|

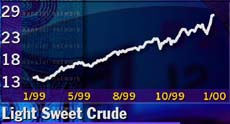

Oil gushes to 9-year high

|

|

January 21, 2000: 2:22 p.m. ET

Cold weather, OPEC curbs trigger concern about dwindling supply

|

NEW YORK (CNNfn) - A deep freeze across the U.S. Northeast and more supply curbs from the Organization of Petroleum Exporting Countries propelled oil prices to nine-year highs Friday, on concern that demand will outstrip supply.

Brent benchmark crude for March leaped a full dollar higher to $27.11 a barrel, the highest since the Gulf War in 1991, before slipping back to $26.90. Light sweet crude jumped to $29.07 a barrel, up 55 cents from Thursday, while heating oil for February delivery rose 3.74 cents to 90.20 cents a gallon on the Nymex's electronic trading system.

Colder-than-normal temperatures across the northeastern United States spurred investors to bid up the price of oil, on expectations that demand will remain strong and supply won't increase any time soon. Forecasts are calling for more cold weather in the weeks ahead, further bolstering demand for oil.

Prices went even higher at midday after Reuters reported OPEC leaders might extend supply cuts until September. Libyan Energy Minister Abdullah al-Badri announced from Tripoli that he had reached agreement with new Algerian Oil Minister Chakib Khalil and Iran's Bijan Zanganeh on the proposal. OPEC curbs were supposed to expire in March.

Oil prices have more than doubled in the past year

"I think OPEC is showing tremendous strength in keeping oil prices firm, but they cannot push it much further," Fadel Gheit, an analyst with Fhanestock & Co., told CNNfn. "If they do, they will have to contend with things that they do not want in the long run, like possible economic troubles."

Continued curbs on oil production imposed by OPEC have prompted oil prices to almost triple in the past two years. In a series of reductions that began in April 1998, OPEC, assisted by non-OPEC members Mexico and Norway, removed 4.3 million barrels of oil a day from world markets. So far, that's reduced overall production by about 6 percent. OPEC member countries produce approximately 40 percent of the world's crude oil.

"OPEC really cannot extend this period much longer," Gheit said. "OPEC wants to do what I call a soft landing, by easing supply back into the market slowly and not causing any shocks."

Iran's state radio said a majority in OPEC favored

prolonging output limits beyond their end of March expiration to prolong a rally that has more than doubled prices in a year. "Most OPEC member countries, including the Islamic Republic of Iran, want this agreement extended in order for oil prices to continue to rise," the radio said.

-- from staff and wire reports

|

|

|

|

|

|

|