NEW YORK (CNNfn) - Blue-chip stocks plunged Thursday, with the Dow Jones industrial average falling for the third straight session, led lower by losses to Alcoa, Intel, Procter & Gamble and General Electric.

But the Nasdaq set its second consecutive record high on its largest volume in history after strong profits from three of the nation's technology bellwethers sparked optimism that the sector will continue to see strong growth.

Citing no fundamental reasons behind the sell-off, analysts linked the Dow's plunge to big losses in several of the 30 firms that comprise the narrow index. Only seven Dow stocks rose.

"There's certainly not one thing you can point to and say 'this is because,' " said Art Hogan chief market analyst at Jeffries & Co. "It's company by company."

The Dow Jones industrial average fell 138.06 points, or 1.20 percent, to 11,351.30. But the Nasdaq composite index jumped 38.21 points, or 0.92 percent, to 4,189.50, surpassing the record set Wednesday. And the S&P 500 lost 10.33 points, or 0.71 percent, to 1,445.57.

The biggest surprise? The Russell 2000. The index of small company stocks, which lagged the Dow and Nasdaq last year, has outperformed all the major stock benchmarks in 2000. The trend continued Thursday, with the Russell gaining 7.26 points, or 1.40 percent, to 526.91.

More stocks fell than rose, as decliners on the New York Stock Exchange beat advancers 1,880 to 1,186. Volume hit 1 billion shares. On the Nasdaq, losing shares beat winners by a 2,130 to 2,152 margin on record volume of 1.85 billion shares, beating the previous record of 1.78 billion shares traded Dec. 9.

In other markets, bonds edged lower. The dollar fell versus the euro but was little changed against the yen.

Alcoa leads Dow down

Alcoa (AA) fell 4-5/8 to 73-1/2 after CIBC World Markets downgraded the world's largest aluminum producer to "hold" from "buy." The Dow's biggest loser accounted for nearly 25 points on the index. Alcoa was the Dow's best performing stock last year, climbing 122 percent.

Intel (INTC) dropped 4-7/16 to 95-5/8. The chipmaker's decline came after a competitor, Advanced Micro Devices (AMD), reported $65 million in fiscal fourth-quarter earnings, beating Wall Street forecasts. But AMD also fell, shedding 3 to 38.

Procter & Gamble further weighed on the Dow. The maker of Tide, Crest and Crisco lost 2-3/16 to 112-9/16 on concern it is serious about acquiring drug makers Warner-Lambert Co. and American Home Products Corp. at what may be an expensive premium.

General Electric (GE) also damaged the blue-chip index, falling 2-25/32 to 145-15/16 after narrowly beating analysts' expectations. The conglomerate said it earned $3.09 billion, or 93 cents per diluted share, in the fourth quarter. GE, which typically posts strong earnings, rose Wednesday ahead of its results.

"I'm actually surprised the Dow is doing what it's doing, given the strength of the IBM and GE reports," said Phil Orlando, chief investment officer at Value Line Asset Management.

IBM (IBM) jumped 1-7/8 to 121-3/8 after saying it earned $2.1 billion, or $1.12 a diluted share, a decline that was less than expected.

Rounding out the Dow's losers, Caterpillar (CAT) slid 2-3/16 to 47-1/8 a day after an arbitrator found the industrial-equipment maker acted fraudulently and deceitfully toward a partner in an alternative-fuels venture. And Boeing (BA) lost 1-1/8 to 46-1/2. The airplane maker rose strongly Wednesday after posting a 42-percent gain in earnings.

Techs lead the way

The solid earnings from IBM, along with those from America Online and Apple Computer, triggered broad technology gains and lifted the Nasdaq.

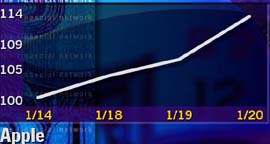

Apple (AAPL) surged 6-15/16 to 113-1/2 after saying it earned $178 million, or $1 per diluted share, well above estimates.

But America Online (AOL), not a Nasdaq member, fell 11/16 to 64-3/16 after the Internet service provider reported a profit of $224 million, or 9 cents per diluted share.

Richard Cripps, chief market strategist for Legg Mason, said each company's report bodes well for the sector.

"AOL certainly validates the idea that more people are spending more time online," he said. "IBM illustrates strength in technology spending while Apple shows demand for personal computers remains strong."

Several of Nasdaq's biggest movers churned higher. Sun Microsystems (SUNW) rose 4-11/16 to 85-5/8, Oracle (ORCL) gained 2-3/16 to 55-5/16 and Dell (DELL) climbed 1-3/4 to 44-1/4.

Earnings roll on

General Motors Corp. (GM), another Dow component, rose 3/4 to 82-1/4 after the world's biggest automaker posted income from continuing operations of $1.15 billion, or $1.86 a diluted share, better than the $1.81 analysts expected.

But Sears, Roebuck & Co. (S) fell 1-11/16 to 32-1/16 after beating expectations. The nation's No. 2 retailer said it earned $740 million, or $1.98 per share, in the fourth quarter.

(For a complete look at the day's major earnings news, click here.)

Rate fears remain

Despite the last quarter's generally solid earnings, stock investors fret the strengthening economy will prompt the Federal Reserve to launch a series of interest-rate hikes ahead. Higher rates increase borrowing costs, crimping corporate profits.

In the latest sign of economic strength, the number of Americans filing for first-time unemployment benefits fell a sharp 39,000 to 272,000 in the week ended Jan. 15. With unemployment at a 30-year low, the news suggests tightening labor markets may prompt employers to hike wages, igniting inflation.

Separately, the nation's trade deficit surged to a record $26.5 billion in November as American consumers, who fuel two-thirds of the economy, continue to spend money on imports.

Bond yields, meanwhile, continue to soar, in a trend that may lure investors from stocks.

(Click here for a look at CNNfn's hot stocks.)

|