|

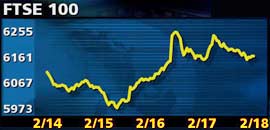

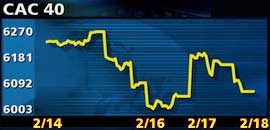

Europe follows Dow down

|

|

February 18, 2000: 1:07 p.m. ET

London, Paris, Frankfurt give up ground as rate fears persist

|

LONDON (CNNfn) - European equity markets finished mostly weaker Friday, tracking an early sell-off on Wall Street as traders digested the implications of Federal Reserve Chairman Alan Greenspan's comments Thursday on the need to curb an overheating U.S. economy.

Zurich ended fractionally higher, Frankfurt was flat, and London and Paris lost ground as benign U.S. inflation data failed to allay Greenspan-inspired rate worries. Amsterdam fell 2 percent.

"On reflection, I think the feeling is that he's not just saying interest rates are going up, but that he's also going to do whatever is necessary to slow growth (in the U.S. economy)," said Peter Oppenheimer, equity strategist at HSBC Securities in London.

Bourses pared gains in late trade as Wall Street's leading gauge, the Dow Jones industrial average, extended its point loss into triple digits, shrugging off fresh data showing U.S. inflation is under control.

In London, the benchmark FTSE 100 closed down 44.3 points, or 0.7 percent, at 6,165.0. The FTSE 100 swung more than 100 points during the session, touching an intraday high of 6,264.1. The index was down half a percent for the week. The CAC 40 in Paris fell 1.5 percent, or 92.24 points, to close at 6,062.72, knocked lower by sharp declines in retailer Carrefour and telecom equipment provider Alcatel, which together shaved more than 40 points from the index. The CAC 40 fell 3.4 percent, or 213 points from last Friday's close.

In Zurich, the blue-chip SMI ended a quarter of a percent higher at 7,047, cooling down after posting sharp gains over the previous two sessions. The SMI was down 1.4 percent for the week. The electronically traded Xetra Dax eased a fractional 6.75 points, or 0.09 percent to 7,573.78 despite a sharp climb by carmaker BMW amid rumors that its principal shareholder, the Quandt family, had received a takeover offer from rival Ford. BMW denied the rumors. The DAX rose 1.7 percent, or 129 points, for the week.

The pan-European FTSE Eurotop 300 fell half a percentage point to 1,549.84, dragged down by heavy losses in its food and drug, mining, oil and gas and tobacco segments. These offset gains in the health, information technology and life insurance sub-indexes.

The euro was quoted at 98.45 cents late Friday in London as the dollar backtracked from session highs around 98 cents.

In London, oil and gas producer BP Amoco (BPA), the FTSE's second-biggest share by index weighting, fell 4 percent, while rival Shell Transport & Trading (SHEL) dropped 3.2 percent.

Financial news and data provider Reuters (RTR) dropped 6 percent, knocked lower by a big brokerage house's sell order, local traders told Reuters. Television broadcaster Carlton Communications (CCM) declined 5.6 percent, giving up some of the sharp gains that recently took media stocks higher amid enthusiasm over takeovers and the outlook for growth in online services.

HSBC Holdings (HSBA) fell 4.8 percent, mirroring a slide in its Hong Kong-listed shares earlier in the day. Halifax (HFX), Britain's largest mortgage bank, was the star performer in London. Its stock jumped 13.2 percent after it announced a 2.8 percent rise in pretax profit for 1999 and became the latest U.K. bank to disclose plans for new online services. The shares soared 22 percent Thursday after Halifax unveiled an online insurance venture.

Bass (BASS) ended up 0.6 percent, well off earlier highs, after saying it plans to review its brewing operations, indicating that Britain's second-largest brewer may slim down to focus just on leisure and lodging.

In Paris, telecom equipment provider Alcatel lost 7.4 percent, while retailer Carrefour (PCA) plunged 8 percent amid reports that the French government is poised to impose new competition rules that could crimp the business of food retailers. Banking powerhouse Credit Lyonnais jumped nearly 7 percent amid speculation that it could become a vulnerable bid target or be involved in a Web-related deal.

In Frankfurt, BMW (FBMW) closed up 4 percent, handing back stronger early gains amid denials from the company of what it described as rumors that it had received an approach from U.S. automaker Ford (F: Research, Estimates). The company has been linked to a deal to sell Rover, its troubled U.K. unit, to Volkswagen (FVOW), whose shares ended down 0.4 percent. Tech company Siemens (FSIE) fell 3.25 percent amid profit taking. The company's shares have risen about 140 percent since mid-October.

Business software maker Baan floundered in Amsterdam, slumping 14.3 percent to close at 5.14 euros. That followed a big drop Thursday, when the Dutch stock exchange warned the company that it could lose its place in the benchmark AEX index in four weeks if it doesn't raise new funds or otherwise improve its financial position.

In Stockholm, market heavyweight Ericsson spurted 4.7 percent to 780 kronor, off its intraday high of 784 kronor. The mobile phone firm contributed more than half of Friday's market turnover.

--from staff and wire reports

|

|

|

|

|

|

|