|

Wednesday's hot stocks

|

|

February 2, 2000: 1:46 p.m. ET

Tommy Hilfiger, Kenneth Cole draw buyers on good financial news

|

NEW YORK (CNNfn) - Investors flocked to two well-known fashion names Wednesday after Tommy Hilfiger and Kenneth Cole gave Wall Street reason to cheer.

Tommy Hilfiger Corp. (TOM: Research, Estimates) jumped 15 percent after the clothing maker reported better-than-expected earnings for its fiscal third quarter of 62 cents per share. The company also said it hired Morgan Stanley Dean Witter to "review various strategic and financial options to enhance long-term shareholder value."

Hong Kong-based Tommy Hilfiger rose 1-13/16 to 14-3/16.

Kenneth Cole (KCP: Research, Estimates), the shoemaker, gained 18 percent after saying it expects fourth-quarter earnings in the mid-50 cents per share range, well ahead of the 41 cents per share expected by analysts surveyed by earnings tracker First Call.

New York-based Kenneth Cole gained 5-7/8 to 39.

No to be outdone, Intimate Brands Inc. (IBI: Research, Estimates) rose 8 percent after the parent company of Victoria's Secret said net sales for the four-week period ended Jan. 29 rose 20 percent to $278.5 million.

Columbus, Ohio-based Intimate Brands gained 2-9/16 to 33-1/4.

In initial public offerings, Telaxis Communications Corp. (TLXS), which makes high-speed wireless access equipment, rose 35-15/16, or 211 percent, to 52-13/16, after being priced at 17.

And Turnstone Systems (TSTN: Research, Estimates), which tripled in its initial public offering Tuesday, continued to draw buyers. Stock in Turnstone, which makes products for the high-speed digital subscriber line business, rose 28-7/8, or 30 percent, to 125-7/8.

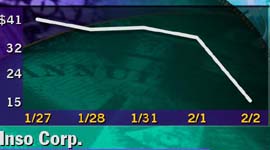

But Inso Corp. (INSO: Research, Estimates) plunged 56 percent after saying its expects "disappointing" fourth-quarter revenue between $11 million and $12 million. Inso, which makes software for managing electronic information, also said it hired Morgan Stanley Dean Witter to evaluate a possible sale of the company.

Boston-based Inso fell 19-5/8 to 15-5/8.

Coulter Pharmaceutical (CLTR: Research, Estimates) jumped 25 percent after the drug maker said it and SmithKline Beecham (SBH: Research, Estimates) received a patent for a drug to treat non-Hodgkin's lymphoma.

South San Francisco Calif.-based Coulter rose 5-9/16 to 27-9/16. Britain's SmithKline gained 3/4 to 60-15/16.

GlobeSpan Inc. (GSPN: Research, Estimates), which makes products for the digital subscriber line business, rose 31 percent after announcing a 3-for-1 stock split and reporting fourth-quarter earnings of 4 cents a share, compared with a loss of 45 cents per share in the year-ago period.

Red Bank, N.J.-based GlobeSpan climbed 37-5/8 to 160.

Datron Systems Inc. (DTSI: Research, Estimates) rose 85 percent after saying it successfully established a high-speed Internet connection to a moving vehicle using one of its satellite television antenna systems.

Vista, Calif.-based Datron catapulted 9-3/8 to 20-3/8.

Objective Systems Integrators (OSII: Research, Estimates) jumped 30 percent after saying Nortel Networks licensed several of its network-management products.

Folsom, Calif.-based Objective climbed 2-15/16 to 12-13/16.

But Integrated Electrical Services (IEE: Research, Estimates) fell 46 percent after announcing a major corporate restructuring, appointing a new executive vice president and five senior vice presidents.

The Houston-based provider of electrical contracting and maintenance services fell 3-15/16 to 4-5/8

|

|

|

|

|

|

|