|

Plan ahead for family biz

|

|

January 26, 2000: 4:27 p.m. ET

Avoid domestic drama as you decide about the future of your business

By The Applegate Group

|

NEW YORK (CNNfn) - Despite all the books, publicity and warnings from experts, most family business owners still don't have a clear, written succession strategy.

In fact, 25 percent of first-generation family business owners who have a written will do not have a succession plan, according to a national survey released by the Family Firm Institute in Boston.

Although 81 percent of those polled said they want their business to stay in the family, 20 percent aren't sure the next generation is committed to keeping the business under family ownership.

Experts advise family business owners not to let emotional ties influence their succession plans, but that's very tough.

"It's harder for people to make good business decisions when there's family involved -- the family issues seem to thicken the plot," said Andrew Sherman, a Washington, D.C., attorney who advises families in business together.

The family drama intensifies when a son or daughter agrees to work for the business under duress. These reluctant children often feel pressured by a parent who is obsessed with keeping the business in the family.

Other options for succession

Passing your business down to a child is just one of many options to consider, according to Sherman.

"You don't have to turn over management decisions to your children, even if you feel it's right to give them the company's stock," Sherman said. "You could sell the business, transform the business, do a joint venture, or sell it to an employee or outsider."

No matter what course you take, Sherman emphasizes the need to put it in writing sooner rather than later. He also suggests being very honest with a child who may want to take over the business when you don't think he or she has the ability or personality to run it.

"Of course, you are going to offend somebody," Sherman said. "But if your life's work is going to be run into the ground, who benefits from that?"

Despite the odds against it, many family firms actually make a smooth transition from one generation to the next. Wineries, for instance, are traditionally family-run and remain so for generations. (The Gallos and the Mondavis come to mind when one thinks of famous family-owned California wineries).

One family's formula

Alfred Scheid, owner of the 6,000-acre Scheid Vineyards in Monterrey County, Calif., devised a successful formula for passing his business to the next generation.

"In our office, the fact you are family is thrown out the window," Scheid said. "When the kids came into the business, we had to make some strict rules. We don't discuss family issues at work, but very frequently, we ask, 'Are you free for lunch today?' "

Scheid didn't expect his children to take an interest in the business, which is headquartered in Marina del Rey, Calif. His oldest son, Scott, now 40, was working on Wall Street as a trader for E.F. Hutton before he transferred to the firm's Costa Mesa, Calif., branch office. One day, his father called to ask if he'd be interested in working in the family business.

"I saw the offer as an opportunity to put together a business, and a chance to learn from someone who is a real mentor to me," Scott Scheid said. "I wasn't going to make New York my permanent home."

Scott Scheid, who serves as chief operating officer, knows he will take over the reins from his father eventually.

"That's my next step, with or without a title," Scott Scheid said.

His sister, Heidi, 37, was working for the accounting and consulting firm Ernst & Young in Los Angeles before she joined the company. She is the chief financial offer.

Computer expertise pays off

"My daughter had completed her master's degree, got married, had a baby, and was on maternity leave when she came to the office for a visit," the senior Scheid recalled. "We had a problem with our computer that day, and she fixed it. I made her a job offer, matched her Ernst & Young salary, and she never went back to her other job."

Although Scheid says he likes having two of his four children working for the business, he says he would not have offered the kids a job unless they had some "real world experience" to bring back to the company.

"What traditionally happens is kids work at the family business during the summers, they go off to finish college, and then, they come back and need a job," said Scheid. "But what do they bring to the party?"

Working as an investment banker for E.F. Hutton prior to starting the winery, Scheid says he saw a lot of unhappy family business successions.

"I've seen so many failures when sons or daughters feel obligated to step into their parents' shoes," Scheid said. "It's very common in the brokerage business when the family name is over the door."

Outside work experience helps

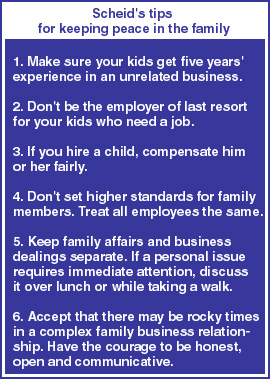

Scheid recommends that children have at least five or six years of outside work experience before they return to the family business. He suggests that they also work in a completely different industry from the one the family business is involved in.

"The more foreign the business is to your kids, the better," Scheid said. "You want to be able to bring in talented people who have other skills."

Scheid's second rule is; Don't hire your kid just because he or she needs a job. His youngest son wanted to work for the winery right after he graduated from college. Scheid put him to work six days a week as an intern, pounding stakes, riding a tractor, and living in a trailer by himself.

"We'll see if he comes back," said Scheid. "We're not thinking about it; he's got to go his own way."

Fairness to all

To be fair, both working and non-working children have equal amounts of company stock.

Scheid also knows how to keep his non-family employees happy.

"Everyone is well compensated, but not overly compensated," he explained. "My kids' salaries are in the 80th-90th percentile for the industry."

Scheid's non-family employees are also treated well. Many winery workers earn $60,000 to $70,000 a year without a high school diploma. He also encourages his employees to attend night school. And a couple of times a year, Scheid hosts a Sunday-night family dinner. "Unless it's a dire emergency, business just doesn't come up," said Scheid. "It's fair game to say, 'Call me on Monday.' "

Recommended reading

John L. Ward, Ph.D., and Craig E. Aronoff, Ph.D., two leading family business experts, have published a new book, Family Business Values: How to Assure a Legacy of Continuity and Success, as part of their Family Business Leadership Series. The two consultants, who are also college professors, have more than a dozen books covering every aspect of family business. Their newest 68-page book is packed with advice, anecdotes and graphics. The price is $16.95, plus a 7 percent shipping and handling fee. For information or to order a copy, call 1-800-551-0633.

-- Reporting by Julie Neal

|

|

|

|

|

|

ApplegateWay.com

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|