|

Techs hold onto gains

|

|

February 2, 2000: 6:39 p.m. ET

Sector outperforms broader market in wake of afternoon rate hike

|

NEW YORK (CNNfn) - Technology stocks held onto their gains Wednesday as investors moved back into the sector after the Federal Reserve announced that it had raised short-term interest rates a quarter point.

The tech-rich Nasdaq composite index remained mostly positive throughout most of the session, finishing 21.98 higher at 4,073.96 after reaching a peak of 4125.75 just after the announcement of the rate hike.

Meanwhile, the Dow Jones industrial average edged down 37.85 to 11,003.2, and the S&P 500 slipped a fraction of a point to 1,409.12.

Tech stocks have been extremely volatile in recent weeks ahead of the Fed meeting, a condition that some market observers expect to see continuing ahead amid skittishness about further Fed action on interest rates.

Mary Farrell, investment strategist at PaineWebber, told CNNfn that she expects tech stocks to continue to be the market's performance leaders, although investors should expect a bumpy ride. [154K WAV or 154K AIFF]

"Future rate hikes are a short-term concern, but I think 2000 continues to hold a very bullish outlook for our group," said Mark Fenton, technology analyst at Salomon Smith Barney.

Making its debut on Nasdaq Wednesday was Telaxis Communications (TLXS: Research, Estimates), which soared nearly 180 percent.

Shares of Telaxis, which makes high-speed wireless access equipment for network service providers such as Newbridge Networks (NNCTO: Research, Estimates) and Motorola (MOT: Research, Estimates), were priced at 17 and ended the session 30-1/2 higher at 47-1/2.

Network equipment maker Cisco Systems (CSCO: Research, Estimates) was the most actively traded name on the Nasdaq Wednesday, ticking down 3-15/16 to 113-7/8.

Qualcomm, another big Nasdaq mover on Wednesday, rose 6 to 142-1/2 after it unveiled an alliance with Ericsson to collaborate on a new wireless technology. Ericsson (ERICY: Research, Estimates) shares advanced ½ to 80-7/16.

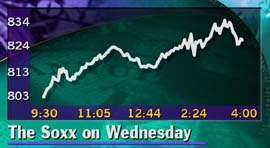

Semiconductor shares shine

Chip stocks soared, sending the Philadelphia Stock Exchange's semiconductor index, or Soxx, up 23.52 to 825.95, a 2.9 percent rise on the day.

Shares of Anadigics (ANAD: Research, Estimates), which makes chips used in wireless and other communications devices, ticked up 8-7/16 to 93, a near 10 percent rise on the day. The company on Friday reported a fourth-quarter profit of 22 cents per share, compared with a loss of 26 cents per share a year earlier, and announced plans for a 3-for-2 stock split payable on Feb. 29 to shareholders of record as of Feb. 10.

Triquent (TQNT: Research, Estimates) also advanced sharply on Wednesday after it said shareholders had approved a 2-for-1 split of its stock. Shares of the communications chipmaker advanced 18-15/16, or 12 percent, ending the day at 177-5/16.

Other strong gainers on Wednesday included: Broadcom (BRCM: Research, Estimates), up 18-11/16, or 6.3 percent at 315-7/16; Motorola (MOT: Research, Estimates), which ticked up 7-3/4 to finish 5.7 percent higher at 144-5/8; Xilinx (XLNX: Research, Estimates), up 2-13/16, or 6 percent, at 50-3/4; and Atmel (ATML: Research, Estimates), which ended 2-5/16 higher at 34, a 7.3 percent rise on the day.

On the down side, shares of Intel (INTC: Research, Estimates) ticked down 1-3/8 to 100-1/16. The microprocessor giant on Wednesday said it was buying a manufacturing facility from Rockwell International (ROK: Research, Estimates) and will invest $1.5 billion in the facility, in a move to boost its short-term manufacturing capacity.

Intel rival Advanced Micro Devices (AMD: Research, Estimates) also finished lower, slipping 9/16 to 36. Analog Devices (ADI: Research, Estimates) fell 1-3/4 to 96-1/4; and LSI Logic (LSI: Research, Estimates) shares lost ½, ending the session at 83-1/2.

Meanwhile, computer equipment makers finished the session mixed.

Shares of Dell (DELL: Research, Estimates) slipped 13-16 to 38-1/8. Compaq (CPQ: Research, Estimates) fell 1-3/16 to 27-5/16. Apple (AAPL: Research, Estimates) ticked down 1-7/16 to 98-13/16.

Advancers among equipment makers included Hewlett-Packard (HWP: Research, Estimates), up 4-3/4, or 4.5 percent, at 110-9/16, and IBM (IBM: Research, Estimates), which added 3-1/2 to 113-1/2, a 3.2 percent rise on the day.

The Goldman Sachs computer hardware index edged up 5.16, finishing at 506.23, a 1 percent rise on the day.

Linux outfits lead software segment

Software companies that supply the Linux operating system got a lift Wednesday on news that an industry group that has been developing a version of the software to run on Intel's next-generation microprocessors said they were ready to release it to developers at large.

Linux is an "open-source" operating system, which means that it is in the public domain and open to modifications by independent developers. Many industry observers see Linux as an emerging rival to Microsoft's ubiquitous Windows operating system, especially in the server market, where Microsoft's NT platform is widely used.

At a joint press conference, companies taking part in the so-called Trillian Project said they had released the programming source code required to create Linux software ready to run on Intel's IA-64, or Merced, chip, due out later this year.

Shares of VA Linux (LNUX: Research, Estimates) ticked up 29, or 27 percent, on the news, finishing the session at 136-7/8. Red Hat (RHAT: Research, Estimates), the best-known commercial distributor of Linux software, added 15-1/2 to 108, a 16.8 percent rise on the day. Meanwhile, shares of Andover.net (ANDN: Research, Estimates) advanced 7-1/8 to 36, a 25 percent rise on the day.

Elsewhere in software Wednesday, Microsoft (MSFT: Research, Estimates) edged down 2-1/8 to 100-13/16; shares of Adobe Systems (ADBE: Research, Estimates) advanced 5-7/16, finishing 9.7 percent higher at 61-5/16; database software vendor Oracle (ORCL: Research, Estimates) added 5/16 to 54-5/16; and Broadvision (BVSN: Research, Estimates) ticked up 1-15/16 to 136-3/4.

Internets continue to climb

Dot.coms continued their advances as the market awaited earnings news from online retailing giant Amazon.com (AMZN: Research, Estimates).

After the closing bell, Amazon reported a wider-than-expected fourth-quarter loss of 55 cents per share on sales that rose to $676 million versus $253 million a year earlier.

Shares of Amazon ended Wednesday's session up 2 at 69-7/16, a 3 percent rise on the day.

America Online (AOL: Research, Estimates) jumped more than 9 percent, rising 5 to 60-1/4. On Wednesday, AOL's merger partner, Time Warner (TWX: Research, Estimates), parent of CNNfn, also posted fourth-quarter operating income of 20 cents per share, up from 11 cents in the year-earlier quarter.

Two business-to-business Internet outfits made sharp gains Wednesday. Ariba (ARBA: Research, Estimates) added 11-1/6, or 6.9 percent, to 172-5/16. Shares of OpenMarkets (OMKT: Research, Estimates) advanced 6.4 percent, ending 3-7/16 higher at 57.

On the downside among B2B Internet companies, shares of VerticalNet (VERT: Research, Estimates), sank more than 7 percent, ending 19-1/8 lower at 233.

The company, which recently partnered with software titan Microsoft and has announced several other high-profile deals in recent weeks, posted a narrower-than-expected operating loss on Tuesday. Market observers attributed Wednesday's slide to investors selling on the good news.

"The stock had a big run-up lately, so I think it's a natural consolidation," Steve Frankel, an analyst at Adams, Harkness & Hill, told CNNfn.com. "I don't see any change in the overall strong fundamentals of the company."

Patrick Walravens of Lehman Brothers agreed. There were a lot of expectations for these deals that they've announced recently, which are all great moves for the company, and the stock went up a lot," he said.

"As a result, I think we're just seeing people taking some profits."

The Dow Jones composite Internet index ended the session 4.94 higher at 394.34, a 1.3 percent rise on the day.

-- from staff and wire reports

|

|

|

|

|

|

|