|

Seagram 2Q hits high note

|

|

February 10, 2000: 11:03 a.m. ET

Music unit helps entertainment company beat estimates; merger rumors surface

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Seagram Co. recorded a better-than-expected fiscal second-quarter profit Thursday, but new rumors that the company may seek a merger partner sent Seagram's stock soaring by mid-afternoon even as its chairman tried to douse such speculation.

For the three months ended Dec. 31, the Montreal-based company earned $522 million, or $1.19 per diluted share, excluding one-time acquisition costs, blistering analysts' estimates of $1.04 cents a share. In the year-ago quarter, the company earned $18 million, or 5 cents a share, excluding one-time items.

Including one-time items, Seagram earned $557 million, or $1.27 per diluted share, a significant rise from the net loss of $226 million, or 63 cents per share, that the company posted in the year-earlier quarter.

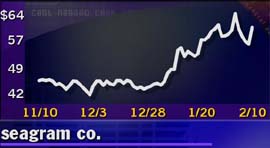

Seagram (VO: Research, Estimates) shares jumped 4-11/16, or more than 8 percent, to 60-1/2 by mid-afternoon, down a bit from the day's high of 63-3/16.

The rise was fueled by a news report that said Seagram's chairman, Edgar Bronfman, may be interested in selling the company. Business Week online, quoting unnamed sources close to Bronfman, said the company's chairman was interested in cashing in on the company's rising stock price, which has climbed more than 25 percent since just the beginning of January.

Seagram's stock has taken off since rumors of Universal Studio's possible sale first surfaced

The report said Bronfman was looking for a hefty premium beyond Seagram's $25 billion market capitalization and wanted to be paid in the convertible preferred stock of a larger entity, giving favorable tax treatment to the Bronfman family, which holds about 24 percent of the company's stock.

That speculation came on top of other rumors swirling around Wall Street in recent weeks that Seagram was looking to unload its money-losing Universal Studios subsidiary.

While refusing to directly address either rumor in a conference call with analysts Thursday, Bronfman made it quite clear he is not looking to make a deal.

"As angry and frustrated as I am with theories that are inaccurate and speculation, I've had a policy at this company ever since I've been CEO that we will not comment on rumors no matter how unfounded or inaccurate," he said. "I like being CEO. I like the businesses that we have -- all of them -- and intend to continue to manage them."

After the call, industry analysts said Bronfman had made his point.

"I'm certainly not counting on Seagram engaging in a blockbuster deal anytime soon," said Tom Graves, an analyst with S&P Equity Group.

Music flows to bottom line

Company officials attributed the quarterly income gains to record profit at its Universal Music Group, which used strong chart positions and cost savings from the integration of Dutch record company Polygram to overcome a pro forma 8 percent loss in revenues due to the discontinuation of certain operations.

Analysts said the results show the music group will be able to compete, even if forced to butt heads with the proposed Time Warner/America Online/EMI Group.

"I don't think you need a deal" to compete, said Christopher Dixon, a media analyst with PaineWebber. "Keep in mind that Universal Music does have an almost 30-percent market share, it's got a very, very strong roster of new artists and new recorded music."

Of particular interest to analysts are a number of new Internet initiatives launched within the music group, including strategic alliances with RealNetworks (RNWK: Research, Estimates) and Listen.com, as well as the launch of Farmclub.com, an integrated music company that includes record operations, online activities and television programming.

Seagram also recorded strong growth in its spirits and wine division, where revenues climbed 8 percent for the quarter to $1.76 billion, driven by millennium buying, particularly in North America. Bronfman said that so far that growth was continuing into the third quarter, although he expected it to slow somewhat throughout the rest of the year.

Recreation sales were also strong, as higher management fees at Universal Studios Escape and stronger gate sales at Universal Studios Hollywood helped push that division's revenues up 27 percent for the quarter.

However, Seagram's Universal Studio unit continued to struggle during the second quarter, although its quarterly losses before interest, taxes, depreciation and amortization narrowed to $20 million from $63 million a year earlier -- a better result than analysts expected.

That unit's results were hurt by the lack of a blockbuster movie release during the quarter - "The Bone Collector" was the studio's highest grossing film with $63.4 million in revenues -- although it said overseas and home video sales were strong.

Rumors have swirled recently that Seagram might look to unload the studio operation -- with USA Networks Inc., the company's distribution partner, being mentioned as a possible buyer -- but analysts said such a deal might be unnecessary because the film division is not a major portion of Seagram's balance sheet.

"Strategically, it's very nice to keep the film studio because you've got this enormous library out there associated with it," said Scott Davis, an analyst with Schroder & Co. "I don't think they have a fire under their feet to do anything."

Analysts are still waiting to see if Seagram decides to invest even more cash in USA Networks (USAI: Research, Estimates) to maintain its current 45 percent stake in the company, which agreed last month to purchase customer service outsourcing company Precision Response Corp. for $608 million.

Bronfman said he had not made a decision yet, but noted Seagram held an option to purchase up to 57.5 percent of USA Networks' outstanding stock on the open market.

"We intend to be at that level one way or another," he said.

Overall, pro forma revenue for the quarter was little changed at $4.97 billion. The figures were pro forma due to an accounting mechanism that assumes that Polygram, acquired in December 1998, had been part of the company during both fiscal periods.

Through the first six months of Seagram's fiscal year, pro forma revenues also remained relatively unchanged at $8.61 billion. Operating income for the first six months jumped to $427 million from $113 million a year earlier, excluding one-time items. Including those items, net income fell to $433 million, or 99 cents per diluted share, compared with net income in the year-ago period of $938 million, or $2.64.

|

|

|

|

|

|

Seagram Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|