NEW YORK (CNNfn) - U.S. Treasury prices soared in frantic trade Thursday as a shrinking supply of government debt sent investors scrambling to buy bonds to cover short positions. The surge sparked widespread fears that many market participants may have suffered substantial losses.

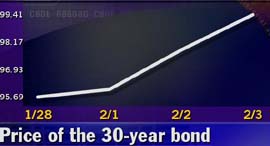

The benchmark 30-year bond rose as much as three points during the day before slipping back to 99-3/4, up 1-15/16. The yield, which moves in the opposite direction of the price, dropped to 6.14 percent from 6.28 percent on Wednesday.

The buying frenzy comes after the Treasury Department -- buoyed by the first budget surpluses in a generation -- said it would borrow less money by issuing fewer bonds. The agency also said it will purchase some of its outstanding securities.

"This is just a buying panic in the long end of the curve," said Mike Ryan, senior bond analysts at Paine Webber. "People are concerned about the supply levels."

With demand so distorted, analysts say the yield on the "benchmark" 30-year bond is no longer a good indicator of inflation expectations. Instead, they look to the 10-year note, whose yield rose to 6.48 percent Thursday.

The move into bonds comes a day after the Treasury said it will reduce the amount and frequency at which it sells debt, lowering the upcoming quarterly refunding to $32 billion.

The agency is cutting back sales of new 30-year bonds to one a year from two, and will sell new five- and 10-year notes twice a year. Further, the government will start buying back debt within two months, focusing on maturities of over 10 years and in initial chunks of about $1 billion.

On the wrong side of a trade

Rumors circulated Thursday that the plunge in bond yields caught traders off guard, leading to big financial losses at some of the nation's biggest bond dealers. Anyone who bet, for example, that the yield spread between the 30-year bond and mortgage rates would narrow got burned. The spread widened. A gamble that yields would fall could be equally costly.

"These various bets were clearly wrong-headed," said Tony Crescenzi, bond strategist at Miller Tabak & Co. "But on the other side of the trade, someone made money."

Still, the possibility of big losses led to rumors that some of the nation's biggest bond dealer took significant hits.

The Federal Reserve Bank of New York took the unusual step of commenting on a rumor, saying it held no emergency meeting to discuss losses. An earlier Reuters report said the bank declined to comment.

"Normally the New York Fed does not respond to market rumors," said Doug Tillet, a spokesman for the bank. "But in this case, they are completely unfounded."

What rate hike?

Bonds showed reaction to the Fed's latest policy decision, when the central bank Wednesday raised short-term interest rates by a quarter point to slow the U.S. economy and pre-empt rising inflation.

The move to increase borrowing costs is the Fed's fourth effort since June to tap the brakes on an economy now in a record 107 month of expansion. Despite the Fed moves, consumer spending and confidence are strong, unemployment is at a 30-year low, and soaring stock markets have created trillion of dollars in paper wealth.

As such, analysts say that Fed inflation fighters still have work to do.

"What the Fed did in the clearest possible way was to signal that they're moving to the defensive and are going to continue to raise rates," Thomas Madden, chief investment officer at Federated Investors, told CNNfn. "And this has got to go on until there's some evidence that the economy is slowing."

None of that evidence came Thursday, when orders at U.S. factories jumped 3.3 percent in December, the Commerce Department said. The result was well above the 0.6 percent gain economists had expected and also above the revised 1.4 percent jump registered the month before.

Further, the Labor Department said the number of Americans filing for first time jobless claims last week fell 5,000, to 274,000. The figures reflect the continued trend of low unemployment and tight labor markets that have existed for years.

A more comprehensive look at the employment picture comes Friday, with the release of January's jobs data. The unemployment rate is expected to fall to 4 percent, and is also expected to show 270,000 non-farm jobs added to the economy, according to analysts surveyed by Briefing.com. Average hourly earnings are seen rising by 0.3 percent.

Inverted curve

Strong demand for bonds has led to an inverted yield curve, when shorter-term securities, like bills and notes, yield more than bonds, whose maturities are longer. The development is unusual, because investors typically demand higher yields on longer-term debt to compensate for the risk that inflation will erode the value of their holdings over time.

Historically, an inverted curve signals an economic slowdown. But analysts call the current inversion a symptom of demand exceeding supply.

Dollar weakens

The dollar, which has climbed all week against the euro, reversed course on Thursday, after the European Central Bank raised its key interest rate by a quarter percentage point to 3.25 percent.

Just before 3 p.m. ET, the euro rose to 98.99 cents from 97.71 cents Wednesday, a 1.32 percent gain in the currency's value.

Higher interest rates in the 11-nation region tend to draw investors into euro-denominated securities, which must be bought in local currency.

The dollar also broke a weeklong winning streak against the yen, falling to 107.65 yen from 108.24 Wednesday.

|