|

Paris leads Europe higher

|

|

February 2, 2000: 12:34 p.m. ET

Vodafone deal helps Frankfurt advance; London reined in by British Telecom

|

LONDON (CNNfn) - European stock markets closed ahead Wednesday after a day of sharp swings dominated by activity in the telecom and media sectors.

The blue-chip index in Paris gained 3 percent on a surge in demand for its media components, while the positive impact of deals involving cellular giant Vodafone AirTouch helped Frankfurt gain 1.5 percent. London ended narrowly ahead, held back by a slump in British Telecommunications shares.

With Wall Street rising in morning trade, an easing of interest-rate fears across the region also helped stock markets ahead of the U.S. Federal Reserve's rate verdict, expected after European exchanges close. Most traders said a quarter-percentage point hike is factored into equity prices, although they may not flinch if the Fed acts more aggressively.

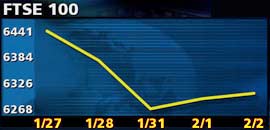

London's benchmark FTSE 100 closed up 11.5 points at 6,302.40, well off its session high as volumes surged and three stocks enjoyed double-digit percentage gains.

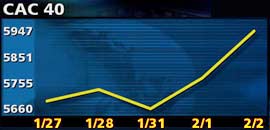

The CAC 40 in Paris closed 3 percent higher for the second session in a row, reaching 5,946.86, with three of its components posting double-digit gains.

The Xetra Dax in Frankfurt added 1.72 percent to close at 7,171.95 on buoyant telecom and financial stocks.

U.S. markets supported European markets with the Dow Jones industrial average up 33 points at the close of business in Europe.

The FTSE Eurotop 300, a broader pan-European index, closed up 1.23 percent at 1,538.13, buoyed by a 4 percent rise in its media and tech segments.

Among smaller markets, the SMI in Zurich ended 1 percent higher, the AEX in Amsterdam added 1.6 percent and Sweden's OMX was Europe's best performer with a 4.05 percent advance.

The euro gained some ground to trade at 97.46 U.S. cents, up from its New York close Tuesday. Bond prices weakened following Australia's decision to raise its interest rates by half a percentage point, more than expected. The benchmark 10-year Bund traded at 99.16, pushing the yield up 2 basis points to 5.468 percent.

Vodafone's 'halo effect'

Vodafone AirTouch (VOD) shares closed 7.5 percent higher at 382 pence after alliance partner Vivendi said the two may team up to acquire a 50 percent stake in Internet service provider AOL Europe from german media group Bertelsmann. Vivendi (PEX) shares surged 7.7 percent while those of its pay-TV unit, Canal Plus (PAN), led the CAC with a 21.2 percent advance.

Trading in Canal Plus was halted twice during the session. Investors believe it will serve as a principal content provider for new joint European multi-access Internet portal planned by Vivendi and Vodafone.

Mannesmann (FMMN), which had also eyed a purchase of the AOL Europe stake as a possible means of strengthening its defense against Vodafone's hostile takeover offer, gained 10 percent to head the Dax. Investors expect that it is now almost certain to lose its takeover battle with Vodafone, with shareholders voting on Feb. 14.

In London, Vodafone had a halo effect and helped other stocks to make progress as volume surged past 2 billion shares, though gainers and declines were evenly matched.

CMG (CMG) led the field with a 27.8 percent surge after the telecom equipment maker announced plans to produce Internet-enabled phones for the world's biggest mobile-phone company.

Other technology shares also soared, with computer-services provider Logica (LOG) jumping 20.4 percent after launching a new billing system for Internet transactions. Chip designer ARM Holdings (ARM) climbed 9.3 percent after posting better-than-expected earnings earlier this year.

And mortgage bank Woolwich (WWH) rose 11.5 percent after it said it would launch an online banking service in partnership with Vodafone.

However, the FTSE 100 was pegged back by some sharp falls to match the huge advances made by tech shares.

In London

British Telecom (BT-A) slumped 17.6 percent to close at 980 pence, having dipped as low as 930 earlier in the session. About 20 billion pounds was wiped off the company's market value after it warned that pretax profit for the year ending March 31 was likely to drop 15 percent. BT also announced plans to slash about 3,000 managerial jobs.

Utility shares were the other weak link in London, with Scottish Power (SPW) down 4.6 percent on reports that parent United Energy may sell the company. United Utilities (UU) lost 5 percent on a report that it may offload its Energi power supply unit.

In Paris

Trading in telecom and utility giant Suez Lyonnaise des Eaux (PLY) was halted, and closed 10.8 percent ahead on hopes that it will secure a license to operate a third-generation mobile phone network.

Defense group Thomson-CSF (PHO) surged 19.5 percent surge after an upbeat earnings report and plans to expand in the U.S. through a pact with Raytheon (RTN.A: Research, Estimates). Mobile phone maker Alcatel (PCGE) gained 6.1 percent ahead of earnings due Thursday. The company said it is aiming for sales growth of 70 percent this year.

Oil group TotalFina (PFP) rose 3.9 percent on the higher oil price. Among technology shares, chipmaker STMicroelectronics (PSTM) added 2.9 percent.

The surge by media stocks helped to outweigh an 8.5 percent fall in auto maker Renault (PRNO), which tumbled after Japanese partner Nissan Motor issued a profit warning.

In Frankfurt

With Mannesmann closing at another record high to secure the top spot on the Dax, steel maker Thyssen Krupp (FTHY) gained second place with a rise of 7.2 percent. Heavyweight Deutsche Bank (FDBK) gained 5 percent while electronics manufacturer Siemens (FSIE) added 1.8 percent.

In other markets

In Zurich, trade inspection group SGS led the market higher with an 8 percent surge, continuing gains in recent weeks on optimism that greater use of the Internet will boost earnings. Banking giant UBS gained 4 percent.

Mobile phone maker Ericsson headed gains in Stockholm, climbing 6.9 percent after announcing a pact with Qualcomm (QCOM: Research, Estimates) to develop wireless technology.

Finnish rival Nokia added 3 percent in Helsinki after its 1999 earnings report met analysts' expectations Tuesday.

--from staff and wire reports

|

|

|

|

|

|

|