|

Telecoms drive Europe up

|

|

February 4, 2000: 12:44 p.m. ET

Paris, Frankfurt surge to records after Vodafone deal; banks, oil hit London

|

LONDON (CNNfn) - Strong demand for Europe's telecom leaders drove most of the region's blue-chip indexes higher Friday. The prospect of more deals in the sector, following Vodafone AirTouch's capture of Mannesmann, sent Paris and Frankfurt into record territory, though London slid back on weak financial stocks.

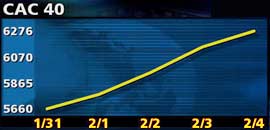

The CAC 40 index in Paris surged 2.05 percent, to close at a record high of 6,275.72, a 9.5 percent gain on last Friday's close.

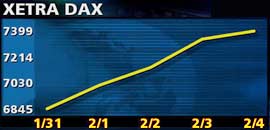

The Xetra Dax in Frankfurt ended up 1.2 percent, at 7,444.61, with a fall in financial shares diluting advances in technology and auto stocks. The index gained 5.4 percent over the week.

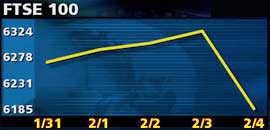

London was Europe's weakest market as the FTSE 100 slumped 139 points, or 2.2 percent, to close at 6,185.0. Bank shares fell back sharply. The index lost 3 percent over the past five sessions.

Shares of Vodafone AirTouch (VOD) fell 5 percent, following its record-breaking purchase of Mannesmann (FMMN) . Mannesmann shares ended the day 1.26 percent lower in Frankfurt.

However, the prospect of more deals in the telecom sector pushed the AEX in Amsterdam ahead by 1.75 percent. The SMI in Zurich joined London in the minus column with a 0.5 percent decline, with financial stocks falling back.

The FTSE Eurotop 300, a broader index of the region's largest stocks, was unchanged at 1,548.86, as gains in telecom and technology stocks were offset by declines in drug and tobacco components.

In currency markets, the euro lost 1.25 cents vs. the U.S. dollar, to end the European session at $0.9775, reversing part of the 2.5 cent rise Thursday in the wake of the European Central Bank's (ECB) quarter percentage point hike in interest rates. The single currency lost 0.75 cents to the U.S. dollar over the week despite the rate rise.

The prospect of higher interest rates in Britain weakened the FTSE 100; the Bank of England is expected to raise rates again next Thursday after its quarter percentage point rise last month.

Insurer Sun Life & Provincial (SLP) was worst hit, closing down 12.1 percent as Morgan Stanley cut the stock to "neutral." Sector rival Prudential (PRU) lost 7.8 percent.

Other financial-service stocks also lost ground in the wake of interest-rate rises this week in Europe, the United States and Australia. Mortgage bank Halifax (HFX) fell 6.4 percent, HSBC Holdings (HSBA) lost 5.6 percent and Barclays declined 4.6 percent. Lloyds TSB (LLOY) fell 3.1 percent and National Westminster (NWB) lost 3.5 percent.

A 4.1 percent slump in oil heavyweights BP Amoco [LSE:BPA} and Shell Transport & Trading (SHEL) also weighed on the index, as oil prices dipped.

Media and leisure group Granada (GAA) also suffered heavily, losing 10 percent, as its prospects of securing regulatory clearance for more deals in the media sector were seen diminishing.

Drug merger partners Glaxo Welcome (GLXO) declined 3.8 percent, and SmithKline Beecham (SB-) fell 5.7 percent.

London also continued to see huge positive swings in some shares. Software publisher and consultant Sema Group (SEM) ended up 23 percent, with a raised rating by Morgan Stanley Dean Witter to "outperform" offering an obvious boost to the stock.

Technology shares also continued their upward run, with Logica (LOG) jumping 12.6 percent after its deal to supply Vodafone with Internet-enabling software for its cellular phones. Chip maker ARM Holdings (ARM) rose 6.6 percent, building on its announcement Monday that profit doubled last year.

Internet-related shares also firmed, with Dixons (DXNS), which owns 80 percent of Internet service provider Freeserve (FRE), up 10.7 percent.

Aside from Vodafone, most other telecom companies continued to rise, with business network operator Colt Telecom (CTM) gaining 3.9 percent and network operator Energis (EGS) up 7.5 percent. Both are seen as potential takeover targets. British Telecommunications (BT-A) gained 5.9 percent, recouping part of its 20 percent slump Wednesday.

Construction-to-telecoms conglomerate Bouygues (PEN) was the best performer, rising 8.5 percent, as investors reassessed the value of its stake in France's second-largest cellular network, which is seen as a prime takeover target.

Data network provider Equant (PEQU) climbed 7 percent after its deal Thursday with Reuters to provide business Internet services. France Telecom (PFTE) ended up 5.6 percent.

Chip maker STMicroelectronics (PSTM) notched an 8.3 percent gain, helped by the previous session's advance on the tech-heavy U.S. Nasdaq composite index.

Telecom equipment provider Alcatel (PCGE) rose 4.5 percent, buoyed by better-than-expected earnings Thursday.

Banks were the weak link, with Société Générale (PSGE) down 2 percent and Crédit Lyonnais (PCL) off 1.9 percent.

In Frankfurt, technology giant Siemens (FSIE) was the Dax index's best performer, gaining 5.4 percent, buoyed by enthusiasm for its new range of Internet-enabled cellular phones.

Business software maker SAP [FSE:FSAP3} rose 4.6 percent, helped by the Nasdaq's advance, and Deutsche Telekom (FDTE) rose 2 percent.

However, financial stocks fell following the ECB rate hike. Deutsche Bank (FDBK) lost 1.4 percent, while HypoVereinsbank (FHVM) slid 3.7 percent.

In Zurich, engineering group ABB continued to gain from better-than-expected results Thursday, rising another 10.7 percent, while Swisscom rose 3.5 percent. Shares of insurer Zurich Allied fell 3 percent, while shares of banking heavyweight UBS lost 2 percent; the declines helped pushed the market into the red.

Amsterdam was lifted by a 16.7 percent surge in Royal KPN, as the telecom company was linked with a possible bid for Britain's Orange. Mannesmann is expected to divest Britain's No. 3 cellular operator following its acquisition by Vodafone.

--from staff and wire reports

|

|

|

|

|

|

|