and the significant contribution of recently acquired brokerage firm Hambrecht & Quist. Even with that, Dublon said, Hambrecht & Quist contributed only 20 days to the entire quarter's results.

Private-equity-related investment gains rose more than fourfold to $1.31 billion from $244 million a year earlier. Company officials said the jump in its portfolio value resulted from a record-making U.S. stock market and several successful IPOs during the quarter.

"The story about our private equity business is about equity creation and not just about the number," Dublon said. "I think we're going to have a repeat of what we had this quarter. It's not going to happen exactly on 90 day intervals, but I think we will do well."

Separately on Wednesday, Chase authorized the repurchase of up to $5 billion of its outstanding common stock, or roughly 9 percent based on current prices. Share buybacks, as repurchases are commonly called, suggest to investors that the company may feel its shares are undervalued.

Internet investment fund launched

"While revenues from private-equity investments may vary from quarter to quarter, we believe that the Chase Capital Partners business system will be a significant long-term source of value creation," said William Harrison Jr., Chase's newly sworn chief executive officer.

The global private-equity firm took another step in that direction Wednesday, unveiling a $100 million Internet investment fund with two Web entrepreneurs to help high-tech and other startups in the United Kingdom.

Investment banking fees, strongly aided by the addition of Hambrecht & Quist, grew significantly during the quarter, rising 31 percent to $499 million as Chase continued to increase its participation in the corporate merger-and-acquisitions business.

Chase's strong market-related gains mimicked similar patterns shown Tuesday by a handful of other large U.S. banks including, Citigroup Inc. (C) and J.P. Morgan (JPM). Also, brokerages rang in a second day of stronger-than-expected earnings.

Fewer worries about interest rates

Dublon also said that further increases in interest rates from the Federal Reserve will not have as significant an impact on Chase as it may have in the past because income from interest on investments comprises a smaller part of the bank's overall income.

"This is really a perception of what banking was about 15 or 20 years ago -- the idea that rising interest rates hurt banks' earnings," she said. "Interest income is about 40 percent of our total revenue; it used to be 70 percent. We are not betting on interest rates in our business," she said.

|

|

|

|

|

|

Chase Manhattan Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|