|

Asia gains on tech rally

|

|

January 20, 2000: 5:09 a.m. ET

Tech shares advance on Nasdaq record; Tokyo, Singapore rise, HK slips

|

LONDON (CNNfn) - Asian stock markets mostly advanced Thursday as technology shares got a lift from the U.S. Nasdaq's latest record-setting performance.

The benchmark Nikkei 225 in Tokyo closed up 110 points, or 0.58 percent, at 19,008.01 after earlier gaining as much as 250 points.

Singapore's Straits Times was the region's best performer, climbing 2.7 percent to close at 2,315.53 and break a five-session losing streak.

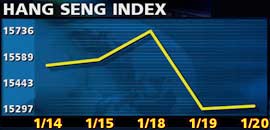

However, the Hang Seng in Hong Kong closed down 60 points, or 0.4 percent, at 15,215.31 after trading in the black for most of the session.

Asian markets took heart from another record close by the Nasdaq Composite on Wednesday, which ended 0.5 percent higher at 4,151.29. While the S&P 500 index also made a closed marginal gain, the Dow Jones industrial average posted a 0.62 percent drop, much of it attributable to a fall in Microsoft stock.

The Nasdaq's advance helped technology-related stocks in Tokyo, with Hitachi gaining 2.3 percent, Sony Corp. up 1.1 percent and cellular market leader NTT DoCoMo closing up 1.25 percent.

The exception was Yahoo! Japan, which ended down 3.7 percent after becoming the first Japanese stock to reach 100 million yen a share in the previous session.

Brokerages continued to gain momentum from recent fourth-quarter earnings and a report that profits this year would beat expectations. Nomura Securities was the sector's best performer, with a 2.1 percent advance.

Banks also made ground despite lingering concern the U.S. may soon raise interest rates. Market leader Bank of Tokyo-Mitsubishi rose 2 percent.

Steel companies were heavily traded after the U.S. Commerce Department imposed new tariffs on imports of steel from Japan, with Nippon Steel the most heavily traded stock on the index, closing up 2 percent. However, other producers fell: Kawasaki Steel dropped 4 percent and Kobe Steel gave up 3 percent.

The Hong Kong market was hit by renewed fears of higher interest rates in a choppy session which saw selling pressure on blue chips in afternoon trade. HSBC Holdings lost 1.6 percent and most telecom shares also fell back. SmarTone lost almost 6 percent, C&W HKT shed 1.3 percent and China telecom fell 2 percent.

Conglomerates were the strongest components, with Swire Pacific gaining 4.7 percent as both recovered from recent weakness. Cathay Pacific, in which Swire retains a stake, was 2.7 percent ahead.

Singapore broke its five-session decline as all the market's heavyweights recovered ground. DBS Group was 3.2 percent higher while Overseas Union Bank and Singapore Press Holdings both gained 2.5 percent.

Technology firms climbed, with systems integrator Datacraft up 7.3 percent ahead of half-year results, due after the session close.

The positive mood extended to smaller markets. The Kospi benchmark in Seoul ended up 0.76 percent at 945.90 after its least volatile session of the week. Traders cited the absence of large program trades, which had contributed to sharp swings in recent sessions.

The All Ordinaries in Sydney added just over 1 percent to close at 3,137.10, helped by a rise in heavyweight commodity stocks.

In Manila, the PHS Composite ended 0.24 percent higher at 2,053.37.

In Jakarta, the JSX closed 2.2 percent higher at 670.13, erasing half of the loss posted the previous session. The KLSE Composite in Kuala Lumpur closed 1.9 percent higher at 950.86 and the Set index in Bangkok rose 0.26 percent to 487.10. Taiwan's Weighted index closed down 0.16 percent at 9,136.95 and Indian shares also fell back, with the benchmark BSE-30 index in Mumbai down 1.4 percent at 5,399.31.

-- from staff and wire reports

|

|

|

|

|

|

|