|

Techs boost Asian markets

|

|

January 26, 2000: 5:37 a.m. ET

Nikkei gains 1.4% on tech buying, weaker yen; Net deals lift Hang Seng

|

LONDON (CNNfn) - Asian stock markets closed firmly ahead Wednesday as investors bought technology shares following a rally on Wall Street Tuesday, while a weakening yen supported Japanese exporters.

The Nikkei 225 benchmark in Tokyo ended with a gain of 215 points, or 1.4 percent, at 19,111.19, further boosted by expectations of firm full-year earnings from technology bellwether Sony Corp.

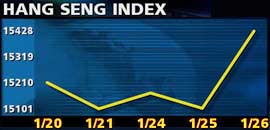

The Hang Seng index in Hong Kong closed 2.15 percent higher at 15,427.72, lifted by strong performances from its telecom and technology components.

The Straits Times index in Singapore broke a four-session losing streak on the back of gains among financial stocks. The index ended up almost 1 percent at 2,259.90.

Strong earnings reports from Disney Corp. (DIS) and Texas Instruments (TX) helped lift U.S. markets as investors put concern about higher U.S. interest rates on the back burner. The Dow Jones industrial average adding 0.2 percent to close at 11,029.89 while the Nasdaq jumped 1.74 percent to 4,167.42.

Japanese export-sensitive stocks were lifted by a move in the yen above 106 per dollar from 105.72 in New York trading.

Sony Corp. closed 1.8 percent higher ahead of its fourth-quarter report, helping to pull other technology issues higher. The Sony figures, released after the close of trading, beat market forecasts, with a smaller-than-expected 10.2 percent drop in operating profit.

Electronics manufacturer Toshiba gained 6.3 percent and NEC Corp. added 4.9 percent. Mitsubishi Electric Corp. was the most heavily traded stock on the Nikkei, leaping 12 percent after announcing a new cellular phone technology. Hitachi Corp. lost 1.1 percent.

Fuji Bank was the best performer among the financial stocks, climbing 3 percent after announcing plans for a new domestic venture in mergers and acquisitions.

Heavyweight telecom operator NTT gained 3.2 percent while its cellular operation, NTT DoCoMo, jumped 7.1 percent.

Hong Kong investors focused on a deal by Hutchsion Whampoa to introduce U.S.-based Internet shopping service Priceline.com to the Asian market, along with a plan to float its own Internet interests in separate vehicles. Hutchison shares climbed 3.4 percent while its parent, Cheung Kong (Holdings), rose 3.7 percent.

Pacific Century CyberWorks, a leading Internet investor, ended 4 percent higher after agreeing a venture with CMGI (CMGI).

The plan to merge telecom heavyweight C&W HKT with Singapore Telecom saw the former's shares gain another 2.3 percent.

Property stocks were lifted by a sector recommendation from Salomon Smith Barney. Henderson Land added 2.6 percent, New World Development gained 1.5 percent and developer Great Eagle Holdings rose 1.3 percent.

Bellwether financial stock HSBC Holdings gained almost 1 percent.

Banks also advanced in Singapore, with DBS Group up 3.2 percent and OCBC 2.2 percent higher. However, most other heavyweight stocks were flat, with Singapore Telecom fractionally down and Singapore Press Holdings off 0.6 percent.

Among smaller markets, Taiwan's Weighted index was the best performer, rallying 2.2 percent to a 28-month closing high of 9,581.96 as overseas investors bought into technology issues.

The Kospi index in Seoul closed 0.6 percent lower at 885.84 while the PHS Composite in Manila was the worst performer, closing down 2.4 percent at 1,998.59. It was the third consecutive slump in the Philippines index, reflecting concern that economic growth is slowing.

Elsewhere, the Set In Bangkok closed down 0.85 percent at 469.22 and the KLSE Composite in Kuala Lumpur lost 1.2 percent at 940.95 while the JSX index in Jakarta lost 1 percent to close at 643.38.

Indian shares also closed lower, with the BSE-30 in Mumbai shedding 1.65 percent to close at 5,367.79 as overseas investors pulled back from some tech issues after some disappointing earnings. Australian markets were closed Wednesday.

-- from staff and wire reports

|

|

|

|

|

|

|