|

Telekom surge continues

|

|

February 9, 2000: 8:31 a.m. ET

German phone firm adds $60B to value on planned Net sale; mega-deal mulled?

|

LONDON (CNNfn) - Deutsche Telekom shares rocketed again Wednesday though analysts played down speculation that Europe's largest telecom player is poised to make a major acquisition or alliance announcement in the wake of the record-breaking takeover of rival Mannesmann by Vodafone AirTouch.

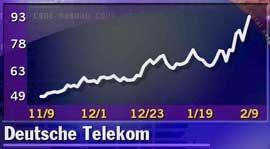

Intense buying of Telekom stock has seen its shares post four double-digit gains in the last eight sessions, but this is being attributed to the planned public sale of its Internet assets.

Telekom (FDTE) shares have surged by a third since the start of the year and 26 percent in the last two weeks alone. At Wednesday's peak, the company was worth 286 billion euros ($280 billion), 70 billion euros more than just five weeks ago, making it far and away Europe's largest publicly traded company. Telekom briefly lost the top spot to Finnish cellular maker Nokia, which now is a distant second with a value of 237 billion euros.

Equity analysts remained tight-lipped, but bankers played down the likelihood of any imminent deal to match the Vodafone acquisition. "I think the rise is fuelled entirely by T-Online," said one European merger specialist with close ties to the German company.

Telekom announced plans to sell a minority stake in T-Online, Europe's largest Internet service provider, in a deal scheduled for April that is expected to value the unit at around 52 billion euros.

T-Online has about 4.2 million subscribers and 60 percent of the German market, far more than rivals such as British Telecommunications (BT-A), which has just 7 percent of the U.K. Internet access market.

Market observers also pointed to the impact of Mannesmann's expected withdrawal from the blue-chip Xetra Dax, a move the Deutsche Borse said Wednesday will lift Telekom's index weighting from 15 to 20 percent in March. Mannesmann will be replaced by Epcos (FEPC), a former components joint venture between Siemens and Japan's Matsushita.

"Telekom has become a core holding for the global telecom industry," said one analyst who declined to be named. "However, that's a little scary given what management have actually achieved."

Telekom chief executive Ron Sommer is under pressure to rebuild its international strategy after the triple whammy of its failed merger with Telecom Italia, its split with former partner France Telecom, and the collapse of the international Global One alliance with the French firm and MCI WorldCom.

The deregulation of its domestic market also has eroded earnings. The company posted a 45 percent slide in preliminary 1999 net earnings to 1.2 billion euros, with revenue flat at 35.3 billion euros. The rapid growth of T-Online and its T-Mobil cellular arm countered a 3 billion euro drop in sales from its fixed-line business.

While Telekom has distanced itself from any imminent announcements, the company has made it clear that it remains on the acquisition trail. It has acquired One2One, Britain's fourth-largest cellular operator, and entered the French mobile market at the end of last year.

Analysts have in the past speculated that SBC Communications could be a bidder as the Texas-based firm has openly expressed its wish to expand in Europe. However, it is thought that Telekom itself is likely to make a move, with Britain's Cable & Wireless (CW-), France's Vivendi and even Italy's Olivetti, which won the takeover battle for Telecom Italia, seen as possible targets.

|

|

|

|

|

|

Deutsche Telekom

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|