|

Europe slides on rate fears

|

|

January 31, 2000: 12:29 p.m. ET

Financial, telecom stocks hit as higher rates loom; takeovers fail to spark buyers

|

LONDON (CNNfn) - Europe's major stock markets all ended sharply down Monday as investors pulled back from equities amid expectations of higher global interest rates this week. London fell to a 13-week low, while Frankfurt shed more than 3 percent and Paris and Zurich also lost ground.

The United States, Sweden and Australia all are expected to tighten monetary policy, a move that the European Central Bank may decide to follow Thursday.

Many believe that U.S. Federal Reserve policy makers will implement aggressive interest-rate hikes this week to keep the lid on inflation; that concern hit financial-service, drug and technology shares hardest. Analysts said equity valuations were also looking strained compared with bonds, where yields continued to rise.

Little relief was available for shares engaged in the final stages of takeover battles in the banking and telecom sectors, even as new moves emerged in the bids for Britain's National Westminster Bank and Germany's Mannesmann.

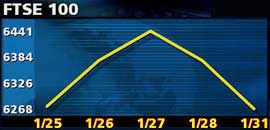

In London, the benchmark FTSE 100 closed 107 points, or 1.68 percent lower, at 6,268.50, weakening in the afternoon session as U.S. markets suffered another slide in technology shares to leave the Nasdaq off 2 percent at the close of business in Europe.

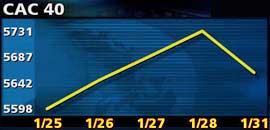

The Xetra Dax in Frankfurt was the weakest of the major bourses, closing down 3.27 percent at 6,835.60, while the CAC 40 in Paris fell 1.2 percent to 5,659.81. The SMI in Zurich gave up almost 2 percent. Among the region's smaller exchanges, the AEX in Amsterdam lost 3.2 percent and Madrid's Ibex 35 ended 1.5 percent lower.

The pan-European FTSE Eurotop 300, which reflects the mood across the region, closed down almost 2 percent at 1,498.38, with its utility, mining and technology segments the worst hit.

Telecoms, media and technology stocks have been the only sectors to rise in Europe this year. Analysts said the weakness of the Nasdaq meant that little positive momentum existed for the region's equity markets. "We can see little to build a bull case around for Europe in the short term," JP Morgan analyst Tim Harris said in a note to investment clients.

The Dow Jones industrial average was flat at the close of business in Europe having fallen 2.6 percent Friday.

The euro remained depressed, ending European trade at 97.74 U.S. cents having spent most of the session above 98 cents. The single currency hit a life low of 97.33 cents Friday.

European bond prices strengthened slightly ahead of the European Central Bank's interest-rate setting meeting Thursday. The benchmark 10-year bund traded at 98.67, pushing the yield down 4 basis points to 5.544 percent.

In London, weak financial stocks weighed on the FTSE 100, with National Westminster Bank (NWB) the leading decline; NWB closed 7 percent lower before Monday's midnight deadline for hostile takeover bids from two Scottish banks. Royal Bank of Scotland (RBOS) increased its offer Monday, but ended 5.7 percent lower. Bank of Scotland (BSCT), which is expected to raise its rival offer later Monday, lost 6.8 percent. Analysts said they don't expect either bid to secure majority support.

Other financial stocks lost ground on the gloomy interest rate outlook. Halifax (HFX), Britain's largest mortgage lender, fell 3.3 percent, while rival Alliance & Leicester (AL) slipped 3.8 percent.

In another takeover battle involving a leading U.K. company, the mobile phone network operator Vodafone AirTouch (VOD) fell 1 percent, after it agreed a partnership on the weekend with France's Vivendi [PAR: PEX] to develop a pan-European Internet portal. The accord was seen as boosting Vodafone's chance of winning control of Germany's Mannesmann (FMMN), which had earlier held talks aimed at sealing a tie-up with the French firm. Vivendi shares climbed 5 percent, while Mannesmann rose 3.35 percent.

However, most European telecom shares fell, with the FTSE held back by a 5.6 percent decline in British Telecommunications (BT-A). Nokia, the world's largest cellular phone maker, lost 2.5 percent in Helsinki.

Cement maker Blue Circle (BCI) was by far the FTSE's biggest gainer, jumping 20.8 percent to 405 pence, after French building materials group Lafarge (PLG) said it was considering a cash bid for its rival, which reports valued at 430 pence a share. Lafarge stock fell 5.2 percent in Paris.

Among other prominent movers, Chip designer ARM Holdings (ARM) gained 9.3 percent after the company unveiled a doubling in fourth-quarter earnings.

Satellite TV operator BSkyB (BSY) rose 9.7 percent, after a report of plans to invest 250 million pounds in developing Internet TV services.

Airport operator BAA (BAA) ended 5.5 percent higher after reporting a 5.5 percent fall in nine-month earnings, ahead of expectations as its duty-free goods service recovered ground.

With Mannesmann one of only two rising leaders on Frankfurt's Dax, the market's three other heavyweights all suffered sharp declines. Software publisher SAP [FSE:FSAP3] led the declines with a slide of almost 10 percent after strong gains in recent weeks on optimism about earnings. Deutsche Telekom (FDTE) followed the sector down with a 7.2 percent fall and engineering and technology firm Siemens (FSIE) lost 6.7 percent. Automaker BMW (FBMW) dropped 4.8 percent, after announcing that 1999 earnings were little changed from a year earlier.

In Paris, high-tech stocks succumbed to spillover from Nasdaq's slide Friday. Data network operator Equant (PEQU) lost 4.9 percent, chipmaker STMicroelectronics (PSTM) retreated 3.6 percent and France Telecom (PFTE) fell 3.9 percent.

Life-sciences group Aventis was the only major gainer after Vivendi, climbing 2.8 percent after an upgrade from Goldman Sachs, which rates the stock as an "outperform."

Swisscom was the worst performer in Zurich, down more than 4 percent, while Terra Networks, the high-flying Internet unit of Spanish telephone company Telefónica, ended 7.9 percent lower on its first day as a member of the Ibex-35 blue-chip index. Terra shares have risen six-fold since their stock market debut in November.

BSCH. Spain's largest bank closed narrowly ahead after posting a 26 percent rise in full-year earnings, and announced plans for an alliance and share swap with France's Société Générale, designed to enable the two to pursue new business opportunities across Europe and Latin America.

Amsterdam shares fell, amid sell-offs in the technology sector. Electronics manufacturer Philips Electronics fell 4 percent and chip equipment maker ASM Lithography lost 3 percent.

--from staff and wire reports

|

|

|

|

|

|

|