|

AMAT profit soars in 1Q

|

|

February 15, 2000: 6:38 p.m. ET

Chip equipment leader airs six-fold jump in operating profit; splits stock

|

NEW YORK (CNNfn) - Applied Materials Inc. handily topped analysts' forecasts Tuesday, as the semiconductor equipment giant posted a six-fold jump in first-quarter operating earnings due to a surge in orders. The company also unveiled a 2-for-1 stock split.

The Santa Clara, Calif.-based company, the world's leading maker of equipment used to make computer chips, reported operating earnings of $328 million, or 80 cents a diluted share, in its fiscal first quarter ended Jan. 30, 2000, up from $46 million, or 12 cents share, a year earlier.

Analysts expected Applied Materials to report earnings of 77 cents a share in the latest quarter, according to research firm First Call Corp., which tracks such estimates.

Revenue rose 125 percent to $1.67 billion.

"It was an absolutely awesome quarter," Robert Maire, an analyst with Bear Stearns who has a "buy" rating on Applied Materials shares, said in an interview. "What we're seeing here is a reacceleration, and demand is now broadening out - it's not just for [personal computers] anymore."

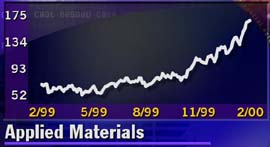

In Nasdaq trading Tuesday, shares of Applied Materials �(AMAT: Research, Estimates) rose 5-7/16 to 166-1/2, but the stock jumped as high as 174-15/16 in after-hours trade.

Click here for an after-hours quote

Executives credited an increase in research and development expenditures by customers, who are upgrading their system to allow for 300 millimeter wafer processing. Chipmakers are also actively working to shrink chip sizes, which means they must upgrade their equipment - to the benefit of companies such as Applied Materials.

"Strong global demand for semiconductors is driving our customers to increase and accelerate their year 2000 capital spending for expanded capacity and more advanced technologies," said James Morgan, chairman and CEO. "We expect increasing demand for semiconductors to continue throughout 2000, driven by the growth of applications in telecommunications Internet-related and consumer products."

"The company's performance was outstanding, reflecting continued strength across the industry," added Joseph Bronson, Applied Materials chief financial officer, during a conference call Tuesday.

With the exception of a short hiccup about six months ago, the semiconductor sector has been on a near-uninterrupted rebound since hitting a low point in September and October of 1998, analysts said.

The 2-for-1 stock split is effective in the form of a stock dividend, expected to be distributed around March 15, 2000,for shareholders of record on Feb. 25.

Applied Materials said new orders topped the $2 billion mark for the first time in its history, reaching $2.4 billion and marking a 43-percent increase from the fourth quarter of last year.

"That was a monstrous increase - even for this company," said Maire of Bear Stearns.

Including one-time items, net income for the first quarter rose to $328.5 million, or 80 cents per diluted share, up from $52.9 million, or 14 cents per diluted share, from a year earlier.

|

|

|

|

|

|

Applied Materials

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|