|

Crude awakening

|

|

February 16, 2000: 4:05 p.m. ET

Oil hits 9-year high, bruising consumers but not crushing them

By Staff Writer Jake Ulick

|

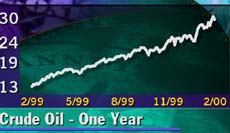

NEW YORK CITY (CNNfn) - The price of crude oil rose above $30 a barrel this week, triple the year-ago price to levels not seen since 1991.

For those who recall the '70s, bad memories emerge: Double-digit inflation, gas lines and presidents in sweaters urging lower thermostats.

Don't count on it this time around, analysts say.

Rising oil prices won't go unnoticed. But they won't cripple the economy like they once did.

"It matters a lot less because the economy has changed," said Kate Warne, oil and energy analyst at Edward Jones.

But while oil is less important, it's hardly obsolete. The gains in oil have showed up at the gas pump, and the cost of home heating oil is rising. Energy stocks, meanwhile, jumped this week as investors anticipate higher corporate profits.

And members of Congress, worried about the bite of higher prices, are pressuring the While House to release the nation's oil reserves.

Supply, demand

The jump in oil prices comes as the Organization of Petroleum Exporting Countries, which controls about 40 percent of world oil, continues to adhere to strict production cuts it set last year. And while oil supply has fallen, demand has jumped as Asia recovers from recession.

The cost increases have trickled down. The American Automobile Association said gasoline prices jumped an average of 7.8 cents per gallon this month, bringing the average price of gas to $1.367 per gallon, the highest since December 1990. Pump prices have jumped 40.7 cents since February of last year.

While AAA doesn't make forecasts, spokesman Douglas Love said the group anticipates higher prices that should coincide with the peak summer travel season.

Bill O'Grady, commodities analyst at A.G. Edwards, forecasts prices at the pump rising to the $1.50 to $1.60 per gallon range, with $2.00 per gallon not impossible.

"Would it be noticed? Sure, Would it be devastating? No," O' Grady said.

Still, data show that Americans, ever in love with big gas-guzzling cars, may be rethinking their purchases. Statistics from Autodata Corp. show inventories for sport/utility vehicles rising.

The heat is on

With oil rising, so too has the price of home heating oil.

The jump has become political, as members of Congress press the White House to release the nation's reserve of oil.

Senator Charles Schumer, D-N.Y., has been particularly vocal on the issue. This week he reiterated calls for the Clinton administration to release part of the nation's 470 million barrel strategic petroleum reserve.

But in an interview with CNN Wednesday, Secretary of Energy Bill Richardson said the market, not the government, should dictate the price of oil. Still, Richardson wouldn't rule out the use of the reserves. (WAV 365K) (AIF 365K)

It's the new economy, stupid

Still, the impact of rising oil on consumers has diminished as the nation's output of goods has increasingly shifted to a service economy focused on technology. In a more competitive and deregulated business environment, analysts say, companies are less prone to pass on costs of rising fuel to consumers, making up for it with better productivity.

And at today's levels, the price of oil adjusted for inflation is not as significant as headlines suggest. Edward Jones' Warne said the price per barrel would need to be $38.24 to compare to 1990's price.

And with the price jump last year, consumers barely noticed. The Consumer price Index, the government's main inflation gauge, rose a modest 2.7 percent in 1999.

Ed Maran, oil analyst at A.G. Edwards, sees oil prices failing ahead. He forecasts an average price of $25 a barrel this year and in 2001.

Edward Jones' Warne has a similar views, believing OPEC will increase production as the cartel recently pledged.

Time to buy?

While oil is less important, it's hardly obsolete. It's still the leading source of heat, fuel, and machinery lubrication -- not to mention that petrochemicals are used to make everything from contact lenses to keyboards.

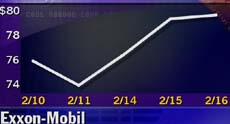

As such, investors have not ignored the recent rise. Exxon-Mobil (XOM: Research, Estimates), the world's biggest oil producer, is up more than 8 percent this week.

.

And it's been a good time for mutual funds that invest in energy. Vanguard' s Energy Fund, for example, whose largest holding is Exxon-Mobile, rose 3.1 percent Tuesday and gained 21 percent last year.

For investors, there are more than 300 U.S. public companies in the oil and natural-gas industry. Further, Morningstar, the Chicago publisher, lists 30 mutual funds under its natural-resources category.

A.G. Edwards' Maran likes Texaco (TX: Research, Estimates), which he calls the purest play on oil because of its limited exposure to natural gas and petrochemicals.

"It will continue to be a good year for integrated oils," Maran predicts

James Falvey, oil analyst at Dresdner, Kleinwort Benson, says despite the recent run-up in oil stocks, it's not too late to get in because the shares are still relatively cheap.

Exxon Mobil, for example, trades at 33 time earnings. Qualcomm (QCOM: Research, Estimates), the provider of digital wireless communications products, trades at 164 times earnings.

In addition to Exxon-Mobil, Falvey likes Amerada Hess (AHC: Research, Estimates), the oil and gas exploration company founded by the late Leon Hess, and Valero (VLO: Research, Estimates), which makes reformulated gasoline and low-sulfur diesel fuel

"At the current price levels, you should be buying," he said. "They are not discounting $30 a barrel crude."

CNN's coverage of rising oil

|

|

|

|

|

|

|