|

Same-store sales jump

|

|

February 3, 2000: 1:38 p.m. ET

Big retailers ring up strong post-holiday sales, but department stores lag

|

NEW YORK (CNNfn) - Consumers continued their shopping spree in post-holiday January, helping boost same-store sales among some of the largest U.S. retail chains, according to sales figures released Thursday.

Companies including Wal-Mart Stores Inc., Kmart Corp., Federated Department Stores Inc. and J.C. Penney posted healthy revenue growth in January, a month after the seasonal holiday shopping blitz and the traditional year-end of many retailers. But, in general, traditional department stores lagged behind other retailers.

Even with ice storms and poor weather conditions across the Southeast, nationwide same-store sales rose a strong 4.6 percent from a year earlier, according to Telecheck, the check-processing subsidiary of Atlanta-based First Data Corp. (FDC: Research, Estimates).

"If you didn't do well as a retailer in January, you stand out like a sore thumb," said Kurt Barnard, of Barnard's Retail Trend Report. "It was really a party for retailers, although traditional department stores didn't sit at the party table."

Barnard and other analysts said that consumers are spending more on goods for the homes rather than apparel, a focus of traditional department stores. Federated did better than other department stores due to its strong housing goods sales, Barnard said. He said that lower-priced apparel retailers such as The Gap Inc. (GPS: Research, Estimates) or The Limited Inc. (LTD: Research, Estimates), are the ones capturing greater share of apparel sales.

"Americans are willing to buy, willing to spend, but they're also looking at price tag," he said. "January was a clearance month."

Michael Exstein, a retail analyst with Credit Suisse First Boston, echoed that view.

"Overall, the numbers look pretty good, with the discount stores doing considerably better," said Exstein appearing on CNNfn's Before Hours program. "For the moment things look good, but with rising interest rates we remain cautious about the rest of the year."

Home-related goods were the big sellers during the month, reflecting the hot U.S. housing market and the need for new furniture, appliances and electronic gadgets. Apparel sales are not as strong, Exstein said.

Exstein cautioned that rising interest rates likely would depress consumer spending, especially if higher mortgage rates slow the home sales and the purchase of household goods. The Fed on Wednesday raised short-term lending rates by a quarter point to slow the economy by making borrowing more expensive.

"Historically, higher rates aren't good for retail stocks," he said. "Rising rates could eventually choke things off at the pass."

But Barnard said he believes as long consumer confidence and employment levels remain strong that a rise in interest rates should do little to depress retail sales. (435KB WAV) (435KB AIFF)

Leader Wal-Mart shows strong gains

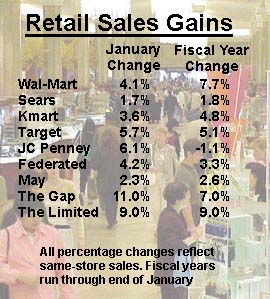

Wal-Mart (WMT: Research, Estimates), the nation's biggest store chain, reported same-store sales rose 4.1 percent from year-earlier levels, aided by strong demand for its low-priced goods. For the year, its same-stores sales rose 7.7 percent.

The Bentonville, Ark.-based company, the nation's largest retailer and a Dow component, saw total sales rise 19.8 percent in its fiscal year ending Jan. 31, to $164.8 billion.

Sears, Roebuck and Co. (S: Research, Estimates) saw U.S. same-store sales rise 1.7 percent in the month, slightly below the 1.8 percent gain it posted over the last 12 months. For its fiscal year, total domestic sales fell 1.9 percent to $29.9 billion , while worldwide sales were off 0.8 percent, to $40.8 billion, during the same period.

Number 3-retailer Kmart (KM: Research, Estimates) saw same-store sales rise 3.6 percent in January and 4.8 percent for its fiscal year. Total sales were up 6.6 percent, to $35.9 billion, for the fiscal year ending Jan. 26.

Target's numbers show department store weakness

Target Corp. (TGT: Research, Estimates), which changed its name earlier this week from Dayton Hudson Corp., saw its same-store sales rise 5.7 percent for the month and 5.1 percent for the year, as the company said sales exceeded plans for the month. Sales for the fiscal year reached $32.9 billion, up 11 percent, allowing it to pass J.C. Penney Co. in total sales and into position as the nation's fourth largest retailer.

But the Minneapolis-based company's numbers showed the problem of traditional department stores. Same-stores sales fell 0.3 percent in January and rose only 0.8 percent for the year in that division of the company, while its discount and moderately priced chains provided the growth for the company.

J.C. Penney (JCP: Research, Estimates) said its same-store sales in its department store division jumped 6.1 percent in January after languishing in December, as heavy promotions of items such as home furnishings and women's apparel helped draw shoppers to its 1,150 U.S. stores. But for the year, the division's same-store sales fell 1.1 percent, while its overall sales declined 1.4 percent.

The company's Eckerd drugstores division, which in January had more sales than the department stores, had a 5.2 percent same store sales growth in January, and a 10.7 percent gain in that measure for the year. Total company sales came to $32.7 billion for the fiscal year, up 6.5 percent from the year earlier period.

Federated Department Stores (FD: Research, Estimates), owner of the Bloomingdale's and Macy's chains, among others, said its January same-stores sales gained 4.2 percent in the four weeks ended Jan. 29, as post-holiday sales continued to drive shoppers through the doors. Its annual same-store sales rose 3.3 percent, while the company's total sales were up 15 percent for the year to $18.2 billion.

May Department Stores Co. (MAY: Research, Estimates), which also operates Lord & Taylor and Filene's stores, said its same-store sales gained 2.3 percent in the month and 2.6 percent for the year.

Discount apparel stores show strong gains

The Gap Inc., which released sales figures on Wednesday, had January same-store sales rise 11 percent, led by its Old Navy stores, which saw percentage same-store sales gains in the mid-20s. For the fiscal year, same-store sales were up 7 percent, while total sales rose 26 percent to $11.6 billion.

Clothing chain store The Limited Inc., which runs clothing stores under the names Limited, Structure, Express and Lerner New York, said its same-store sales rose 9 percent both last month and for its fiscal year. Total sales reached $9.3 billion in the fiscal year.

Shares of The Gap and The Limited were among the best performers in the retail sector Thursday, with The Gap up 4-1/4, or 9 percent, to 51-1/16, and The Limited up 2-5/16, or 7 percent, to 35-9/16 in midday trading.

But the other major retail stocks mostly were under pressure, despite the strong January numbers.

Midday trading saw Wal-Mart shares off 1-13/16, or 3.1 percent, to 59-9/16, and Target shares down 1-13/16, or 2.7 percent, to 66-3/16.

Bucking the trend, shares of Kmart were up 3/16, or 2.1 percent, to 9-1/16, and Sears shares edged up 1/8 to 31-3/16. But Federated shares fell 7/8, or 2 percent, to 41-15/16, while May shares slipped 3/16, or 0.6 percent, to 30-9/16. Penney shares edged down 1/16 to 18-5/16.

|

|

|

|

|

|

Telecheck

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|