|

Unilever to cut 25,000 jobs

|

|

February 22, 2000: 11:20 a.m. ET

Anglo-Dutch household goods maker aims to boost profit, catch up to rivals

|

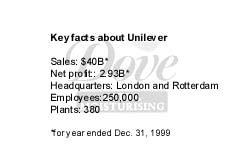

LONDON (CNNfn) - Unilever, Europe's biggest consumer-goods maker, said Tuesday it would axe 25,000 jobs in a five-year cost-cutting program as it seeks to gain ground on faster-growing rivals such as Procter & Gamble.

The Anglo-Dutch maker of Dove soap, Lipton tea and Calvin Klein fragrances also posted a 2 percent increase in fourth-quarter earnings.

Unilever said it will close about 100 manufacturing sites and shed nearly 10 percent of its workforce in a 5.3 billion-euro ($5.3 billion) program estimated to generate annual savings of 1.6 billion euros from 2004. Unilever had said last September it would cut back its range of consumer brands to about 400 from 1,600.

The streamlining will "dramatically improve our ability to market our leading brands," said Antony Burgmans, chairman of Unilever's Dutch holding company.

The company said it would increase marketing spending on its chosen brands by 1.6 billion euros over the five-year period, aiming to boost annual sales growth to 5 percent by 2004 from 1 percent in 1999. It hopes to lift operating profit margins to 15 percent from 10.4 percent.

Market welcomes shake-up

Shares of Unilever, which is owned jointly by companies listed in the Netherlands and the U.K., surged on optimism the changes would lead to higher earnings. Unilever NV rose as much as 5.6 percent to 48.60 euros in Amsterdam, while shares in London-based Unilever Plc gained 6 percent to 409 pence.

Unilever said most of the job losses are expected to be in Europe and the Americas. The cuts come after recent announcements of layoffs at Ford Motor Co.'s European division, which last week said 1,500 positions would go, and British Airways, planning 6,500 staff cuts over the next three years. Thousands more will go amid streamlining moves following big mergers, such as those recently agreed by insurers CGU and Norwich Union and drug makers Glaxo Wellcome and SmithKline Beecham.

Unilever faces a battle to overcome investor apathy towards food and consumer-goods makers, which lag in terms of shareholder appeal behind companies in faster-growing industries such as telecommunications and drugs.

"Unilever has been hit very hard by Procter & Gamble in Latin America, and is experiencing very serious pressures in the region, but no solution to that particular problem was outlined" in Tuesday's announcement, said Iain Daly, an analyst at London brokerage Charles Stanley.

Procter & Gamble last month posted a 13 percent profit increase for the fiscal second quarter to $1.3 billion, or 88 cents per diluted share, excluding one-time items, and has said that it expects earnings growth for this fiscal and beyond to be at the top of its target range of 13 percent to 15 percent.

Unilever's closer neighbor Danone, France's biggest food maker, posted a 14 percent rise in 1999 net profit to 681 million euros as a long-running streamlining program came good.

Unilever said it would restructure its Elizabeth Arden cosmetics unit during 2000. The future of its European bakery business is also "under review", Unilever said. "It is being restructured to improve performance significantly or it will be divested by the year-end".

"The remaining businesses that do not meet performance standards or which are no longer part of our strategy will be reorganized or divested," Unilever said.

The firm said it would expand its e-commerce activities and planned to roll out an Internet-based procurement system over the next two years.

"We are intent on achieving a rapid expansion of e-business and have committed 130 million pounds to these initiatives in 2000, and this will grow," Unilever said.

Going online

The company expected development of online selling to be pioneered by the recently announced venture with U.S. group iVillage to sell beauty and personal care products on the Internet. Alliances with AOL, Microsoft and Excite@Home are in place to "support brand communication and build consumer understanding", said Unilever.

The cost-cutting measures came as Unilever reported a 2 percent increase in net profit for the fourth quarter of 1999 to 636 million euros from 621 million a year earlier, as sales rose 7 percent to 10.36 billion euros.

For holders of the Unilever's U.K shares that meant fourth-quarter earnings of 0.0932 euros per fully diluted share, up from 0.0811 euros a year earlier, while the Dutch parent company's earnings per diluted share rose to 0.62 euros from 0.55 euros.

Full-year net profit fell 4 percent, in line with analysts' estimates, to 2.97 billion euros from 3.09 billion. Sales for the year grew 1 percent to 40.98 billion euros.

Unilever said it expected sales to grow by 3 to 4 percent in 2000.

"We are confident that we will see further margin improvement in 2000, leading to an annual rate of earnings per share growth before exceptional items in the range of 8 to 10 percent," Unilever said.

|

|

|

|

|

|

|